Over the last decade, the average Stocks and Shares ISA investors has enjoyed an average annual return of 9.64%. That’s pretty solid, I’m sure you’d agree.

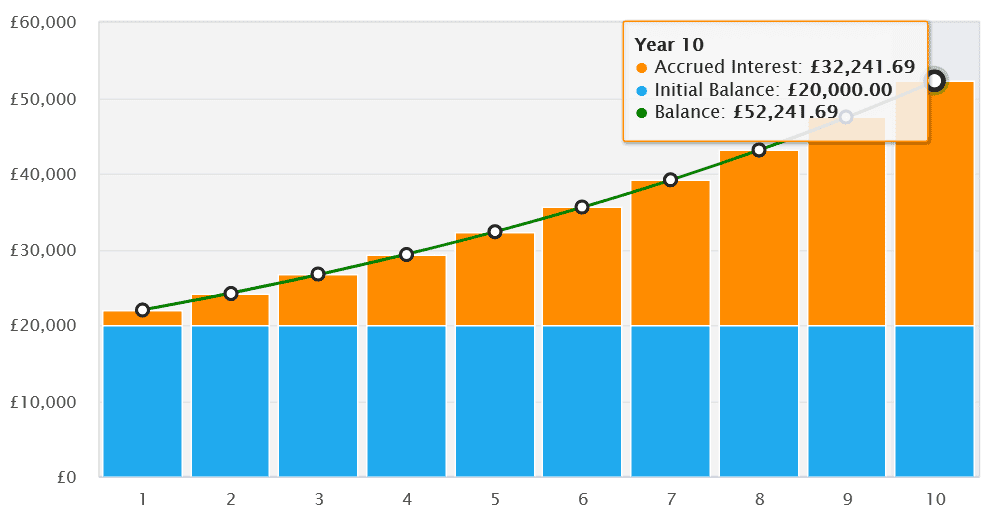

It means that someone who invested £20,000 in 2015 would — if they managed to secure this average — now be sitting on a healthy £52,242. What’s more, thanks to the tax perks of the ISA suite, they wouldn’t have had to pay any tax on capital gains or dividends either.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Yet while this represents a decent return, as an ambitious investor I’ll be hoping my ISA performs better over the next decade and more. With a wealth of shares, trusts and funds to choose from, both from the UK and overseas, I’m optimistic I’ll be able to hit my target.

A winning portfolio?

Here’s just one combination of shares I think could deliver a better-than-average return between now and 2025:

| Stock | Average Annual Return Since 2015 |

|---|---|

| Games Workshop | 39.7% |

| BAE Systems | 14.1% |

| Scottish Mortgage Investment Trust | 13.8% |

| HSBC | 6.9% |

| iShares Edge USA Quality Factor ETF | 12.2% |

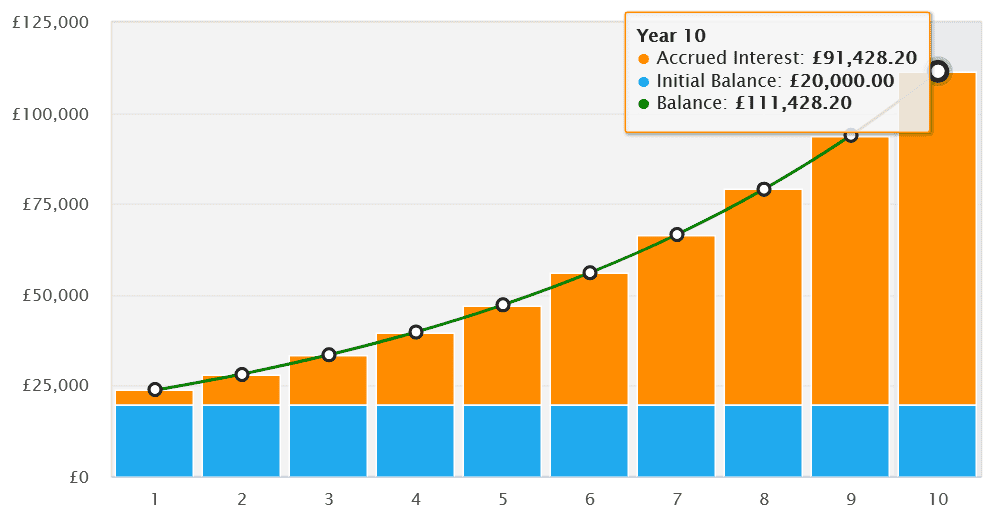

Delivering an average 17.3% yearly return over the last 10 years, a Stocks and Shares ISA comprising these stocks would have turned a £20,000 lump sum at the beginning into £111,428 today. That’s twice the return that the average ISA investor has enjoyed over the same timeframe.

I like this portfolio because it offers incredible diversification that can help investors spread risk while targeting ambitious returns.

Across each of the FTSE 100 shares, investment trusts, and exchange-traded funds (ETFs) it holds, it provides exposure to 225 separate companies. These span both cyclical and non-cyclical sectors and a wide variety of regions, allowing the portfolio to effectively absorb downturns in one business or industry.

Past performance isn’t always a reliable guide to future returns. And there are never any guarantees. But I’m optimistic that — despite the enduring threat of trade tariffs — Games Workshop and BAE Systems will deliver more substantial share price gains as their markets grow.

I’m confident too, that HSBC‘s focus on fast-growing Asian nations could also deliver long-term returns, even though interest rate cuts will squeeze margins.

I’d also back Scottish Mortgage to keep performing strongly as the tech revolution rolls on. That’s despite growing threats from China to key holdings like Nvidia and Tesla rising.

A top ISA pick

Among this grouping, I think iShares Edge USA Quality Factor ETF (LSE:IUQA) may be the best way for ISA holders to consider balancing risk and reward. With holdings in 123 different shares, it provides “direct investment in US companies that have historically experienced strong and stable earnings“.

This fund carries a high weighting of technology stocks such as Microsoft, Nvidia, Apple and Adobe. In total, IT accounts for 30.2% of the ETF, providing investors with exposure to exciting growth sectors including artificial intelligence (AI), cloud computing and robotics.

Other well-represented sectors include financial services, consumer goods, healthcare and telecoms. This could provide the fund with strength if economic conditions worsen and tech spending dips. But at the same time, such a big weighting to tech stocks still means it will suffer if they underperform.

On balance, I think this diversified ETF might be a great one to think about for a winning Stocks and Shares ISA.