Investing for a second income is becoming more challenging as recessionary risks grow in key economies. Dividends from a broad range of UK shares could be under threat if earnings stagnate or fall.

In this climate, seeking a passive income with diversified investment trusts could be a shrewd strategy to consider. With this in mind, here are two such trusts I think deserve close attention.

High energy

With a 13.4% forward dividend yield, SDCL Energy Efficiency Trust‘s (LSE:SEIT) one of the top three highest-yielding investment trusts on the London stock market.

As its name implies, this trust owns assets that seek to improve energy efficiency and reduce carbon emissions. These include electric vehicle charging stations, rooftop solar panels on retail buildings, and waste heat recovery systems for industrial clients. In all, it has 50 different projects on its books.

These span both cyclical and defensive sectors — such as healthcare, retail and data centres — as well as different parts of the world. Around two-thirds of its assets are in the US, with the remainder spread across the UK, Asia and Mainland Europe. This diversified approach facilitates a smooth stream of income even if individual industries or territories suffer turbulence.

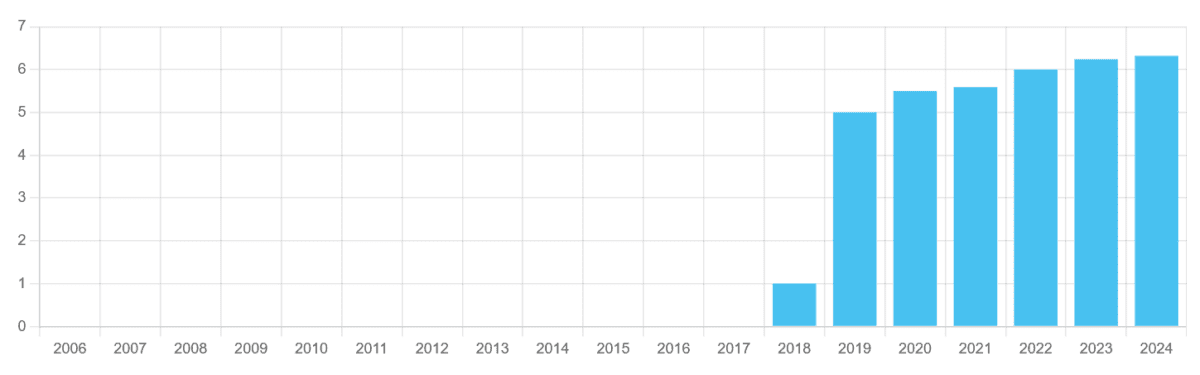

As the chart below shows, SDCL’s dividends have grown each year since the trust’s initial public offering (IPO) six years ago.

That’s not to say future earnings aren’t immune to pressure however. I’m especially mindful that changing green policy in the US under the Trump presidency could limit future returns.

But I believe this is more that reflected in SDCL’s rock-bottom valuation. At 46.3p per share, it trades at a 48.5% discount to its net asset value (NAV) per share. Combined with at 13%+ dividend yield, I believe the company merits a serious look.

Good health

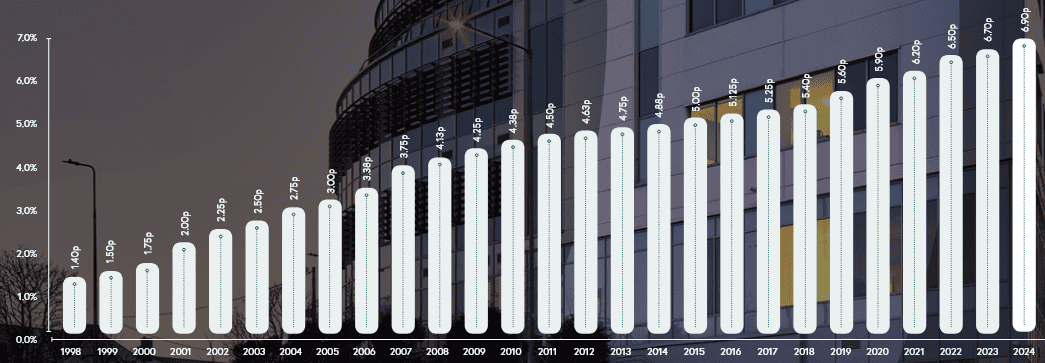

Primary Health Properties (LSE:PHP) is another investment trust with sky-high dividend yields and a long record of payout growth. Indeed, annual dividends here have risen for 28 straight years.

This partly reflects its classification as a real estate investment trust (REIT). Under sector rules, at least 90% of earnings from its rental operations must be distributed in the form of dividends.

It’s also because of its focus on the ultra-defensive healthcare sector. The vast majority of its 500-plus properties are doctor surgeries, with other properties including dentists, pharmacies and diagnostics centres.

This wide portfolio helps protect group earnings from localised issues, though in reality any seismic issues are unlikely. This is because the rents it receives are indirectly paid by local authorities and government bodies.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Profits could be at risk if NHS policy changes unfavourably. However, the cost benefits that primary healthcare in general brings means such actions are unlikely (if not totally off the table). Just this week, the UK government announced a £102m cash injection to build new surgeries and modernise existing ones.

Primary Health Properties’ forward dividend yield is also a market-beating 7%.