On Friday (30 May), hVIVO (LSE:HVO) became a penny stock once more.

A brutal reaction from investors to an unexpected trading update brought the company’s market cap below £100m, having spent most of the past two years above this level.

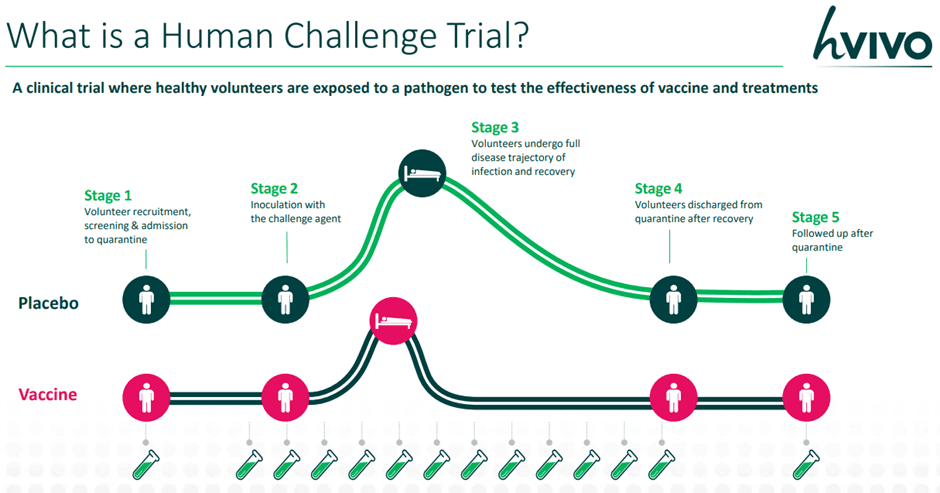

The group describes itself as “the world leader” in human challenge clinical trials. It claims to operate the world’s largest quarantine facility in London and boasts seven of the 10 biggest biopharma companies as its customers.

What’s the problem?

But blaming uncertainties in the pharmaceuticals industry — and a lack of liquidity in biotech financing — the group reported that it had “received notification of a significant human challenge trial contract cancellation alongside a postponement and a smaller study cancellation”.

After taking into account the cancellations, the company was able to confirm that it still has £47m of contracted revenues for the year ending 31 December 2025 (FY25). However, if no further work’s secured, the company’s expected to report a “mid-single-digit” operating loss.

Of course, given the market uncertainty, there’s little the company could do. But the news is particularly disappointing given that just seven weeks ago, the directors issued FY25 revenue guidance of £73m.

At this stage, it’s unclear how this will affect the group’s progress towards its target of £100m of turnover by 2028.

For FY24, the company reported an operating profit of £12.9m and adjusted earnings per share of 1.67p.

Not all bad

However, the business should be able to cope with its current problems. Due to a strong balance sheet — at 31 December 2024, it had £44.2m in the bank and no debt — it has the financial firepower to fund this year’s anticipated losses.

Positively, the group’s pipeline is reported to be at record levels with some “high probability” opportunities possibly providing “significant revenues” in FY26.

And unusually for a company that’s in its infancy, it’s about to pay a dividend costing £1.4m. After last week’s share price drop, the stock’s yielding 2.5%. Given the group’s healthy cash position, I think the payout appears secure for now.

Mixed opinions

But leaving aside Friday’s drop of 46%, the company’s share price performance has been disappointing.

Since June 2020, it’s fallen 36%. Over the past 12 months, it’s down 67%. And it’s now 72% below its 52-week high.

However, analysts appear upbeat. Of the six covering the stock, all are recommending that their clients take a position. The average 12-month price target is 32p, with a range of 24p-43p. The shares closed on 30 May at 8.7p. But it’s important to remember these forecasts were prepared before the trading update was released to the stock market.

Although the group has lots going for it, it’s not my kind of investment. The decline in its market cap — before last week’s bad news — suggests investors are losing patience. Also, the contract losses are likely to further dent confidence in the company’s prospects.

And as I get older, I can’t afford to wait for a business to establish itself. An investment in hVIVO would be too risky for me.