It has been a remarkable few years for shareholders in Rolls-Royce (LSE: RR). During the depths of the pandemic, the aeronautical engineer was on its knees. Rolls-Royce shares sold for pennies apiece as recently as 2022.

Now though, the Rolls-Royce share price is over £7. It is up 585% over the past five years. With that sort of momentum, could the shares possibly go any higher – and ought I to buy some for my portfolio?

Some possible boosters for business growth

I do see some ground for optimism when it comes to the potential ongoing growth of Rolls-Royce’s business, both at the top line (revenue) and bottom line (profits).

Demand for aircraft engine sales and servicing remains high. The same is true for power systems and the defence business. Last year saw underlying revenue growth in those areas of 24%, 11% and 13% respectively.

While the civil aviation number stands out – especially as it is the largest business – all of those growth figures are strong. With ongoing high demand, I reckon revenues could grow this year too.

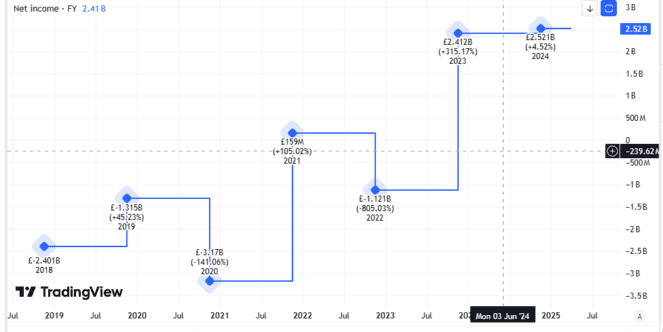

Meanwhile, the company’s net income grew last year, but not by as dramatic an amount as some investors may have hoped.

Created using TradingView

That may suggest that some of the easy wins for the company have already been achieved when it comes to cutting costs. However, this year the company has upgraded its medium-term targets, which were already ambitious by the company’s recent historical standard. It is now aiming for £3.6bn–£3.9bn of underlying operating profit by 2028 and an underlying operating margin of 15-17%.

I’m nervous about the share price

But that is far from guaranteed. Current trade disputes threaten demand for new engine sales. Sharp swings in some key currencies could also have an impact (negative or positive) when they are reported back into Rolls’ reporting currency of sterling.

On top of that there are ongoing risks that concern me about the aviation industry as they can be signficiant but fall largely outside the control either of airlines or engine makers. Another pandemic, large terrorist event or war could suddenly send passenger demand into a headspin. That would likely be bad for revenues and profits

With the right margin of safety in the share price, that would not bother me. All shares carry risks, after all: the smart investor simply aims to price them properly.

But a growing share price has been pushing Rolls-Royce’s price-to-earnings ratio upwards. It now stands at 24.

Created using TradingView

That is too high for my comfort when it comes to having a margin of safety.

Every investor is different, of course. I can well imagine that if investor enthusiasm remains high or the company announces further good news, the share price may move up from here.

From a long-term investing perspective though, the current share price is not attractive to me and I will not be investing.