Investing in equities with a Stocks and Shares ISA isn’t for everyone. Despite their superior average returns, some people prefer the convenience, the guaranteed return, and the safety that products like the Cash ISA provide.

Share investing doesn’t necessarily mean individuals need to take on excessive risk however. The multitude of investment trusts and funds available today means investors can target life-changing returns in a shares ISA without having to endure significant risk.

Here’s what I just bought

Take the example of the L&G Cyber Security ETF (LSE:ISPY). This is an exchange-traded fund (ETF) I recently purchased for my own portfolio.

Companies that help businesses and individuals protect themselves against online threats have significant growth potential. According to Statista, the broader cybersecurity sector’s set to grow at an average of 7.6% each year through to 2029.

Purchasing any individual tech stocks is a high-risk endeavour. Due to the sector’s fast-paced evolution, market leaders may struggle to maintain their competitive edge over time. And for cyber security providers, any high-profile systems failure can leave their reputation (and future sales prospects) in tatters.

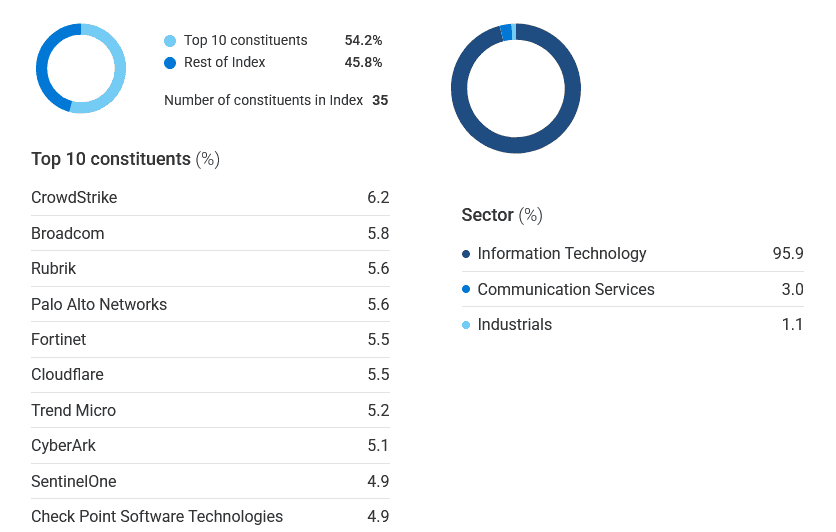

By investing in a product like this L&G Cyber Security, I can lessen (if not totally eliminate) the chances of my holdings becoming obsolete. The fund invests in dozens of tech businesses across the information technology, telecommunications and industrials sectors.

However, it still provides excellent exposure to some of the cybersecurity industry’s biggest and most innovative players:

£400 a month = £1m?

It’s a common misconception that diversifying like this means investors must settle for mediocre returns. Nobel-prize-winning economist Harry Markowitz famously called diversification a “free lunch“, where investors can enhance safety without compromising long-term returns.

L&G Cyber Security’s performance over the past decade proves this perfectly. Since its creation in September 2015, it’s provided an average annual return of roughly 11%.

If this were to continue, someone putting £300 in this fund each month would — after 30 years — have a £1.1m nest egg (excluding trading fees) to retire on.

Other options

That’s all well and good. But some investors may be sceptical that the cybersecurity industry can deliver the sort of growth that the likes of Statista expect.

The good news is that the ETF market has exploded, and individuals have thousands of these lower-risk instruments to choose from. Investors can gain exposure to different sectors, regions, themes, and can tailor the amount of risk they with to take on.

The Xtrackers MSCI World Momentum fund, for example, holds shares in 360 global companies. These range from Apple and Walmart in the States, through to non-US shares like Unilever, Siemens and Ferrari.

As you can see, this provides even greater diversification for investors. And what’s more, its return over the last decade is even higher, at 11.8%.

ETFs like these can still fall during periods of market volatility. But over the long term, I believe they’re attractive ways to consider targeting retirement wealth without taking on excessive risk.