The Taylor Wimpey (LSE:TW.) share price was down around 1.5% in early trading today (30 April). This follows news that the spring selling season is progressing “as expected” and confirmation that the anticipated result for 2025 is in line with previous guidance.

Although ‘business as usual’ statements rarely excite investors, this reaction was a little surprising to me. I thought there was enough good news in the press release to prompt a more positive reaction.

An improving picture

For example, the group’s forecasting it will build 10,400-10,800 houses (including those with its joint venture partners) this year. In 2024, it sold 10,593.

Also, the company acknowledged that the affordability of mortgages was improving. Indeed, on 27 April, the BBC reported a “mini price war” noting that all major UK lenders were now offering fixed rate loans at less than 4%.

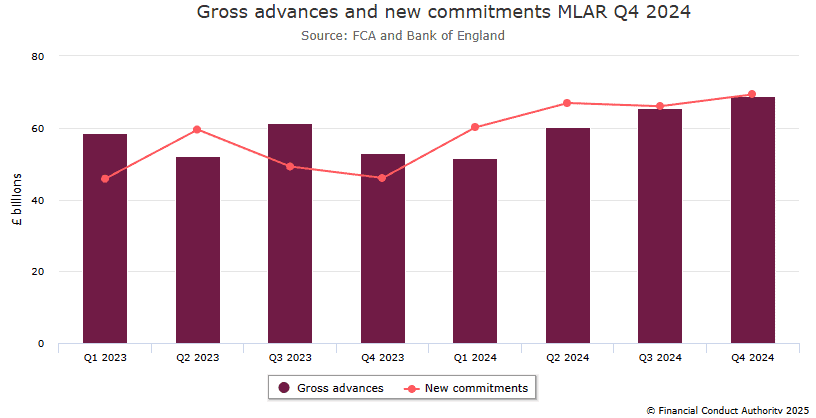

Recent figures from the Financial Conduct Authority are also encouraging. The latest quarterly data (31 December 2024) disclosed a 4.9% increase in the value of mortgage lending, compared to the previous three months. More significantly, it also revealed a large rise in loans agreed to be advanced in the coming months (new commitments). This was 50.7% higher than for the same quarter in 2023, and was at its highest level since Q3 2022.

Given this promising outlook, the company was able to confirm its status as one of the best dividend payers on the FTSE 100. Its 2024 full-year dividend of 9.46p means the stock’s now yielding over 8%. This makes it particularly attractive to income investors. Although it’s important to remember that payouts cannot be guaranteed.

Possible headwinds

However, Taylor Wimpey’s update did contain some cautionary statements. It warned that “first-time buyers continue to experience some challenges”. This is a key demographic for housebuilders. It’s estimated that around a quarter of the group’s sales are to those looking to get on the property ladder for the first time.

I also note that its cancellation rate is 16%. This is higher than the 13% reported for the same period in 2024. Three percentage points might not sound like a lot but, if this persists, it could equate to over 300 homes over the course of a year.

The group also sounds a little wary of the government’s proposed planning reforms. Although describing them as “positive”, it says they “require increased resources and a focus on the implementation phase to drive outcomes and deliver much-needed new homes across the country.”

But the group owns plenty of plots on which it could build. At current rates, its landbank is equivalent to over seven years of sales. It also has a “strategic land pipeline” equivalent to another 13 years.

I believe today’s statement — and other economic data — supports my view that there are some green shoots emerging in the housing market, suggesting that a recovery is under way. And with the Bank of England expected to resume cutting interest rates at its meeting on 8 May, this could help to further boost demand for new houses.

In my opinion, the group’s managed to emerge from the post-pandemic housing market downturn relatively unscathed. Its balance sheet remains strong and the group has little debt.

For these reasons, long-term growth investors could consider adding Taylor Wimpey to their portfolios.