2025 is shaping up to be a tough one for global stock markets. With the global economy under growing stress, the opportunity for investors to make healthy capital gains may be limited. In this climate, the best way to target a positive return may be by buying high-yield dividend stocks.

Following recent stock market volatility, investors have an excellent chance to make a market-beating passive income this year. Dividend yields across the London Stock Exchange have shot higher, and many top shares now offer yields miles above the 3.6% average for FTSE 100 shares.

2 top dividend shares

With this in mind, here are two of my favourites to consider in May.

| Dividend share | Dividend growth | Dividend yield |

|---|---|---|

| Foresight Environmental Infrastructure (LSE:FGEN) | 2.6% | 10.7% |

| NextEnergy Solar Fund (LSE:NESF) | 1.9% | 12.3% |

While dividends are never guaranteed, here’s why I think these passive income stocks merit a close look.

Green machine

Despite recent pushbacks against the ‘green agenda,’ companies that produce renewable energy, promote sustainability and champion resource efficiency still have tremendous investment potential, in my book. Foresight Environmental Infrastructure is an investment trust whose broad operations support the long-term fight against climate change.

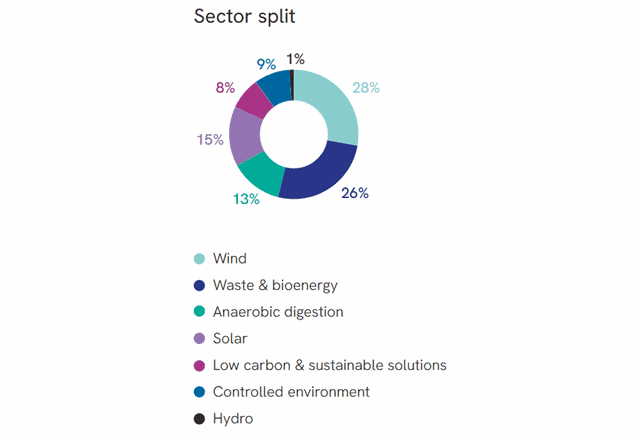

The company owns more than 40 assets in the UK and Mainland Europe. These range from Scottish wind farms and energy-from-waste plants in Italy, to battery storage projects and wastewater facilities in England.

What’s more, the company’s portfolio is diversified intelligently across these assets types. This provides resilience when, for example, cloudy weather conditions impact power generation from its solar assets. Dividends here have risen each year since 2011, underlining the stability that its operations provide.

For 2025, the predicted dividend is covered 1.2 times by operational cash flow, providing a decent margin of error. I think it’s a top defensive dividend share to consider, even though earnings could be impacted by rising inflation that pushes interest rates higher.

Sun king

NextEnergy Solar Fund is another renewable energy stock I feel is worth close look. With a dividend yield above 12%, it’s one of the highest yielding dividend shares across the whole London stock market.

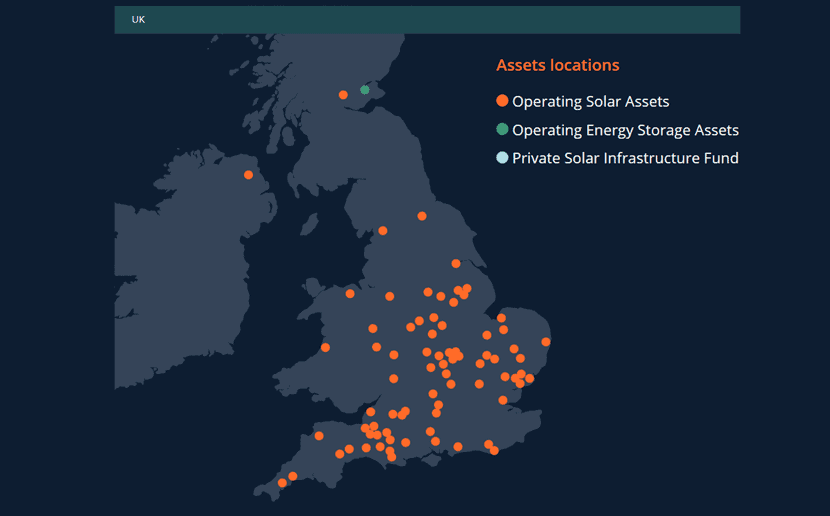

Unlike Foresight Environmental Infrastructure, its operations aren’t divided across a wide range of technologies. As its name implies, the lion’s share of its portfolio is dedicated to solar farms (it currently has 101 operating projects on its books). Meanwhile, its energy storage asset base comprises of just one operating site.

While this creates greater risk, this isn’t to say that NextEnergy Solar isn’t still well diversified. Its UK farms cover the length and breadth of the country. It also owns solar projects in Italy, Spain and Portugal.

Dividends here have risen each year for around a decade, and it has returned around £346m in cash rewards since its IPO in 2014. With a strong balance sheet — it’s also undertaking share buybacks of up to £20m — I’m expecting the fund to remain a great dividend payer.