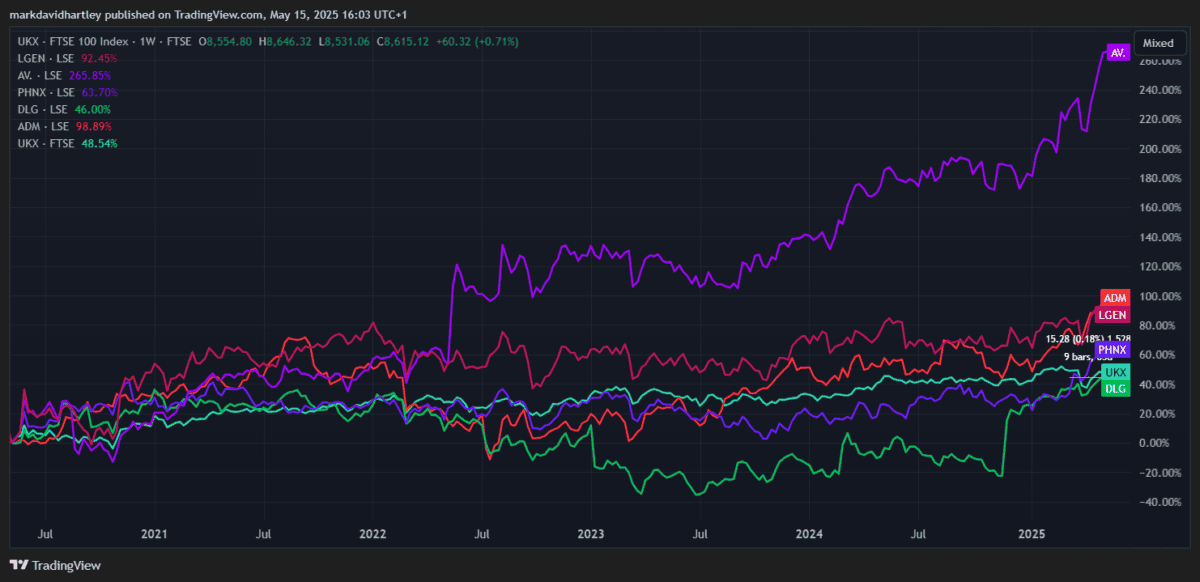

Looking at a price chart, investors might feel a bit underwhelmed by the five-year performance of Legal & General (LSE: LGEN) shares. The stock’s up only 30% since the early days of the pandemic — notably less than many other FTSE 100 shares.

However, when accounting for dividends, it tells a different story.

The UK stock market has experienced significant volatility since Covid, compounded by other issues such as Brexit and fluctuating interest rates. Despite these challenges, many UK companies have demonstrated resilience and provided consistent returns to investors.

While Legal & General Group has failed to match price performance, its impressive dedication to dividends has made it a worthy investment.

Crunching the numbers

Calculating exact returns from dividends can be complex and requires some assumptions, so in this example I’m working with averages. Five-year annualised price growth comes to 5.5% and the yield has fluctuated between 6% and 9%. As such, I’m assuming an average annual total return (including dividends reinvested) of around 13%.

With this figure, an investment of £10,000 in May 2020 would’ve likely grown to around £18,500 — an 85% return. This is considerably higher than the FTSE 100 average of 48.42% and that of rival insurers Phoenix Group and Direct Line.

However, it falls slightly behind that of Admiral and is considerably lower than Aviva’s 266.5% return — a particularly impressive performance considering the headwinds during the period.

So are Legal & General shares still worth considering in 2025? Let’s take a look.

Financial overview

In its 2024 full year results, Legal & General reported a 6% increase in operating profit to £1.62bn. This was driven by record retail annuity sales and improvements in its asset management division. The company’s focus on institutional retirement and asset management positions it well to capitalise on the growing demand for retirement solutions.

Assets under management stood at £1.12trn, making it one of Europe’s leading institutional investment managers. A strategic overhaul under CEO António Simões included selling some non-core assets in the US to focus on retirement, asset management and UK retail pensions. These moves aim to streamline operations and enhance shareholder value.

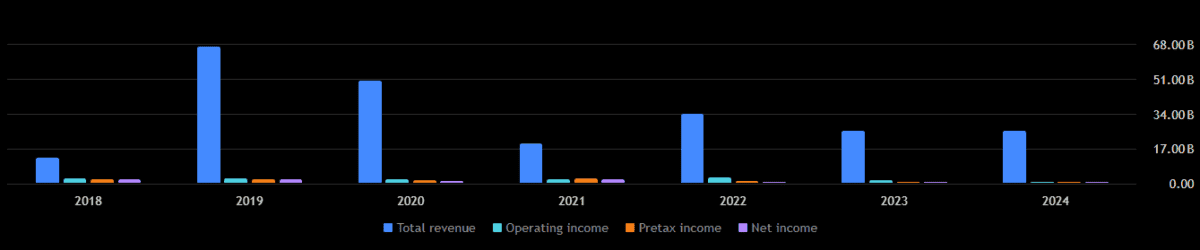

However, revenue and earnings have suffered notable declines since 2019.

The underwhelming performance is likely due to macroeconomic factors like interest rates and market conditions, which can impact investment returns.

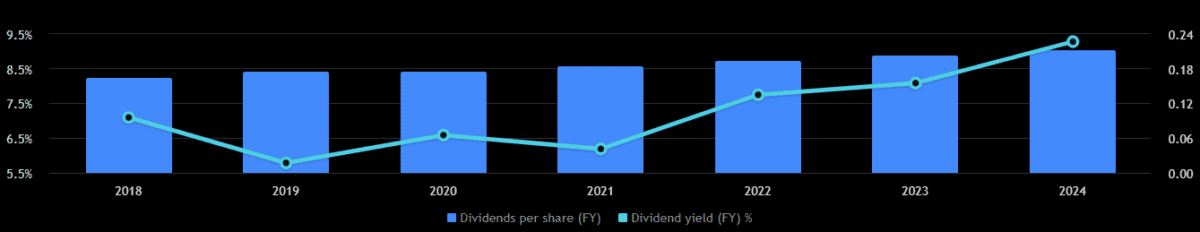

Meanwhile, dividends have continued to increase.

This stands as testament to the company’s long-held reputation as one of the best dividend stocks in the UK. Over the past 15 years, it’s increased dividends at an average annual rate of 12.12%, outpacing all other rivals in the insurance sector.

What’s more, it recently initiated a £200m share buyback programme to support future dividend payments and increases. The strategy aims to return over £5bn to shareholders over the next three years, solidifying its commitment to delivering consistent income to investors.

That said, its payout ratio is very high, prompting concerns about sustainability. If earnings don’t improve, it could pressure the company’s ability to maintain current dividend levels.

Overall, the spectacular track record reassures me that dividend payments can continue unhindered. While the concerns are valid, I still believe it’s a stock worth considering for an income portfolio.