Investors may be forgiven for thinking that supermarkets like Sainsbury’s (LSE:SBRY) are among the most secure dividend shares out there. Food retail’s one of the most stable sectors, even during economic downturns. So in theory, earnings and dividends should remain steady over time, right?

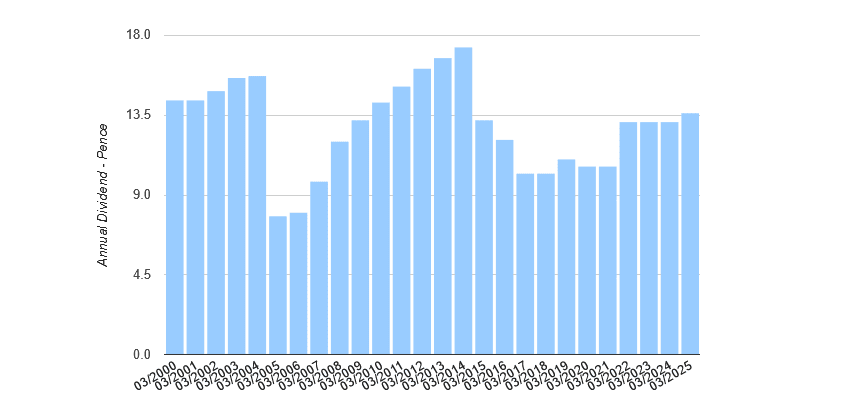

Well, J Sainsbury’s more recent dividend record has told a different story. Annual dividends dropped three times in a row during the mid-2010s. They fell again during the pandemic period, even as Tesco was able to keep raising shareholder payouts.

But since then, dividends per share have risen (albeit not in a straight line). This included a 4% increase in the last financial year (ending February), to 13.6p.

Can Sainsbury’s continue raising shareholder payouts though? And should I buy the grocer’s shares for my portfolio?

Near-6% yields

| Financial year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2026 | 15.35p | 12.9% | 5.8% |

| 2027 | 15.17p | -1.1% | 5.8% |

| 2028 | 15.40p | 1.5% | 5.9% |

As the table shows, City analysts expect total dividends at Sainsbury’s to surge this financial year, before falling and rising again.

However, this doesn’t reflect expected earnings volatility or balance sheet pressure. Instead, it highlights the retailer’s plans to pay £250m worth of special dividends this year. This will follow the sale of its banking operations to NatWest (scheduled for completion in May).

Actually stripping out this supplementary dividend, cash rewards on Sainsbury’s shares are tipped to keep growing all the way through to 2028. But how realistic are these forecasts? Well, based on predicted earnings, they’re looking pretty fragile, in my view.

As an investor, I’m seeking dividend cover of 2 times and above for a wide margin of safety. At Sainsbury’s, predicted payouts are covered between 1.3 times and 1.6 times by expected earnings over the next three years.

However, predicted earnings aren’t the whole story, and it’s important to visit the retailer’s balance sheet. Here things look more promising.

The grocer’s net-debt-to-EBITDA ratio was 2.6 times at the end of fiscal 2025, at the lower end of the targeted 2.4-3 times. Reflecting this, the board raised the annual dividend and declared a new £200m share buyback.

Are the shares a buy for me?

Despite the City’s optimistic dividend forecasts, I’m not tempted to purchase this FTSE share for my portfolio. I believe that mounting competition poses a threat to both earnings and shareholder payouts in the coming years, as we saw during the 2010s.

Last year, Sainsbury’s enjoyed “a record-breaking year in grocery” that drove group sales 3.1% higher. It enjoyed its best market share gains for around 10 years, and helped by its Nectar loyalty programme, there’s a chance it could continue its recent strong momentum.

Yet I feel the odds are stacked against it, and certainly unless it slashes prices as a new price war heats up.

Underlying operating margin rose to 3.17% in the last financial year, but remain vulnerable to weakening again, with Aldi and Lidl continuing to expand, and Asda announcing its biggest price cuts for decades. Tesco has also vowed to get busy slashing prices.

Sainsbury’s also faces mounting stress at Argos as the cost-of-living crisis drags on. So on balance, I’d rather find other UK shares to buy for passive income.