Banks like Lloyds (LSE:LLOY) are some of the most popular passive income shares out there. Their stable cash flows — generated from interest income, product fees, and investments — give them the means to pay a large and often growing dividend almost every year.

What’s more, retail banks only have limited growth opportunities. This means they tend to pay a greater proportion of their excess capital out in dividends compared to many other UK shares.

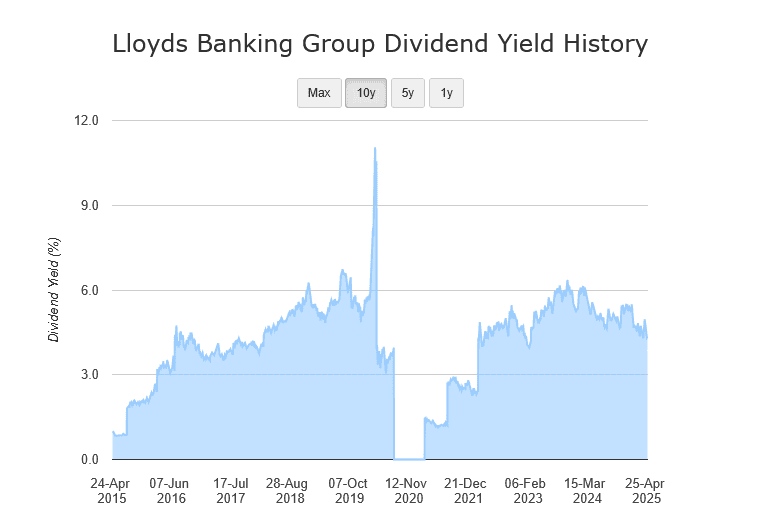

This has resulted in a long history of Lloyds shares delivering yields that trump the broader FTSE 100:

The only exception to this came in 2020, when the Bank of England demanded UK banks stopped dividends during the height of the pandemic.

Yet while this was an anomaly, it also shows that dividends are never, ever guaranteed. So what is the payout forecast like for Lloyds shares over the next few years?

Dividend growth

Banks are among the most cyclical companies out there. When economic conditions worsen, profits can fall through the floor as revenues dry up and loan impairments shoot higher.

This danger is especially high at the moment as Britain’s economy stagnates. However, this isn’t expected to put an end to Lloyds’ progressive dividend policy, as analyst forecasts below show:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 3.59p | 13.2% | 4.9% |

| 2026 | 4.29p | 19.5% | 5.9% |

| 2027 | 4.84p | 12.8% | 6.6% |

As you can see, the yields on Lloyds’ predicted dividends all sail above the FTSE 100 long-term average of 3%-4%.

On top of this, predicted double-digit percentage growth is expected to comfortably outpace the impact of inflation. To put this rate of predicted growth into further perspective, dividends across the broader UK share complex are tipped to grow at an average 2% this year.

Robust foundations

As I say, dividends are never in the bag. But I’m optimistic that Lloyds shares can deliver the cash rewards that City brokers predict.

Firstly, expected dividends are covered either 2.1 or 2.2 times by anticipated earnings over the period. This provides a decent margin of safety in case profits are indeed blown off course.

Lloyds also has a strong balance sheet it can utilise to pay more market-beating dividends. At the end of 2024, its CET1 capital ratio (a measure of solvency) rang in at 14.2%, well ahead of its targeted minimum of 13%.

Should I buy Lloyds shares?

The bad news is that dividends are only one thing to consider when choosing a stock to buy. So while Lloyds shares could keep delivering a large passive income, these benefits could be offset by an underperforming share price.

I’m not just concerned about bank earnings if (as I expect) Britain’s economy remains under pressure. Income levels could also disappoint as the Bank of England steadily cuts interest rates, pulling margins lower. Net interest margins (NIMs) were already alarmingly thin at 2.95% in 2024.

And while Lloyds has considerable brand power, revenues and margins are under significant threat from growing competition in the banking industry. Finally, Lloyds’ share price could take a pummelling if an investigation into motor finance goes against it, causing billions of pounds in financial penalties.

Despite its solid dividends forecasts, I would — on balance — rather find other passive income shares to buy right now.