For a while, Nvidia (NASDAQ: NVDA) looked like one of the hottest things on Wall Street. Lately, it has lost some of its shine. The Nvidia stock price has fallen 28% since January.

Still, over five years, the chipmaker’s stock has soared 1,370%. Yes, 1,370%.

That is the sort of performance that would thrill me as an investor!

So given the recent fall in Nvidia stock, could now be the time to add some to my portfolio? Or is the fall a sign of a change in fortunes that ought to put me off buying now?

A possible long-term bargain

Let’s start by looking at the bargain side of the argument. Currently, Nvidia is trading on 36 times earnings. I do not see that as cheap, although it is markedly lower than it has been at some points recently.

Created using TradingView

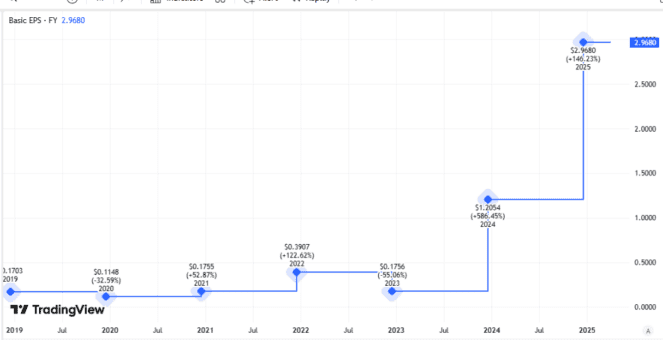

In recent years, earnings per share have grown sharply.

Created using TradingView

That largely reflects the major investment companies have been making as they scale up their artificial intelligence (AI) offer. It could be that there is a lot more where that came from, as really what we have seen so far is essentially just the first wave of big budget expenditure on AI.

If that is the case, it could be excellent news for Nvidia’s earnings, making the current share price look a potential bargain from a long-term perspective.

After all, with proprietary technology, a large client base and strong brand, Nvidia is a clear leader in this space and I reckon it could stay that way.

Possible value trap?

Why then, the fall of close to 30% in a matter of months? For one thing, trade conflict is a significant risk to a multinational company whose clients straddle both the US and China. It could hurt revenues and profits seriously.

Even beyond that though, Nvidia’s AI windfall has also exposed other potential future risks. What if AI is developed that requires less computing power than currently? That has been a big concern since the launch of the Deepseek AI model.

What if the initial ramp-up spending on AI chips is not the first wave, but in fact the one and only wave? After all, in many cases the business case for AI remains to be made.

With a market capitalisation of $2.6tn, there is a lot of optimism about the AI chip outlook reflected in Nvidia’s stock price, even after its recent fall.

Glass half-full, or half-empty?

It could turn out to be a value trap, but I would be surprised. While the future scale of AI chip demand remains uncertain, my guess is that it will be substantial.

Let’s not forget too that Nvidia already had a roaring business even before businesses starting shelling out to build AI capability at scale.

Still, the risks here look substantial to me and while the P/E ratio is lower than before, I am not comfortable that it offers me sufficient margin of safety.

For now, I will keep Nvidia stock on my watchlist. But I will not be buying yet.