Over the past 12 months, the share price of Vodafone (LSE:VOD), the FTSE 100 telecoms giant, has fluctuated between 62.4p and 79.5p. This is a relatively narrow range and, as a shareholder, I find this lack of movement extremely frustrating.

But some people won’t be too bothered by this. They buy shares for passive income and are more interested in receiving dividends than achieving capital growth. However, in recent times, I think income investors will also be disappointed.

Shareholder returns

In respect of Vodafone’s March 2018 financial year (FY18), a dividend of 15.07 euro cents was declared. The next year it was cut to 9 euro cents. For FY25, it’s been halved to 4.5 euro cents.

Based on current (7 May) exchange rates, it means the stock’s yielding 5.3%. This puts it in the top 20% of FTSE 100 dividend payers, which is pretty good. However, its above-average yield has more to do with its stagnant share price than its generous dividend.

And I have to remind myself that my personal yield is much lower because I first took a position when the share price was close to 100p.

Admittedly, the company’s tried to soften the blow by announcing a series of share buybacks. Since 15 May 2024, its spent nearly €2bn on the company’s shares. And what’s happened to the share price? It’s fallen 2.4%.

Personally, I would rather have the cash in my hand. And I think it’s a reminder that if a company’s stock has fallen out of favour with investors, it’s a waste of money reducing the number of shares in issue. The cash would be better used elsewhere.

Why bother?

So far, I haven’t painted a particularly rosy picture. Meanwhile, the share price appears stuck and the dividend’s 50% lower than it was a year ago.

So it begs two questions. First, what’s the point of investing? Second, should I sell?

Indeed, the situation in which I find myself reminds me of one of Warren Buffett’s famous quotes: “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks”.

A possible valuation

But I think there’s some evidence to suggest that the stock’s undervalued. On 20 May, the company’s due to report its FY25 results. These are expected to disclose EBITDAaL (earnings before interest, tax, depreciation and amortisation, after leases) of €11bn (£9.4bn). This means the group’s valued at around 1.9 times EBITDAaL.

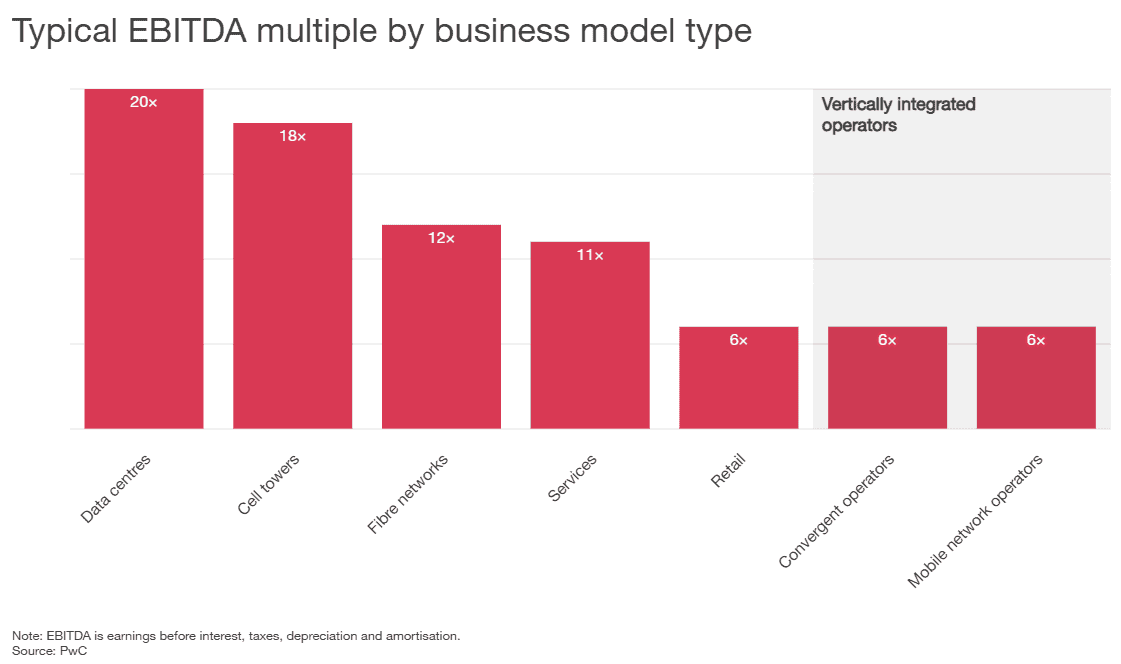

According to PricewaterhouseCoopers, a typical earnings multiple for a vertically-integrated telecoms group is six. Apply this to Vodafone and its share price should be over three times higher.

Difficult times

However, the group faces some challenges. Due to a change in law on the bundling of television contracts in Germany — its biggest market — it’s losing customers.

The group’s also going through a period of transition and has sold some of its non-core divisions. This makes it difficult to know what a slimmer Vodafone will look like although, positively, most of the sales proceeds are being used to reduce the group’s significant debt burden.

But I admit my patience is wearing thin. However for now, I’m going to hold on to my shares in the hope that others will soon agree that the group’s presently undervalued.