it has not been a great 2025 so far for shareholders in chip company Nvidia (NASDAQ: NVDA). The Nvidia share price has tumbled by over a fifth since the start of the year.

Still, long-term shareholders have a fair bit of consolation, I reckon.

Over five years, the tech stock has increased by 1,396%. That is the sort of price gain I would be happy to see in my own portfolio!

So, could the recent fall offer me a buying opportunity?

I like the business, what about the share price?

To start, I will step back from the specifics of this one company.

Buying shares usually involves me asking two questions.

First, am I very enthusiastic about the long-term commercial prospects for the business? Second, does the current share price offer me an attractive level at which to buy, compared to how I see those long-term prospects?

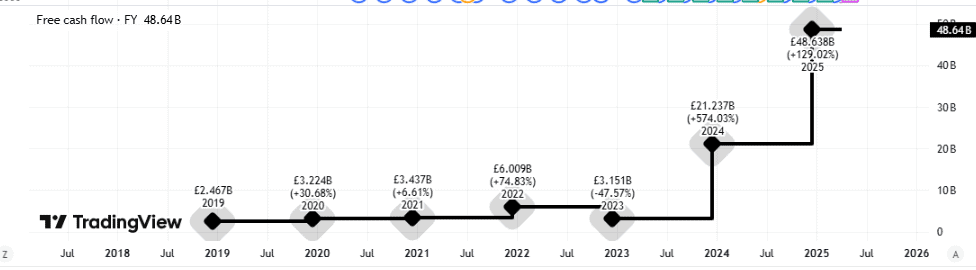

When it comes to Nvidia, I think the business is outstanding. It has a large addressable market. Proprietary designs and an established customer base help it to serve that market. It has been growing fast, has very high profit margins and is aflush with free cash flow.

Created using TradingView

But despite eyeing the company for a while, I have not yet invested in it. Why? The Nvidia share price looked too expensive for my tastes. That simple!

I’m still not ready to invest

On that basis, a falling share price sounds like good news. After all, it ought to lead to a more attractive valuation.

Indeed, the Nvidia price-to-earnings ratio is now 36. I do not see that as lower, but it is certainly lower than it has been at some points in the past.

Created using TradingView

The thing is, though, that just like its name suggests, a price-to-earnings ratio has two key components. The Nvidia share price has fallen – but what happens if earnings also fall? In that case, the valuation may not be as attractive as it seems.

I see that as a distinct risk. There has been some uncertainty to date about the sustainability of the elevated levels of spending on AI chips we have seen over the past several years.

Added to that more recently have been additional risks from trade tariffs and certain technology export bans. All of those things are risks to Nvidia’s earnings in my view.

Tempted, but erring on the side of caution

I admit, I am still tempted. I do see Nvidia as an excellent company and would gladly own its shares.

But the risks strike me as real and significant. They introduce a level of uncertainty into valuing Nvidia.

If the Nvidia share price offered me a big enough margin of safety, that would bother me less. However, I do not think its current valuation offers me sufficient cushion if the risks turn out to be very problematic for the company.

So, although I am tempted to dip my toe in the water following the recent share price fall, for now I will just keep Nvidia on my watchlist rather than adding it to my portfolio.