Shares in FTSE 250 real estate investment trust (REIT) Great Portland Estates (LSE:GPE) look cheap at the moment. The stock currently trades at around 66% of its book value.

I think this raises a number of interesting possibilities for investors. And at a 43% discount to where it was five years ago, it could well be worth closer attention.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

London real estate

Like all REITs, Great Portland Estates leases properties and returns the cash to shareholders as dividends. Its portfolio consists of around 40 office-type buildings located in Central London.

It’s no secret that demand for office space has been weak since the Covid-19 pandemic. And this has been reflected in both the firm’s operational performance and its financial returns.

Vacancy rates have increased from below 2% to around 9% over the last five years. As a result, the company hasn’t increased its dividend since 2020.

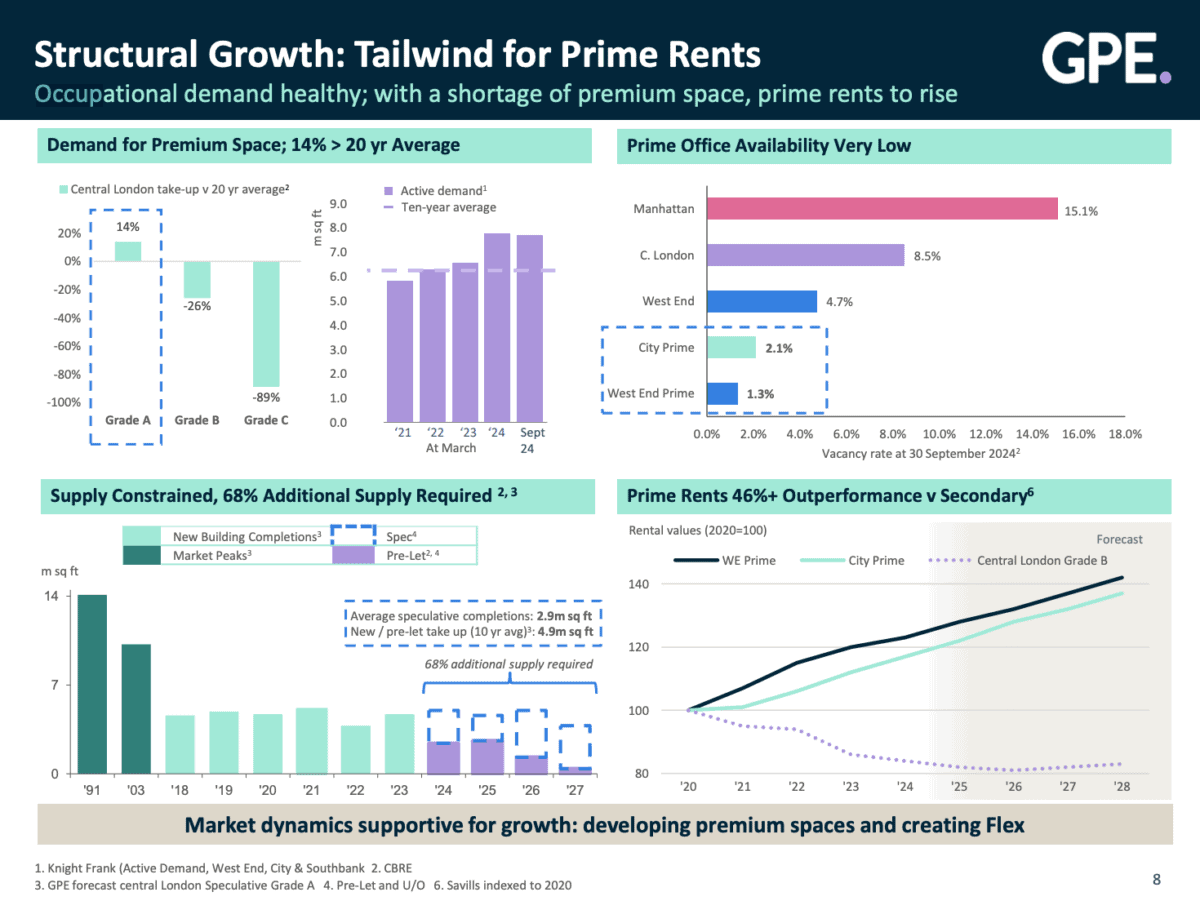

Neither of these is a positive sign, but there are reasons for optimism. One is the fact the imbalance between supply and demand seems to be improving, from the firm’s perspective.

Source: Company presentation

That’s partly a feature of the company’s focus on properties in desirable Central London locations. But there’s another reason the stock has been catching my eye lately.

I don’t normally view a stock trading at a big discount to the net value of its assets as particularly significant. But in this case, things are a bit different.

