The FTSE 250 index is home to a diverse mix of mid-cap companies and investment funds, often offering a sweet spot between the global reach of FTSE 100 giants and the growth potential of smaller firms. For investors seeking long-term wealth accumulation, high-yield dividend stocks on the mid-cap index can be particularly attractive.

Not only can they deliver regular income but also the possibility of capital growth over time.

However, while a high dividend yield might be promising for shareholder returns, it can also be a red flag. Exceptionally high yields sometimes indicate a share price under pressure or unsustainable payout ratios. As such, investors should assess the underlying fundamentals carefully before relying on yield alone.

One FTSE 250 stock that’s caught my attention recently is Twenty Four Income Fund (LSE: TFIF). With a staggering dividend yield of almost 10%, it appears to offer both income and value – but does it have the resilience to deliver over the long term?

A top-performing FTSE 250 dividend gem

Twenty Four Income’s a closed-ended investment fund that focuses on asset-backed securities, primarily in the European and UK credit markets. It aims to provide attractive risk-adjusted returns while generating a high level of income for shareholders.

Over the past five years, the share price has risen by 22%, supported by strong performance and an experienced management team. Out of every 10%-plus-yielding FTSE 250 stock, it’s the only one that has enjoyed positive price growth over five years.

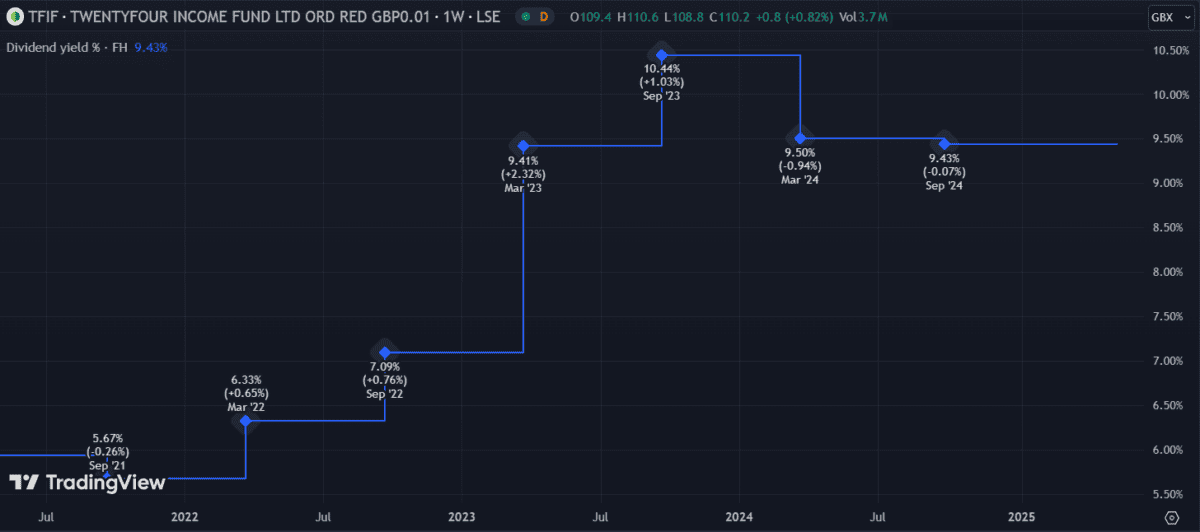

More impressively, its dividend has grown at an average annual rate of 5.23% over the past decade — a clear signal of sustainability and long-term commitment to income investors.

Latest results and ratios

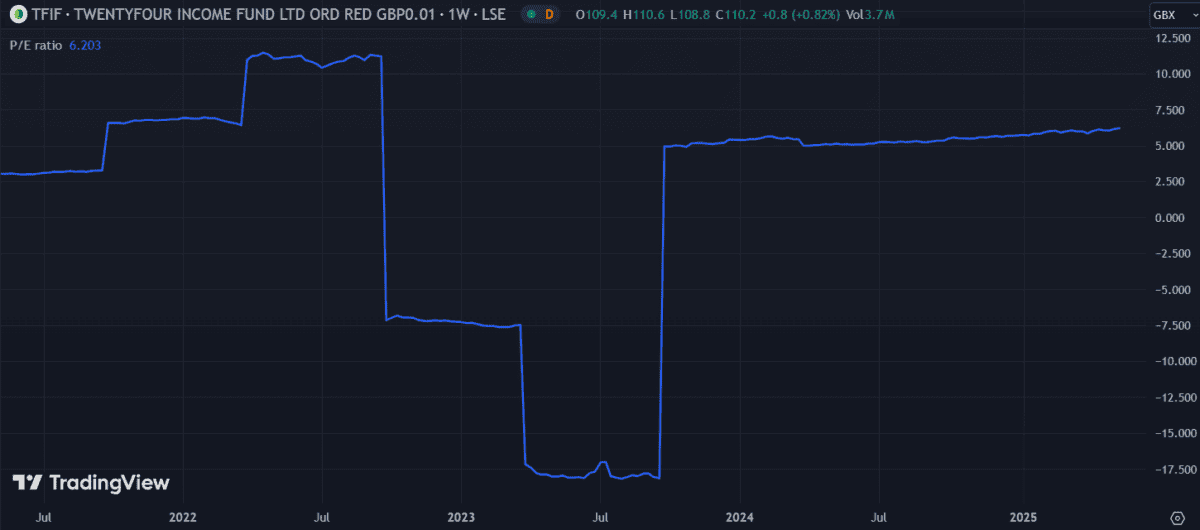

In its latest full-year results, the fund posted revenue of £52.7m and a net profit of £136m, a significant turnaround from the £22.6m loss recorded the previous year. These figures point to robust management and an effective investment strategy during a period of rising interest rates and economic uncertainty.

With a price-to-earnings (P/E) ratio of just 6.2, the price looks undervalued with decent growth potential. This is further supported by a return on equity (ROE) of 16.65%, suggesting efficient use of capital.

What could go wrong?

As always, investments come with risk. Despite the attractive yield and solid performance, Twenty Four Income’s no exception. It invests in credit markets, which are sensitive to economic conditions, interest rate changes and liquidity fluctuations. Any deterioration in asset-backed security valuations or a spike in defaults could impact earnings and future dividends.

Additionally, high-yielding funds are often exposed to leverage and interest rate risk. While the fund has navigated recent volatility effectively, the outlook for fixed income markets remains uncertain.

An opportunity to consider?

For investors like myself who consistently search for reliable dividend stocks, I think Twenty Four Income Fund’s an intriguing option to consider. Its combination of double-digit yield, long-term growth and strong profitability suggests it could make a good addition to an income-focused portfolio.

That said, no investment should be made in isolation. It’s essential to conduct thorough market research and aim for a diversified portfolio to reduce sector-specific risk – especially when dealing with high-yield assets.