A rupturing of the geopolitical landscape has supercharged the BAE Systems (LSE:BA.) share price in recent years.

The FTSE 100 defence giant has risen 233% in value since the start of 2022, a rally first sparked by Russia’s invasion of Ukraine. Since then, orders, sales, and profits have rocketed higher as broader spending by NATO members has increased. Fears over Chinese expansionism and fresh conflict in the Middle East have further reinforced military-related spending.

Price gains tipped

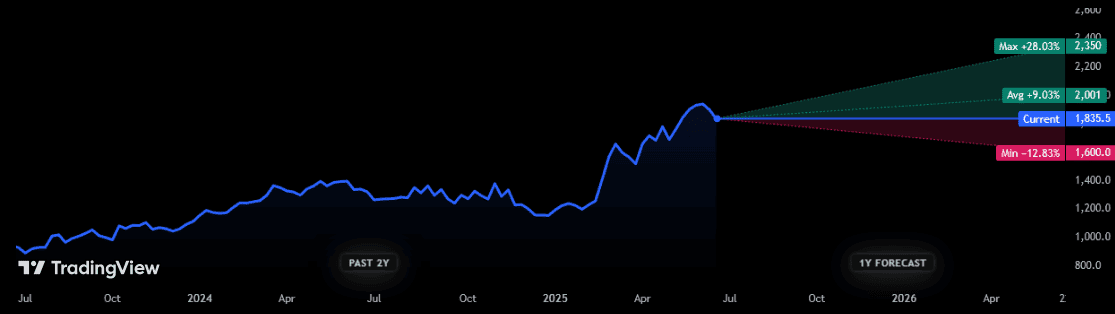

Even after rising 38% in the last 12 months alone, the Square Mile’s brokers broadly believe BAE Systems shares will continue to rise over the near term.

There are 12 brokers who currently have ratings on the FTSE share. As the chart shows, the average price target among them is just over £20 per share, representing a 9% increase on current levels of approximately £18.36.

But the number crunchers aren’t unanimous in their largely bullish view. One especially optimistic analyst thinks BAE’s share price will rise as high as £23.50 per share. But at the other end of the scale, one broker thinks it will drop back to £16.

Dividend growth expected

There’s a lot of cash sloshing around in the company’s coffers, underpinning the City’s bright forecasts.

Free cash flow was £2.5bn on 2024, and the business predicts this will be “in excess of £5.5bn” in the three years to 2026. That’s up from a prior forecast of above £5bn.

Reflecting this, City analysts also believe annual dividends will continue rising sharply over the next couple of years at least:

- A 35.7p per share payout is tipped for 2025, up 8% year on year.

- A 39.4p per share dividend is expected next year, up 10%.

If these forecasts are accurate, the dividend yield is 1.9% and 2.1% for these years. That’s below the FTSE 100 long-term average of between 3% and 4%.

However, expected dividend growth is better than the 1.5% to 2% increase analysts tip for the broader blue-chip index. It will also keep BAE’s long record of annual dividend increases going (cash rewards have risen each year since 2012).

Is BAE a buy?

Based on City expectations, then, BAE Systems may look to some like an attractive share for capital gains and dividend income. But there are significant risks to buying the company.

One is a potential drop in US defence spending. This is the FTSE company’s single largest market and responsible for around half of revenues. There’s also the danger that the growth of ESG (environmental, social, and governance) investing will limit demand for its shares.

However, there are also significant investment opportunities as NATO countries ramp up defence spending. This month, all 32 group members (except Spain) agreed to splash out 5% of their GDPs on defence by 2035. To put that in context, spending averaged 2.2% across the bloc in 2024.

BAE systems has the scale, the geographic footprint, and the expertise across multiple technologies to capitalise on this opportunity. This is reflected by its record order backlog of £77.8bn at the end of last year, up 77% in just three years. More major contract wins in 2025 include a $356m contract from the US army to support armoured multi-purpose vehicle (AMPV) production.

While not without risk, I believe the company is worth serious consideration today.