The Fresnillo (LSE:FRES) share price was the best performer on the FTSE 100 in June. During the month, it increased 25%. And since the start of the year, it’s risen by more than 150%.

What’s going on?

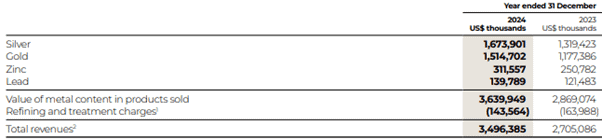

Given that Fresnillo describes itself as the “world’s leading silver miner” — and “one of Mexico’s largest gold producers” — this isn’t surprising. Since the turn of the year, the prices of these two precious metals have soared. Both are up around a quarter.

During periods of economic uncertainty, investors tend to buy these commodities. They’re seen as a ‘safe haven’ and a possible hedge against stock market volatility.

General speaking, a weak dollar, rising inflation and falling interest rates can help boost their prices. But this makes it virtually impossible to accurately predict future movements.

For example, gold currently trades at around $3,285/oz, having fallen from its all-time high of $3,500 achieved in April. I’ve seen one forecast claiming that it will reach $7,000/oz by 2030. Although this must be treated with caution, there appears to be a consensus that it should steadily rise over the long term. And this can only help the Fresnillo share price.

More immediately, Goldman Sachs is predicting a price of $3,700/oz by the end of the year. But if there’s a US recession, it could be higher. The bank believes that demand from central banks will play a major role in driving prices higher.

Many are also forecasting silver prices to rise.

Some challenges

However, prices are irrelevant if a miner cannot get its metals out of the ground. During the first quarter of 2025, the group reported an 8.4% year-on-year decline in silver production. Some of this was due to planned mine closures. But there were also some operational issues including a shortage of equipment and unplanned maintenance. A lower grade of silver was also reported.

These problems illustrate how difficult mining can be. There are all sorts of operational, environmental and financial issues that must be overcome. And reserves are constantly being depleted. It’s expensive looking for new deposits.

Even so, the group’s retaining its previous guidance for production in 2025. But given the unpredictable nature of prices, it doesn’t give any indication as to what its revenue or earnings might be. However, given current elevated commodity prices, its top line is likely to be much higher than in 2024.

A reasonable yield

Owning physical gold doesn’t generate any income. However, Fresnillo shares do.

But its payout is erratic reflecting the volatile nature of precious metals prices and, therefore, the group’s earnings. Based on amounts paid in respect of its 2024 financial year ($0.743), the stock’s currently yielding 3.8%, which is marginally above the FTSE 100 average. However, this includes a special dividend of $0.418.

Over the past four years, its payout has been $0.056 (2023), $0.167 (2022), $0.339 (2021) and $0.258 (2020).

Final thoughts

For those investors who have confidence that, over the long term, silver and gold prices will climb higher, Fresnillo could be a stock to consider.

Showing a net cash position, its balance sheet remains strong. And it claims to have a below-average cost of production. However, anyone taking a position should be conscious of the risks specific to the sector, most notably the unpredictable nature of metals prices.