Strong recent earnings and exciting growth potential has made Rolls-Royce (LSE:RR) one of the FTSE 100‘s most popular shares. What attracts less attention is the company’s capacity for robust dividend growth in the coming years. And boy, the outlook looks incredibly promising.

Thanks to its repaired balance sheet and improved end markets, the engineer last year paid a full-year dividend of 6p per share, its first since the pandemic. With dividends back on the agenda, City analysts expect distributions on its shares to rise sharply through to 2027 as well.

But of course dividends are never, ever guaranteed. So just how realistic are current payout forecasts? And given the uncertain economic outlook, should investors consider buying the aviation giant today?

Dividend growth

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 7.78p | 29.7% | 1% |

| 2026 | 9.67p | 24.3% | 1.3% |

| 2027 | 10.81p | 11.8% | 1.4% |

The first thing investors tend to look at is dividend yield. And on this front Rolls-Royce shares are less than impressive.

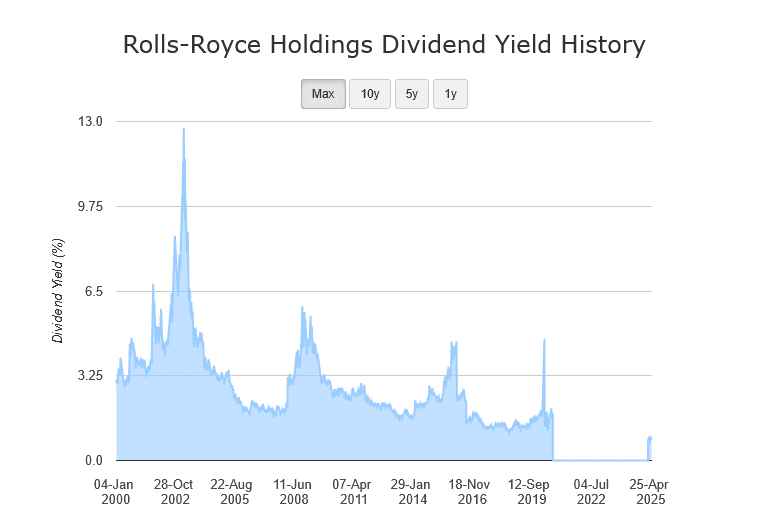

However, an underwhelming yield is nothing new, as the chart below shows. Aside from brief periods when Rolls’ share price sank and the yield bounced higher, the size of shareholder payouts have long lagged the average for UK blue-chip shares:

This is perhaps unsurprising given the expensive nature of the firm’s operations. Developing technologies like aeroplane engines and nuclear reactors requires a mountain of cash, as reflected in Rolls’ low payout ratio of 30%.

The good news is that strong dividend growth projections help to make up for the currently low yield. Although slowing through to 2027, annual payouts are tipped to grow by double-digit percentages through the period, comfortably outstripping the likely rate of inflation.

Robust estimates

It’s also important to consider that Rolls-Royce looks in good shape to meet current dividend forecasts.

For the next three years, predicted payouts are covered 3-3.1 times over by anticipated earnings. This provides a wide margin of error in case profits are blown off course (any reading above 2 times is typically regarded as robust).

Heavy restructuring and improving end markets have also given the business a solid balance sheet. It ended 2024 with net cash of £475m, while free cash flow rose to £2.4bn (and is tipped by Rolls to hit £2.7bn-£2.9bn this year).

Are these shares a buy for me?

Yet while it looks in great shape to grow dividends, I’m not tempted to buy Rolls-Royce shares for my own portfolio.

With a forward price-to-earnings (P/E) ratio of 30.3 times, the FTSE 100 firm is much too expensive for my liking. Not only can I see little value at these levels, but this sort of valuation could prompt a price correction if earnings forecasts come under pressure.

And the risks are growing for Rolls-Royce’s profits and share price, in my opinion. While its defence markets are in great shape, signs of weakness in the commercial aviation market are a serious concern. A slew of US airlines have recently warned on demand, while Delta has withdrawn its full-year guidance entirely.

Conditions could worsen too, if fresh global trade tariffs sap economic growth. What’s more, trade barriers also threaten to send costs through the roof and disrupt supply chains.

On balance, I’d rather buy other dividend growth shares today.