Like many Britons, I came to the realisation some time ago that the State Pension will unlikely be enough to help me retire comfortably. So through a blend of the Cash ISA and Stocks and Shares ISA, I’ve set about trying to fix this.

This week, the Office for Budget Responsibility (OBR) reported that State Pension spending “rose from around 2% of GDP in the mid-20th century to around 5% of GDP (£138bn) today, and is estimated to rise further to 7.7% of GDP by the early 2070s“.

Such growth is unsustainable, and likely to result in a) benefits that fail to keep up with inflation, b) a steady rise in the age at which claims can be made, or c) both.

Taking charge

I don’t know about you, but I hope to thrive, and not just survive, when I retire. I want something to show for having worked hard for most of my life.

So I’m reducing my dependence on the State Pension later on and hope to become totally financially independent. Part of my strategy involves regularly investing in a Cash ISA and Stocks and Shares ISA, alongside putting money aside in a Self-Invested Personal Pension (SIPP).

Each of these products enables me to build wealth free of tax. The savings I make can be considerable over time, which I can invest to boost the compound growth of my portfolio.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

My strategy

That said, the amount I devote to each one differs a lot. While a cash account safeguards my capital and provides a guaranteed return, using this alone is unlikely to help me retire in comfort.

The numbers speak for themselves. Since 2015, the average Cash ISA user has received an average annual return of 1.2%. That’s significantly below the 9.6% that those owning shares in an investing ISA have enjoyed.

For this reason, I invest around 20% of my spare cash in the former, and 80% in shares, trusts and funds with the latter and through my SIPP.

Like most people, the amount I invest varies from month to month. But if I can achieve the same returns of the last decade, a £500 monthly investment split across those lines will — after 30 years — give me a sizeable pension pot of £873,872.

Talking trusts

I own a diversified range of assets in my Stocks and Shares ISA and SIPP. And more recently, I’ve been targeting investment trusts to spread risk while still targeting mighty returns.

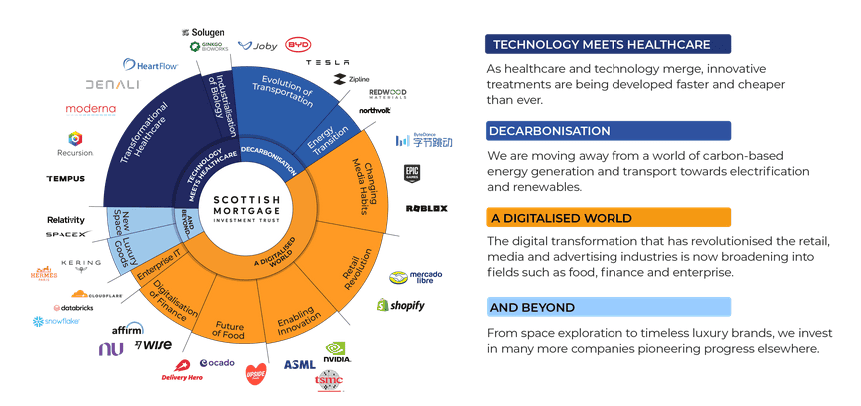

Scottish Mortgage Investment Trust (LSE:SMT) is one I’m considering today. While its name may suggest otherwise, this financial vehicle focuses chiefly on technology stocks. It’s a strategy that leaves it vulnerable during economic downturns, but which I’m confident also provides significant long-term growth potential.

As you can see, the fund invests in companies (95 in all) that are well placed to capitalise on multiple ‘megatrends’.These include industry heavyweights such as Nvidia, BYD and Shopify, which have market leading positions and strong records of innovation. But it also holds shares in a range of smaller, private companies that could deliver superior growth from this point on.

Since 2015, the fund’s provided an average annual return of 14.6%. I feel it could be a great portfolio addition to help me retire in comfort.