Billionaire investor Warren Buffett has a well-known metric for measuring stock market valuations. And it indicates that share prices – specifically US ones – are expensive at the moment.

Given that US companies account for almost 70% of the global equities, it’s probably fair to say this means stocks as a whole are expensive. But what should investors do about this?

The Buffett indicator

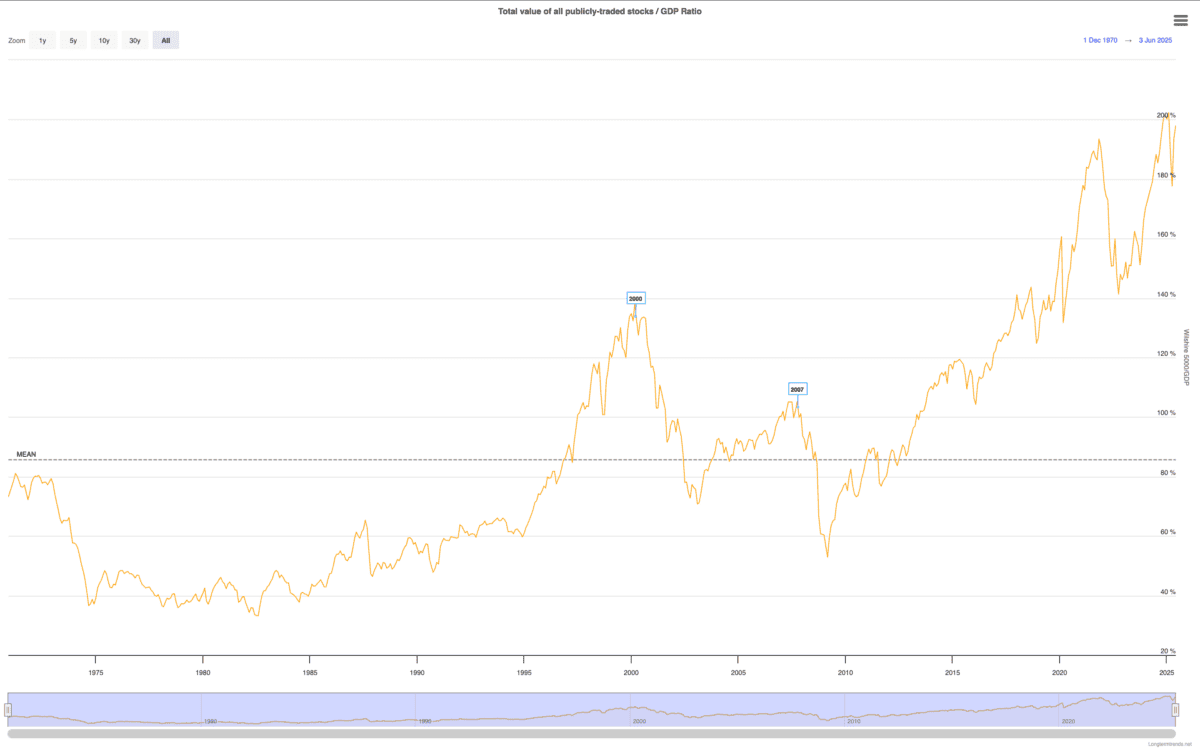

Buffett’s famous metric involves comparing the market value of equities with gross domestic product (GDP). And on this basis, US equities look unusually expensive at the moment.

Source: Longtermtrends

The so-called Buffett indicator has a decent history of being a good indicator of a stock market crash. Unusually high levels have often been followed by a sharp downturn in share prices.

Right now, the metric is the highest it has ever been, but I’m wary of making predictions on this basis. The main reason is that it’s been high for some time.

The Buffett indicator has been at unusually high levels since 2019. But the only stock market crashes in that time have been attributable to other things – Covid-19 and US trade tariffs.

Valuations

I don’t think valuation metrics are a good indication of what stocks are going to do in the near future. But they do mean that the effect on share prices can be dramatic if something happens.

From a long-term perspective, the picture is slightly different. One reason for this is that there can be cases where valuation multiples don’t give a good indication of how expensive an individual stock is.

Polaris (NYSE:PII) is a good example. The firm is one of the leading manufacturers of recreational vehicles, including boats, motorcycles, and snowmobiles.

At a price-to-earnings (P/E) ratio of 56, the stock looks very expensive. But I think this is a case where things aren’t quite what they seem at first sight.

A stock that’s cheaper than it looks

Polaris relies on consumers having disposable income. And a lot of its sales involve financing, which means high interest rates can dampen demand and weigh on margins, leading to profits falling away.

This is what has been happening recently and that’s the risk with this business. Furthermore, it makes the firm’s dividend look unsustainable if things don’t pick up reasonably quickly.

If this trend reverses however, the stock could look very cheap at today’s prices. And Polaris has generated average annual earnings per share of just over $5 over the last 10 years.

On this basis, the current share price implies a P/E ratio of around 8, which looks much more reasonable. So despite the high valuation multiple, I don’t actually think the stock is that expensive.

Investing in an expensive market

I think the Buffett indicator is worth paying attention to. But I’m not making plans for a stock market crash based on the historically high reading at the moment.

Instead, I’m looking for individual stocks to buy. And one type of opportunity is where unusually low earnings are making share prices look more expensive than they are.

Polaris is one example I think is worth considering right now. The P/E ratio might be high, but there’s a clear reason why this shouldn’t necessarily put investors off.