The Lloyds (LSE: LLOY) share price has delivered an impressive performance in 2025 so far, climbing almost 39% year to date. For a bank often criticised for its lack of international diversification, that’s no small feat. The rally has left me wondering: is there more room to run, or have most of the gains already been priced in?

A slew of favourable conditions appear to be behind the recent surge. A more stable interest rate environment has played into Lloyds’ hands, particularly given its focus on UK retail and mortgage lending. The Bank of England has kept rates higher for longer, supporting net interest margins. Positive GDP growth in Q1 went some way to quell fears of a UK recession — although more recently there has been concern around a dip in consumer spending and private sector activity.

Globally, the banking sector has benefitted from reduced volatility. US banks have stabilised, credit default concerns have subsided and European banks are also showing signs of renewed strength. Lloyds, with its clean balance sheet and strong capital position, has emerged as one of the UK’s more dependable names.

But wait…

Before diving into the forecasts for 2025 and beyond, there are some considerations to take into account. Most notably, there’s the ongoing court case regarding the mis-selling of motor financing. In a worst-case scenario, the ruling could cost the bank as much as £44bn in compensation.

Lloyds is also heavily tied to the UK economy, and a slowdown in housing or a spike in loan defaults could weigh on future earnings. Its lack of international operations means there’s little geographic diversification, which could leave the business vulnerable if domestic conditions sour.

Broker forecasts

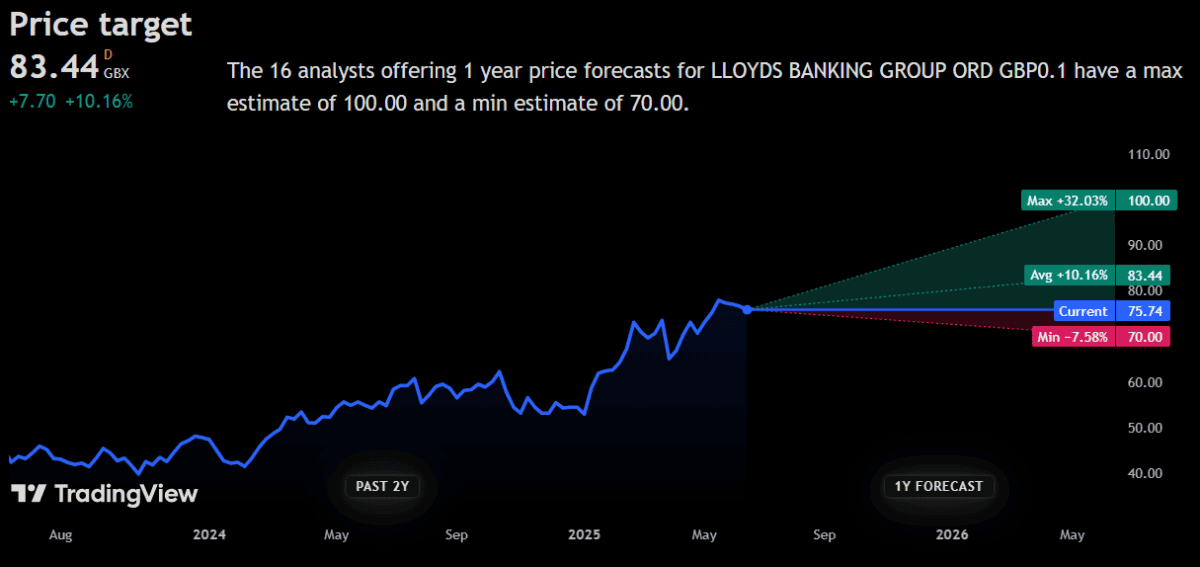

With that said, let’s see what brokers have to say. Recent forecasts paint a cautiously optimistic picture. According to TradingView, the average 12-month price target for Lloyds shares now sits around 83p, with a low estimate of 70p and a high of 100p. Several other financial platforms suggest a similar consensus of 80p to 82p, pointing to modest further growth from today’s levels.

The stock is generally rated a Buy or Outperform, although not without some dissent. JPMorgan Cazenove, for example, reiterated an Underweight rating with a target of 71p in late March, citing valuation concerns. Shore Capital and Citigroup, on the other hand, have reaffirmed more bullish stances, highlighting strong capital returns and potential dividend upgrades.

Still good value?

Despite the share price rally, Lloyds doesn’t look outrageously expensive to me. The bank trades on a forward price-to-earnings (P/E) ratio of around 7, with a dividend yield of approximately 5.5%, based on current forecasts. Add in the possibility of continued share buybacks, and the total yield could push towards 7%, as some analysts have suggested.

So while it may not be the bargain it was at the start of the year, there’s still a case for cautious optimism. Financially, it looks sound, and its valuation remains attractive – the elephant in the room being the outcome of the motor financing probe.

Overall, for those seeking reliable returns in the UK financial sector, I think it remains a worthy consideration – just be aware that the easy gains may already be behind us.