With the FTSE 100 close to all-time highs, investors need to look carefully for opportunities. And this is especially true when it comes to growth stocks.

There is, however, one UK stock that I think growth investors should pay attention to at the moment. Despite trading at a high multiple, it’s better value than it looks.

Safety first

Halma (LSE:HLMA) is a collection of technology businesses focused on safety. And it’s been one of the FTSE 100’s best-performing stocks over the last 10 years.

This is partly the result of the firm’s impressive sales growth. Over the last decade, revenues have increased by an average of 12% per year – that’s faster than Apple (8%) or Microsoft (11%).

Buying other businesses has been a key part of Halma’s growth strategy. It looks to acquire companies that have leading positions in niche industries, making them difficult to disrupt.

This is an inherently risky strategy – paying too much for a business is always a possibility and it can destroy value for shareholders. But the FTSE 100 firm has done very well recently.

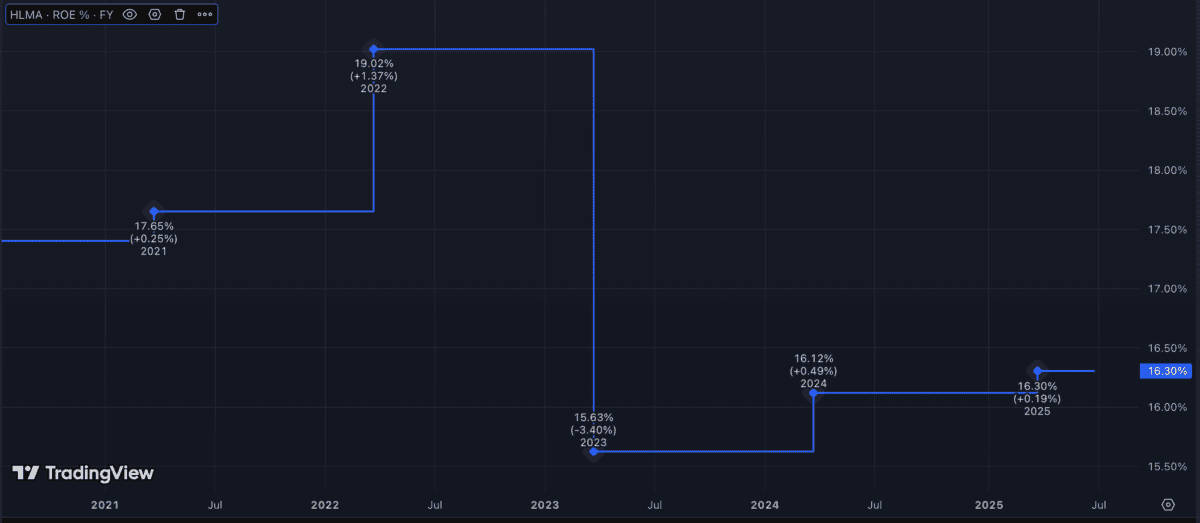

Over the last five years, Halma’s returns on equity have been very stable at around 17%. That’s a very good sign the company is managing to avoid overpaying for its acquisitions.

Source: TradingView

Source: TradingView

This is very encouraging, but – as Warren Buffett points out – it’s possible to pay too much even for shares in an outstanding business. Fortunately, I think the stock is actually unusually cheap.

Valuation

At first sight, Halma doesn’t look cheap. The stock trades at a price-to-earnings (P/E) ratio of 41, which is extremely high compared to the FTSE 100 average of just below 18.

Appearances, however, can be deceptive. The company’s acquisition-based growth strategy means the amortisation costs on its income statement are unusually high.

As a result, the firm’s net income doesn’t always give a good indication of the cash the business generates. This is something investors need to take note of.

Source: TradingView

In terms of free cash flow, Halma shares are actually trading at an unusually low multiple at the moment. This is why I think the stock is worth considering at today’s prices.

Looking further ahead, management expects to be able to generate revenue growth of around 7% per year. And that’s from existing operations – without factoring in acquisitions.

If it achieves this while finding opportunities to buy businesses at attractive prices, the stock could be a great investment. The company’s winning formula could still have a way to go.

Growth investing

Over the long term, a company’s shares go up for one of two reasons. Either the underlying business makes more money, or the multiple the stock trades at increases.

Obviously, the best investment opportunities are those where there’s scope for both. And I think Halma might fit the bill for UK investors.

The underlying business continues to grow strongly, driven by disciplined acquisitions. So while the shares trade at an unusually low multiple, investors should at least take a look.