Looking for the best UK shares to buy and hold over the long term? Here are two I think demand serious consideration.

Green machines

With holdings in 86 different shares, the iShares Electric Vehicles and Driving Technology ETF (LSE:ECAR) provides a balanced way for investors to capitalise on growing demand for cleaner cars.

Consumer concerns over climate change continue to rise, meaning this fund has further significant growth potential in my opinion. It’s delivered an average annual return of 11.1% over the last five years, a period in which electric vehicle (EV) sales have risen eightfold.

As one may expect, this exchange-traded fund (ETF) provides exposure to major EV makers like Tesla, Li Auto, Volkswagen and XPeng. It also holds shares in information technonlogy firms and industrials that provide the guts these next-generation cars need to run.

Its holdings include semiconductor maker Nvidia and car components supplier Denso.

There is one fly in the ointment, however, with Tesla being the fund’s single largest holding. Sales here are falling off a cliff (down 49% in Europe during April, according to the European Automobile Manufacturers’ Association (ACEA)). They could continue sliding too, given growing public hostility to CEO Elon Musk and his associations with US Trump administration.

But although things can change, I’m encouraged by the fact just 7% of the fund is locked up in Tesla shares, thus limiting investors’ exposure.

With EVs expected to account for around 70% of all new vehicle sales by 2035, the iShares Electric Vehicles and Driving Technology ETF could prove a top long-term investment to consider.

Dividend star

Renewable energy is another sector tipped for rapid growth as businesses and consumers embrace ‘net zero’. Greencoat UK Wind (LSE:UKW) is a London-listed stock with substantial investment potential in this landscape.

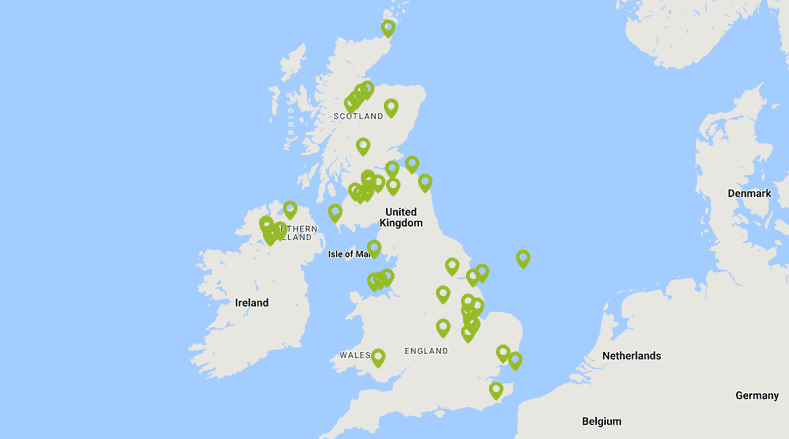

In total, this investment trust owns and operates 49 onshore and offshore wind farms. These assets span the length and breadth of the country, which protects energy generation at group level from weather-related issues in certain locations.

This broad footprint is just one reason why Greencoat UK is such a dependable share. Like other energy producers, it benefits from the largely stable nature of power demand across the economic cycle. Furthermore, its contracted revenues are linked to inflation, which preserves income stability.

These qualities have enabled the company to pay a large and growing dividend in 10 of the last 11 years.

The trust’s geographic footprint isn’t as diverse as some other renewable energy shares. And while this gives it fuller exposure to UK renewable energy policy, which is especially favourable right now, it remains a risk if UK government policy wer to c=shift.

Today Greencoat UK trades at a near-25% discount to its net asset value (per share). It also packs an enormous 9% dividend yield, which is one of the highest on the FTSE 250.

I think it’s an excellent value stock for long-term investors to consider.