The most important part of working towards a second income is taking the first step. It may still take years to reach a desired goal, but getting the ball rolling is often the hardest part.

Many would-be investors spend years saving and saving, thinking of the ideal day when they’ll have enough to start investing. But the truth is, any amount of money’s enough to get started.

In fact, savings often lose money over time as they fail to beat inflation. So it can be a case of chasing a never-ending goal. When calculating compounding returns over a certain time period, it becomes increasingly evident how important it is to start investing early.

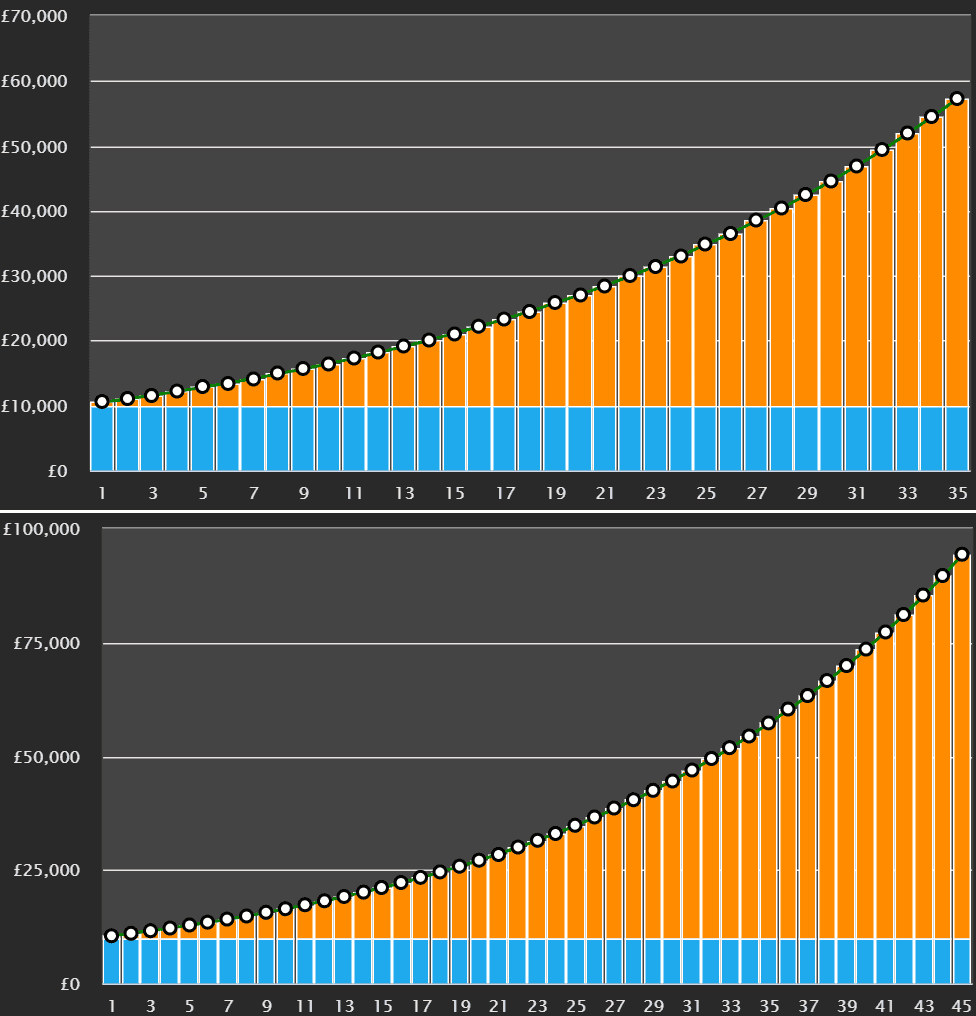

Imagine an investment of £10,000 into a FTSE 100 tracker with an average 5% return. An investor that started at age 30 would have £57,000 by retirement at 65.

But an investor who began just 10 years earlier, aged 20, would end up with almost double that!

No matter the financial situation, the sooner the better!

Building a second income with investments

The key to achieving a second income through investing is with dividends. When an investor has a large enough pot of savings, the dividends alone provide a steady stream of income.

For example, £750 a month equates to £9,000 a year. Let’s take a conservative approach and assume a decent portfolio can achieve an average 6% yield. That’s how much of the total it pays out annually.

Nine grand is 6% of £150,000, so that’s how much would be needed. With only £10k, it would take a long time to reach £150k — possibly 40-45 years. Realistically, regular contributions would be needed to speed things up. By adding just £100 a month to the pot, it could reduce the time to 26 years.

How to construct a portfolio

There’s two ways to work towards a second income by investing. One option is to aim for a high growth portfolio that achieves an average of 9-10% annual returns. This is possible but risky. Another option is to opt for reliable dividend stocks and reinvest the dividends to maximise growth.

Such stocks typically see minimal price appreciation, but the reinvested dividends make up for it. I find this approach more successful.

One under-the-radar example that income-focused investors may want to consider is TPICAP (LSE: TCAP). On first inspection, it might not scream ‘high returns’, particularly as the price is down 22% in the past five years.

It’s a relatively small brokerage firm but plays a significant role in the UK financial services industry. As one of the world’s largest interdealer brokers, it provides liquidity and trade execution across multiple asset classes, including fixed income, commodities and equities. Notably, it facilitates transactions between major financial institutions, investment banks and asset managers worldwide.

At the same time, this is its biggest risk, as an economic downturn can hurt the stock.

Dividend-wise, the 6.2% yield is more than sufficient. Its long-term dividend growth was hindered by Covid but during strong economic periods, it often increased by more than 10% a year. Now at 16.1p per share, it’s the highest it’s ever been.

When considering income stocks, it’s best to opt for well-established firms in strong industries with good dividend history.