Scottish Mortgage Investment Trust (LSE: SMT) shares took a pasting after President Trump’s ‘Liberation Day’ speech on 2 April. They dropped 13.5% in just three trading days!

Since then though, they’ve bounced back to 930p and fully recovered. Therefore, an investor who’d bought £5,000 worth of shares at 815p on 7 April would now have roughly £5,700.

Volatility is the norm

That said, this whipsawing demonstrates how volatile the FTSE 100 investment trust is. It tends to really fly when the Nasdaq Composite heads higher, and vice versa.

There are also Asian, Latin American and European stocks in the portfolio, making up nearly 40%. But for better or worse (fortunately the former over the long run), Scottish Mortgage moves with US-listed shares.

Therefore, a potential US recession is a risk to companies’ earnings and valuations. That’s why it’s necessary to take a long-term view with this growth-focused trust.

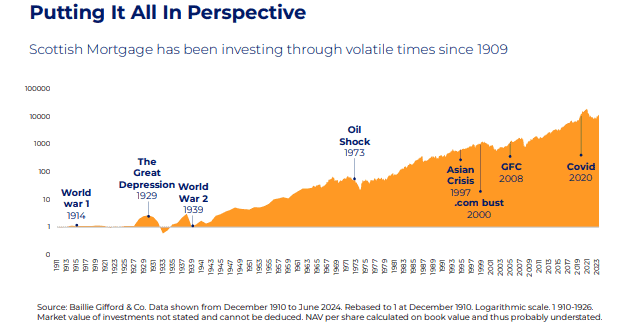

For perspective though, Scottish Mortgage has survived various crises over the past century, including two world wars, global pandemics, and 15 separate US recessions. It will survive another downturn then keep moving higher, in my view.

Portfolio progress

We’re currently in the middle of Q1 earnings season. So we can assess the progress of some of the trust’s top holdings that have already reported earnings.

Let’s start with Amazon, the third-largest holding. Q1 revenue rose 9% year on year to $155.7bn, with AWS sales jumping 17% to $29.3bn. Amazon’s advertising revenue, which increased 17.7%, is now becoming a meaningful contributor to profits. Overall operating income surged 20% to $18.4bn.

The fourth-largest holding — Meta Platforms — also reported strong growth. Revenue increased 16% to $42.3bn, while the operating margin expanded from 38% to 41%.

Elsewhere, Spotify‘s free cash flow continues to explode higher, rising nearly tenfold in just two years. The Spotify share price has more than doubled in the past year.

Meanwhile, Chinese electric vehicle firm BYD has just reported a doubling of profits as it aggressively expands worldwide. Scottish Mortgage recently wrote: “If BYD is subject to the tariffs on China, it could still one day sell 10m cars or more a year outside the US, including autonomous and rapid charge technology.”

Yesterday (6 May), Ferrari reported a very solid 18% rise in earnings per share.

These are all excellent firms growing strongly. Ultimately, it will be some of these that will help drive Scottish Mortgage’s long-term performance.

Roblox

Another interesting holding that continues to impress me is Roblox (NYSE: RBLX). Shares of the gaming platform are up 75% over the past year.

In Q1, revenue surged 29% to just over $1bn, while bookings grew faster at 31%. Bookings basically reflect the total value of digital currency Robux purchased on the platform.

Average daily active users (DAUs) jumped 26% to 97.8m, while hours engaged rose 30% to 21.7bn. Growth was strong in all regions, including the massive growth market of India (DAUs up 77%).

One issue with Roblox is that it remains unprofitable on a net income basis, which adds risk. It reported a quarterly net loss of $216m.

I think the company’s profitability should improve as it scales its advertising business over the next few years. But it remains pricey and high risk, in my opinion. I feel Scottish Mortgage is the safer long-term bet to consider.