Oil stocks have been one of the biggest casualties of the tariff-induced sell-off over the past couple of weeks. But with a recent pivot away from renewables, the Shell (LSE: SHEL) share price could be set to push higher in the years ahead.

Oil price slump

This month’s collapse in the price of Brent Crude to four-year lows has clobbered Shell. It also starkly highlights how the company’s fortunes are tied to the price of an asset over which it has no control. This may be so, but is this really a valid reason against making an investment?

If I took this argument to its logical conclusion I’d end up investing in nothing. The point is that no company or industry is in complete control of various macro external forces. A bank can no more prevent a recession than an insurance company can prevent devastating floods or wildfires.

What I’m much keener to understand is what the long-term demand trajectory for oil and gas looking like. Here I’m on much more solid ground.

Scenario planning

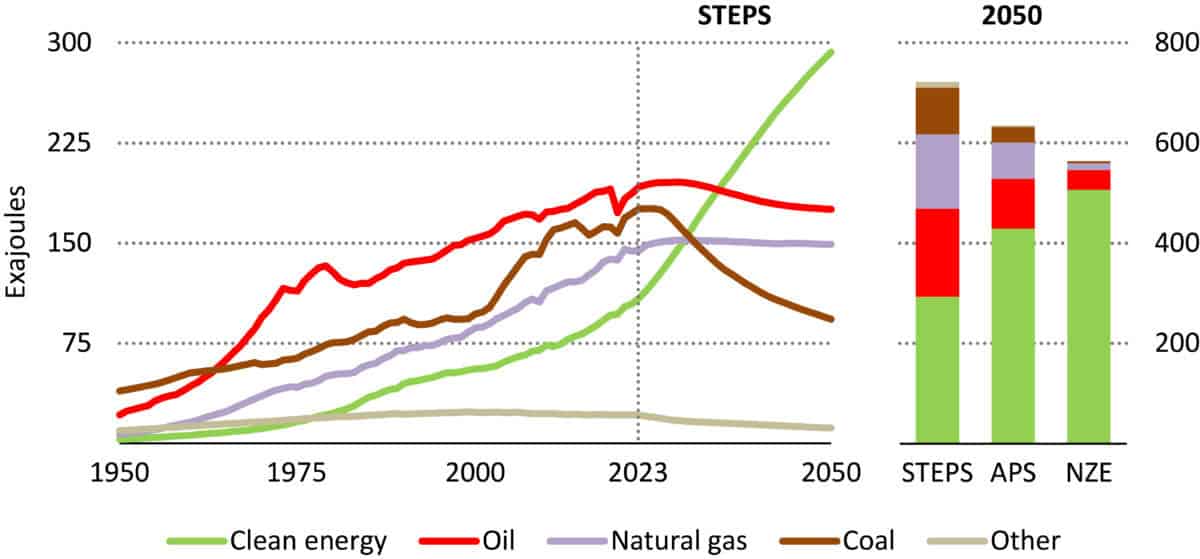

In its World Energy Outlook 2024, the International Energy Agency, updated its energy mix projections out to 2050. For its default Stated Policies (STEPS) scenario, both oil and gas demand peaks in 2030. But unlike oil, which thereafter slowly declines, natural gas demand remains flat.

Source: International Energy Agency

Its Net Zero (NZE) scenario sees huge declines in fossil fuel demand. However, its energy trajectory assumptions seem completely unrealistic to me, particularly based on the present state of technology and adoption rates.

At its Capital Markets Day in March, Shell released its own updated scenarios. Some argue that scenarios are just guesses, but that fundamentally misses their utility. They’re not used as expressions of a strategy or a business plan. But they do help stretch minds, broaden horizons and explore assumptions.

Demand for energy

I believe we can learn a lot about future energy demand from cues happening now. Not since the end of the Cold War have we seen political and societal tensions of this size. Plus countries are grappling with a new era of economic growth from AI, energy security and climate change.

The slow unwinding of globalisation and unfolding trade wars has the potential to re-draw the world’s manufacturing base away from China. Developments in China will likely accelerate higher-income lifestyles there, thereby boosting energy demand. At the same time, as the US builds more manufacturing capability, that can only be a boost for demand too.

Ultimately, I see hydrocarbons remaining an important part of the energy mix for decades to come. But the pace of adoption to net zero is the big unknown and remains Shell’s greatest risk.

We’re already seeing increasing regulatory pressure in the UK, which is preventing any further exploration licences. Should investors turn against the industry en masse the consequences for it could be disastrous.

Like its peer BP, Shell recently slashed its spend on low-carbon technologies. I remain convinced this is the right approach to take. As it prioritises shareholder returns in the coming years, I think its share price at clearance sale levels means investors should consider adding it to their portfolios.