Anyone who started investing in 2025 would have had a baptism of fire. That’s because at the beginning of April the global stock market completely tanked. A handful of my shares crashed 30% inside a week!

Thankfully, most stocks have since recovered strongly. Both the FTSE 100 and S&P 500 are now only around 3% off new record highs.

Here are three reasons why today’s still a great time to consider starting an investing journey.

Market volatility creates opportunities

Right now, the market’s choosing to overlook the likely damage done from the sweeping tariffs implemented at the beginning of April. But if the global economy’s heading for a significant slowdown, sentiment could quickly sour.

Moreover, there are no guarantees the US and China will iron out all their differences. I expect more twists and turns with President Trump in the White House. Consequently, I think there will probably be a lot more volatility ahead this year.

While that might sound scary for newbie investors, it’s actually the best thing that can happen for long-term wealth-building. I did a bit of shopping for my Stocks and Shares ISA at the start of April. And those purchases have done very well as the market’s bounced back.

There’s likely more volatility to come, but this will create opportunities.

Rates are coming down

The second reason now’s a great time to start investing is because interest rates are on a downwards trajectory. Earlier in May, the Bank of England cut borrowing costs by a quarter of a percentage point to 4.25%.

As things stand, investors anticipate the rate coming down to around 3.5% by the end of the year. That’s assuming inflation doesn’t throw a spanner in the works.

Of course, when interest rates fall, savings accounts return less. In theory, this should motivate investors to move money into stocks in search of better returns, pushing up prices.

All things equal, higher stock prices mean lower dividend yields. Therefore, now might be a great time to bag some high yields before they move lower.

The compounding snowball

Finally, the sooner someone starts investing, the more time there is to get compounding going. This is the wealth-building miracle where interest starts earning interest.

One FTSE 250 dividend stock that looks attractive to me right now is 4imprint (LSE: FOUR). The company specialises in promotional merchandise, selling and distributing things like pens, clothes, cups and bags that are customised with clients’ logos or messages.

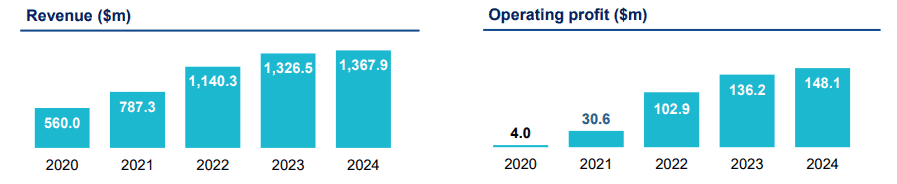

That might sound very low-margin, but the firm actually enjoys solid margins (10.8%). And growth has historically been impressive, rising from $787m in 2021 to nearly $1.4bn last year. Around 98% of revenue comes from North America.

However, the stock’s down 42% since the start of February. This is partly due to uncertainty around US tariffs, which could push up costs for customers and even cause a US recession, thereby dampening growth.

But I think these risks are already priced into the stock, which is trading at just 11 times earnings. Adding to its appeal is a 5.3% dividend yield. At its current level, I think 4imprint’s worth considering.