Selling opportunities

The reason I don’t usually pay attention to book value is that it’s unlikely to be realised. Unless a company starts selling its assets, their market value doesn’t really matter.

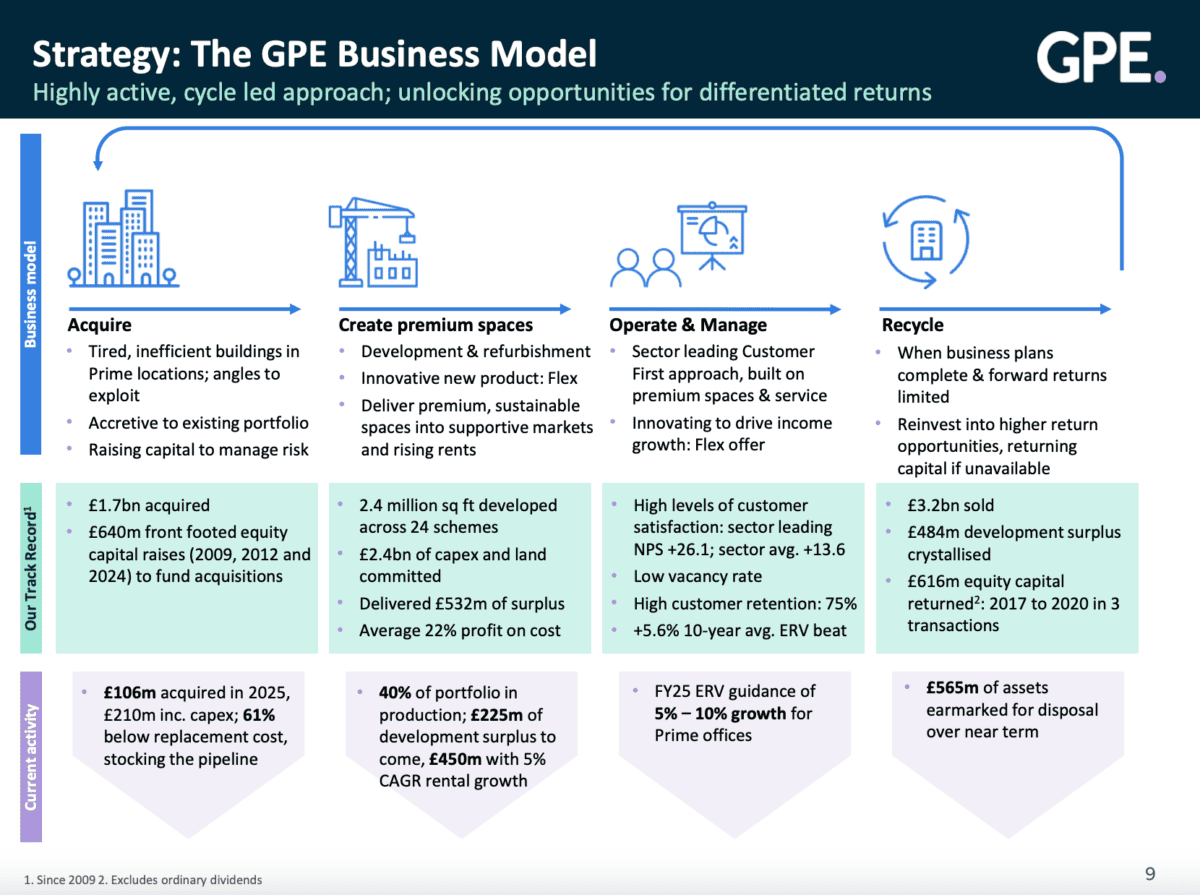

With Great Portland Estates, however, selling assets is a key part of the business. The firm’s strategy involves acquiring, developing, leasing, and ultimately disposing of properties.

Source: Company presentation

In fact, the company currently has plans to dispose of around £565m worth of properties. That’s the equivalent of almost 45% of its market value.

This means shareholders could well benefit from the FTSE 250 firm selling some of its assets. And there’s one last thing to note as well.

UK REITs have been attracting a lot of attention recently from institutional investors. A number of real estate stocks trading at discounts to book value have been takeover targets.

The possibility of being bought out at a premium to the current share price isn’t the primary reason to consider buying the stock. But I do think it’s something investors shouldn’t ignore.

A stock to consider

I think investors have a number of ways to get a good result from shares in Great Portland Estates. One is from the company’s operations and the other is from selling its assets.

An improving balance between supply and demand (albeit from a low base) could boost occupancy rates and rental income. And this could result in a return to dividend growth.

Equally, the firm’s scope for selling assets – either as part of its strategy or in an acquisition is another possibility. And this is especially plausible with the stock trading below book value.

Having multiple routes to a good return is something that makes the stock attractive. And I think it’s worth considering at today’s prices.