The S&P 500 remains highly volatile as tension over a widescale trade war intensifies. In this climate, it can be a good idea for investors to consider buying some classic defensive stocks.

Some like Newmont Corporation (NYSE:NEM) even have the potential to soar in value over the short term (and even beyond). Here’s why I think the gold miner’s worth serious consideration right now.

Dividend boost

Investing in gold mining stocks remains an attractive proposition to consider. The yellow metal’s price surge continues and it struck new highs of above $3,230 an ounce just now. Conditions seem to be perfect for further substantial gains.

As the world’s largest gold company — metal reserves are a whopping 135.9m ounces — I believe Newmont Corporation could be one of the best stocks to buy to capitalise on this.

Owning gold stocks and price-tracking funds are the most popular ways that people gain metal exposure nowadays. But owning the companies that actually produce the precious metal has multiple advantages.

Gold itself doesn’t actually provide an income, unlike many mining shares that pay a dividend. Newmont’s one of these that provides cash rewards to shareholders. For 2025, its dividend yield is a solid 2%.

Strong performance

Gold stocks can also outperform gold if operational performance is strong. On this front, owning Newmont shares could have substantial advantages, given recent production news.

Gold production rose 9% in the fourth quarter, latest data showed, meaning total production of 5.9m ounces for the full year beat forecasts. All-in sustaining costs (AISCs) also dropped 1.5% in the quarter to $1,463 per ounce, well below the current price of gold.

All that said, even the best-run miners can sink in value due to factors outside of their control. Major base and precious metal-producing regions are often located in politically unstable places, creating substantial risks through possible potential unrest, regulatory changes or conflict.

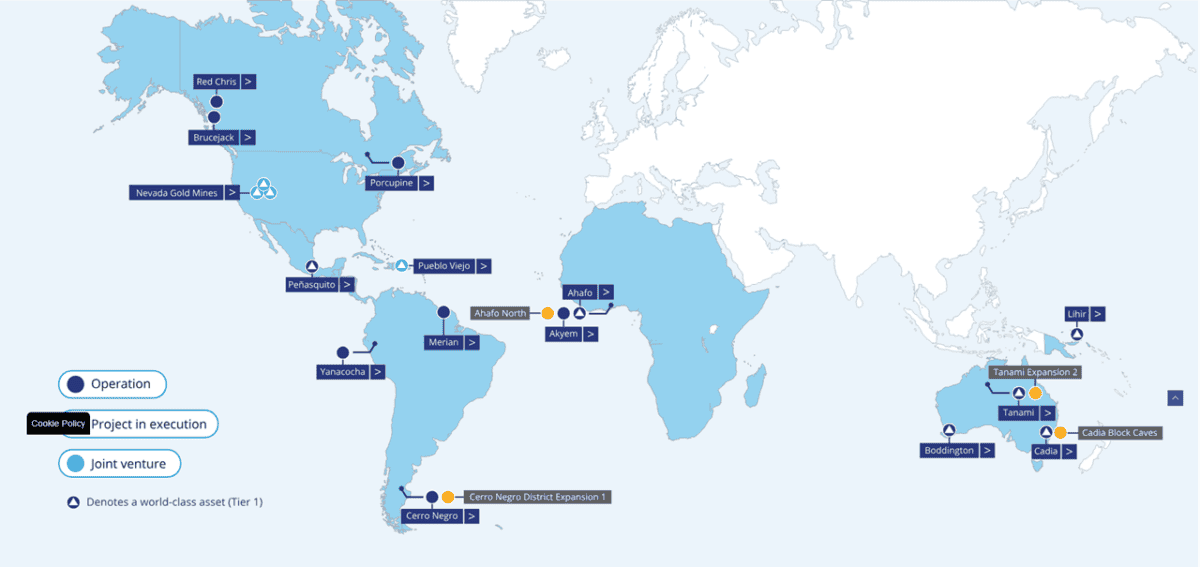

This is one reason why Newmont’s one of my preferred sector picks. While it’s also vulnerable to such events, with assets spanning The Americas, Africa and Australasia, such problems can be better absorbed at group level.

An S&P 500 bargain?

The largest risk however, for any commodities-producing business is a sharp fall in the value of their product. In the case of gold, a sudden pick-up in risk appetite could see a wide scale dumping of the safe-haven metal.

But as I mentioned earlier, I think the landscape is ripe for gold (up 37% over the past year) to keep on soaring.

The trade spat between the US and China continues to intensify, posing a substantial threat to the global economy. Uncertainty over future trading relationship between the US and its other major trading nations also rumbles on during the 90-day tariff pause.

A gloomy outlook for the US dollar also bodes well for greenback-denominated assets like gold. The US dollar index fell below the critical level of 100 earlier today for the first time in years.

City analysts expect Newmont’s earnings to rise 18% in 2025. This leaves it trading on a price-to-earnings growth (PEG) ratio of 0.9, suggesting it’s underpriced relative to predicted profits.

All things considered, I think investors should give the mining giant a close look.