Resurgent sales have propelled Marks and Spencer Group (LSE:MKS) shares sharply higher since October 2022. Before the recent cyberattack (more on this later), they hit their most expensive for almost a decade at 417.8p each in late April.

Yet despite these gains, someone who bought the FTSE 100 retailer 10 years ago would still be nursing some significant losses.

At 345.4p, Marks and Spencer’s share price is 36.7% lower than it was at this point in 2015, at 546.1p. It means that £10,000 worth of shares bought back then would now be worth £6,328.

Thanks to some dividend payments delivered in that time — these equate to 86.23p per share — someone who invested £10k in the retailer would have also received £1,582 in passive income. That would have improved their total return to £7,910, or -20.9%.

That’s a pretty shoddy result, I’m sure you’d agree. But with its revamped clothing strategy paying off and its digital proposition delivering the goods, could Marks and Spencer outperform the UK’s large- and mid-cap shares looking ahead?

And should I consider buying the retailer for my portfolio?

Positive price forecasts

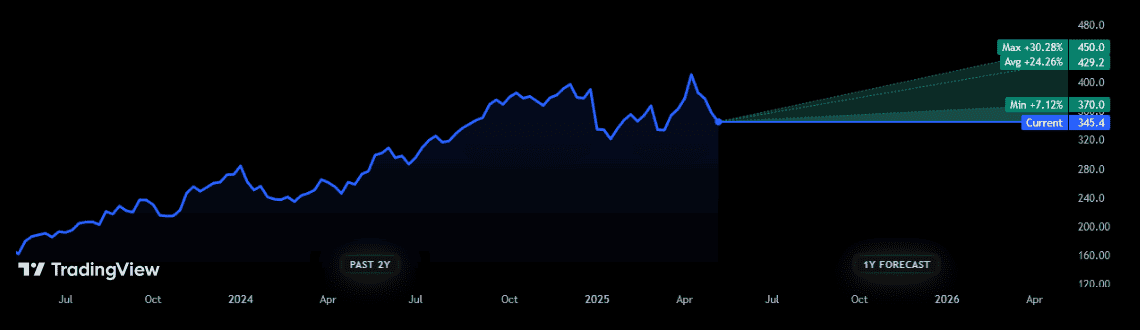

Unfortunately, share price forecasts aren’t available for the shares for the next decade. However, they are available for the next 12 months. And encouragingly, they suggest the retailer will keep its share price recovery going.

As the graph shows, the 11 analysts with ratings on the stock are united in their optimism. One especially bullish forecaster expects the retailer to march to new multi-year highs of 450p.

Should I buy?

On the one hand, it’s perhaps no surprise that City brokers are bullish on the Footsie company. The recovery that long-term investors were desperately seeking is finally here and continues to deliver in spades.

Clothing, home and beauty sales rose 1.9% on a like-for-like basis in the 13 weeks to 28 December, latest financials in January showed. Corresponding food revenues meanwhile were up 8.9% year on year.

The core clothing division is striking the right balance of style, value and quality, and continues to gain market share. And heavy investment in online is also paying off, with internet sales rising 11.7% in the last quarter.

However, I’m not convinced the shares are a buy for me right now. Its failure to offer full-year guidance in January underlined growing uncertainty as consumers feel the pinch. The retailer also faces ongoing competitive threats, and especially in food where the UK’s major supermarkets are embarking on a new price war.

I’m also concerned about the implications of the cyberattack last month that halted online orders. In the near term, this could take a big bite out of profits (internet sales accounted for 34% of group sales in the January quarter). As I type, online orders are still paused.

And the damage could be even more severe over the long term. On Tuesday (13 May), the business said “some of their personal customer data has been taken.” The reputational damage to the M&S brand could be significant and prompt online shoppers to go elsewhere.

While they’re not without potential, on balance I’d still rather leave these shares on the shelf right now.