Exchange-traded funds (ETFs) listed on the London Stock Exchange are a fantastic way to invest in themes inside an ISA. They also give instant exposure to a wide selection of companies, thereby helping to spread risk through diversification.

Here are three ETFs spanning cybersecurity, artificial intelligence (AI) and defence I think have tons of potential and are worth further research.

No longer a luxury

First up is L&G Cyber Security UCITS ETF (LSE: ISPY). This fund holds 41 stocks across the increasingly relevant cybersecurity industry. In recent weeks, Marks and Spencer, Co-op and Harrods have all been hit by cyber attacks.

On 27 May, Adidas was the latest firm to have customers’ personal information stolen. This highlights how cybersecurity spending is now a necessity rather than a luxury for organisations of all sizes.

The fund holds many top stocks in the space, including CrowdStrike, Cloudflare, and Palo Alto Networks. So far in 2025, CrowdStrike and Cloudflare are up 37% and 50% respectively.

The ETF’s share price is up 56% over the past two years. However, one consequence is that valuations are quite high across much of the portfolio. A risk here then is that the stock market pulls back, reducing the ETF’s value in the near term.

Over the long term though, I think it’s set up for further gains. AI’s creating an escalating arms race between cyber attackers (groups and nation states) and the defending companies in this ETF.

AI innovation

Sticking with AI, I think the iShares AI Innovation Active UCITS ETF (LSE: IART) is well worth considering. According to McKinsey Global Institute, AI software and services alone are projected to generate $15.5trn-$22.9trn in annual economic value by 2040!

As the name suggests, this ETF’s invested in firms doing a lot of AI innovation today. Top holdings include chip king Nvidia, Microsoft, which has a large stake in ChatGPT maker OpenAI, and Meta, the social media giant that’s using AI to improve targeted ads on Facebook and Instagram.

Now, one thing worth pointing out is that this actively-managed ETF was only launched in January. So there’s no track record of outperformance to go on, which adds a bit of risk.

However, I like that among the 39 holdings there are some smaller innovative names in there. These have the potential to eventually become tech giants in their own right. Examples include cloud-based data firm Snowflake, gaming platform Roblox, and Cloudflare (again).

Dual focus

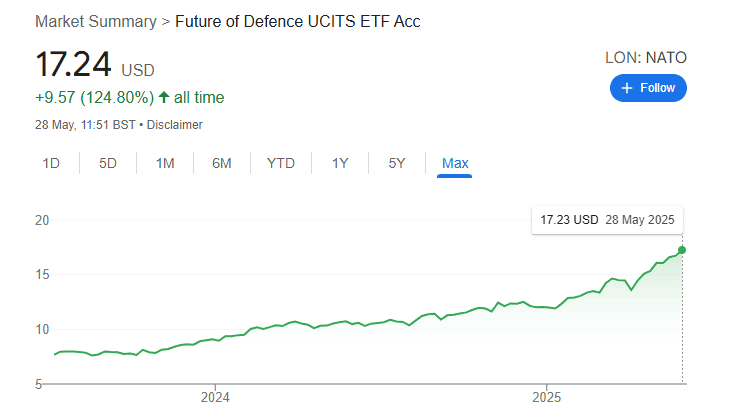

The third fund is the HANetf Future of Defence ETF (LSE: NATO). Since launching in mid-2023, the share price has more than doubled.

This ETF has a dual focus. It provides exposure to companies benefitting from both NATO military and cyber defence spending. Top holdings include Germany’s Rheinmetall, the UK’s BAE Systems, and AI software giant Palantir.

While these stocks have been on fire recently, a cut to the US defence budget could hurt their upwards trajectory. Meanwhile, a global recession might lead to lower growth and earnings for some firms in the portfolio.

On the other hand, European nations are now committed to spending hundreds of billions on building their long-neglected defence capabilities. This is a powerful multi-decade trend that’s likely to push the ETF higher, over time.