Shares have been volatile recently. This year, many stocks are down 10%+. Is there the possibility of a major stock market crash from here? Well, I don’t think we can rule one out, because right now, there’s a new risk emerging.

A major risk?

At the moment, most investors are focusing on two main issues – tariffs and the possibility of a US/global recession. These are both legitimate concerns and they justify the recent market weakness.

I’m growing increasingly concerned about another – less talked-about – risk, however. And that’s the rapid flight of capital out of the US.

You see, for a long time, the US has been seen as a pillar of safety in the financial markets. The US dollar, for example, is the world’s ‘reserve currency’ and the currency that investors typically flock to when there’s uncertainty.

US Treasuries, meanwhile, are generally seen as safe-haven investments. During periods of uncertainty, global investors tend to move into these bonds, pushing prices up and yields down.

However, today the landscape seems to be changing. Due to the unpredictable and volatile nature of policies and rhetoric (tariffs, tweets, talk of removing the Fed Chair) coming out of Washington, global investors are moving money out of the US at an alarming speed.

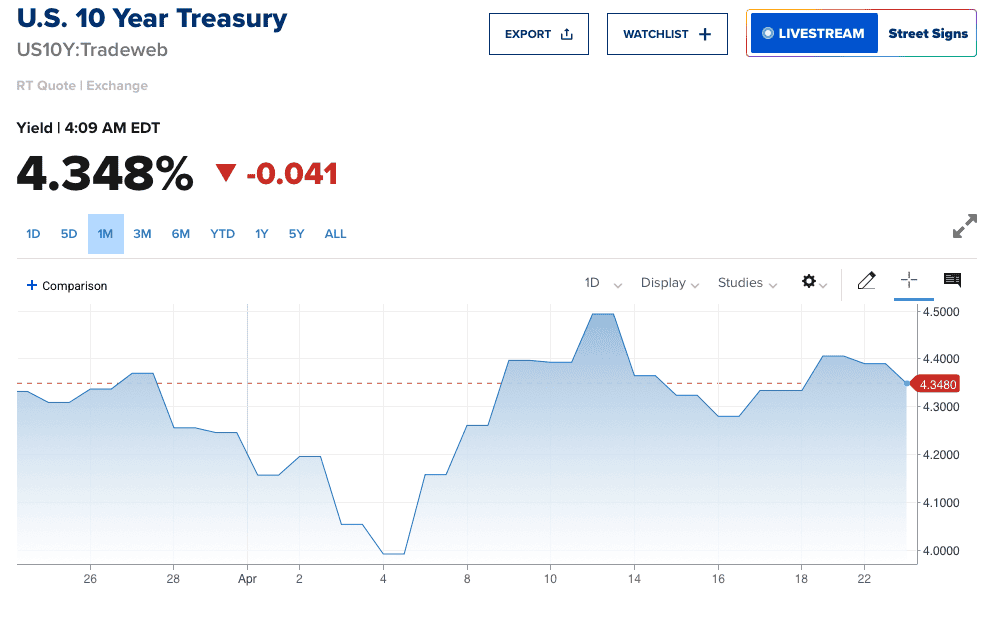

We can see this in bond yields. Since ‘Liberation Day’, 10-year US Treasury yields have risen sharply as China and Japan have offloaded US debt.

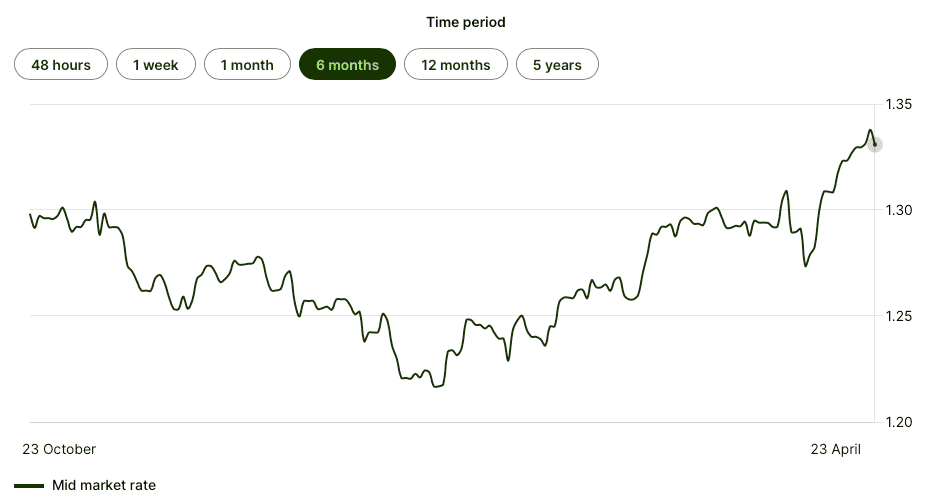

We can also see it in the US dollar. Just look at how much the pound has strengthened against the greenback in recent weeks.

I’m getting concerned that this trend could escalate if the political backdrop doesn’t settle down. If it was to escalate, it wouldn’t be good for global markets.

One implication could be high borrowing costs for US companies and consumers. This could hurt the world’s largest economy significantly.

Another implication could be the downgrading of US debt by a ratings agency such as S&P. This could potentially send stocks down sharply.

Overall, the backdrop is a little concerning. So, we can’t rule out a stock market crash.

Should the market’s trust issues with the US administration deteriorate further, then this could be the catalyst for the sell-off to take on its next leg.

TD Securities’ Prashant Newnaha

What I’m doing

Now, I’m not going to dump all my stocks because of this risk. That wouldn’t make sense as a long-term investor.

But I am focusing on risk management. More specifically, I’m looking at boosting my ‘defensive’ positions.

One stock I may top up is Unilever (LSE: ULVR). It produces everyday items such as soaps, deodorants, and detergents – stuff people tend to buy no matter what’s happening in the economy.

In the past, this stock has provided some protection against economic/market weakness. And it appears to be doing the same thing now – year to date it’s up about 7%.

One other thing to like is that it’s a very reliable dividend payer. The yield is about 3.3% currently, and this could attract investors if UK interest rates fall.

Of course, as a global operator, this company could face some tariff issues. It could also come under pressure if consumers downgrade to cheaper brands.

But if there’s a major market meltdown, I’d expect the stock to outperform. So, I think it’s worth considering today.