easyJet (LSE:EZJ) shares have achieved lift-off in recent weeks. At 574p per share, the FTSE 100 flyer has risen 15.7% in the past month alone, boosted by a falling oil price and improving hopes for the global economy.

But airline shares are famously volatile investments. And in the case of easyJet, someone who invested a lump sum a decade ago would now be nursing a hefty loss.

Since mid-2015, the budget airline’s dropped 57.6% in value from £13.55 per share. It means that £10,000 worth of the shares bought back then would now be worth £4,239.

Dividends totalling 223.94p per share have cushioned the blow for long-term investors. But even accounting for this, a £10k investment in easyJet shares 10 years ago would have delivered a total return of £5,892, or -41.1%.

While easyJet shares still trade well below pre-pandemic levels, should I consider buying them in June as they pick up momentum?

Bullish forecasts

City analysts, perhaps unsurprisingly, haven’t released price forecasts for the next 10 years. But they have provided estimates for the next 12 months. And, pleasingly, they are largely upbeat.

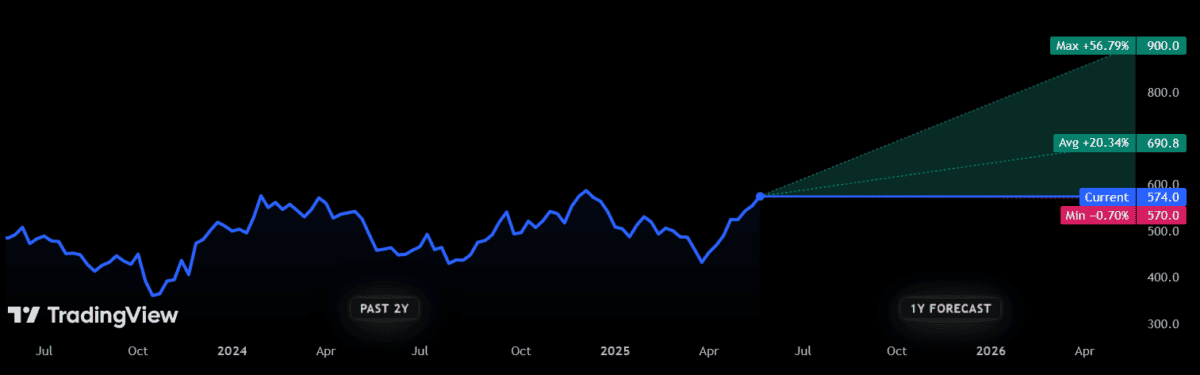

As of today, 18 analysts currently have ratings on easyJet stock. The consensus among them is that the airline will rise around a fifth in value over the coming year, to around 691p per share.

Encouragingly, only one of these brokers believes prices will reverse during the period. And the scale of the decline is less than 1%. At the other end of the scale, one especially bullish forecaster thinks prices will hit 900p, the highest level since May 2021.

Remember though, that broker consensus can often miss its mark, eitherh to the upside or the downside.

Sunny side up

Looking on the bright side, trading at easyJet remains largely pretty impressive. Passenger and ancillary revenues are expected to continue to climb, while demand at easyJet Holidays is shooting through the roof (sales rose 29% between October and March). As a result, group revenue was up 8% year on year.

Forward bookings have also been marching higher — these were 80% and 42% for quarters three and four respectively, up 0.5% and 2.2%.

With falling oil prices delivering a fuel cost boost too, I wouldn’t be shocked to see easyJet shares gain further ground.

Risks remain

But it’s not all sunny, and there are significant hazards on the horizon for the low-cost carrier. easyJet’s half-year results were also notable for signs of price softness in more recent months. Total airline revenue per seat dipped fractionally, to £69.78 from £69.87 in the prior period.

While the numbers themselves weren’t seismic, they do suggest a cooldown in the travel sector as people feel the pinch. With recent trade tensions hitting consumer confidence since then, it’s possible easyJet’s next update won’t be half as impressive.

Tough competition from budget rivals like Ryanair may also be behind that revenue per seat decline. This is an enduring threat that’s discouraged me from investing before, and — like the danger of economic downturns — it’s not the only one.

Sudden oil price spikes, strike action by airport and air traffic control staff, and geopolitical tensions are evergreen risks to airline profitability. And they could continue to depress easyJet shares, as they have at times during the last decade.

This is why, all things considered, I prefer other UK shares today.