When it comes to dividends, the difference between buying shares when they’re cheap and when they’re expensive can be dramatic. And this is something passive income investors need to pay attention to.

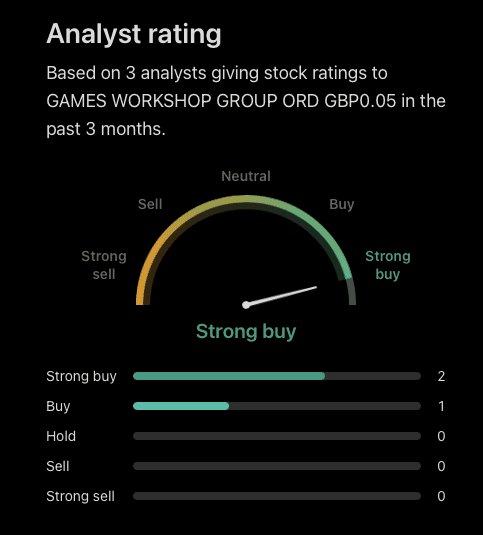

Right now, there are a number of stocks that analysts have positive views on. But a couple stand out to me as particularly interesting opportunities to consider.

Games Workshop

Games Workshop (LSE:GAW) is a firm favourite with analysts covering UK stocks. And whether it’s growth or dividends, the stock has been an outstanding investment for shareholders.

Source: TradingView

In terms of growth, earnings per share have more than doubled in the last five years. And while this has happened, the firm has paid out almost 80% of its net income as dividends.

This can be risky. If demand falters, because household budgets tighten and discretionary spending comes under pressure, there’s a real chance the dividend might not be sustainable.

In some ways, though, the high payout ratio is a sign of Games Workshop’s strength. Its main asset is its intellectual property and this doesn’t take huge amounts of investment to maintain.

For most companies, paying dividends means compromising on returns. The cash returned to shareholders can’t be used to open new stores, recruit more staff, or acquire other businesses.

With Games Workshop, though, the situation is different. That’s why it’s grown to be the largest investment in my Stocks and Shares ISA and why I think it’s worth considering in July.

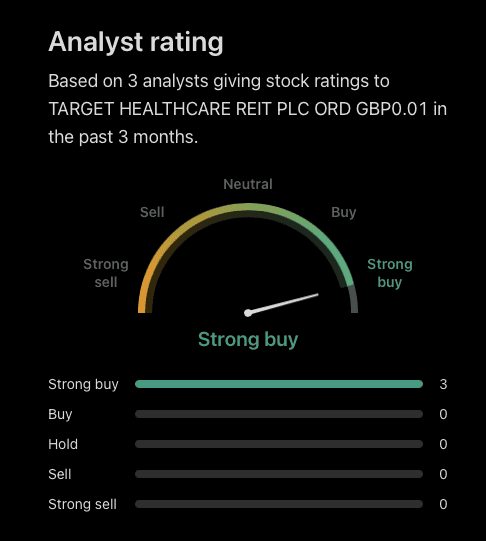

Target Healthcare REIT

There aren’t many analysts paying attention to Target Healthcare REIT (LSE:THRL), but the ones that do all think it’s worth considering. And it’s easy to see why.

Source: TradingView

The firm owns a portfolio of 94 care homes, which it leases to operators across the UK. Like other real estate investment trusts (REITs), it returns 90% of this to shareholders as dividends.

Occupancy levels are around 85% at the moment, which is on the low side. And this reflects the ongoing risk of inflation on the firm’s tenants, which have limited ability to increase prices.

I think, however, that a general trend of longer life expectancy should make for strong demand over time. And there’s a lot more to like about the stock from an investment perspective.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Target has a strong balance sheet, which isn’t automatic when it comes to REITs. And its leases also have an average of 25 years left to run, providing good long-term stability for the business.

Given all of this, I think 5.6% dividend yield is relatively attractive. So I can see why analysts think this is one for investors to check out – and it’s certainly one I’ve got my eye on right now.

Finding stocks to buy

I’m often reasonably sceptical of analyst ratings – especially positive ones. When it comes to investing my own money, I tend to be a bit more cautious.

With Games Workshop and Target Healthcare REIT, though, the consensus view looks plausible to me. I think there’s a lot to like about both stocks and dividend investors should take a look.