Generating a reliable second income from an ISA is a goal for many investors, but how much capital is required? The answer depends on dividend yields and the power of compounding over time.

A £6,000 monthly income translates to £72,000 per year. But, the amount needed in an ISA to provide that depends on the average dividend yield of the portfolio. With a 5% dividend yield, an investor would require a portfolio worth £1.44m. At 4%, the figure rises to £1.8m. At 3%, it would take £2.4m to generate the same level of income.

Targeting a 5% yield strikes a balance between income generation and sustainability. However, simply chasing high yields can be risky, making diversification crucial.

Building the portfolio

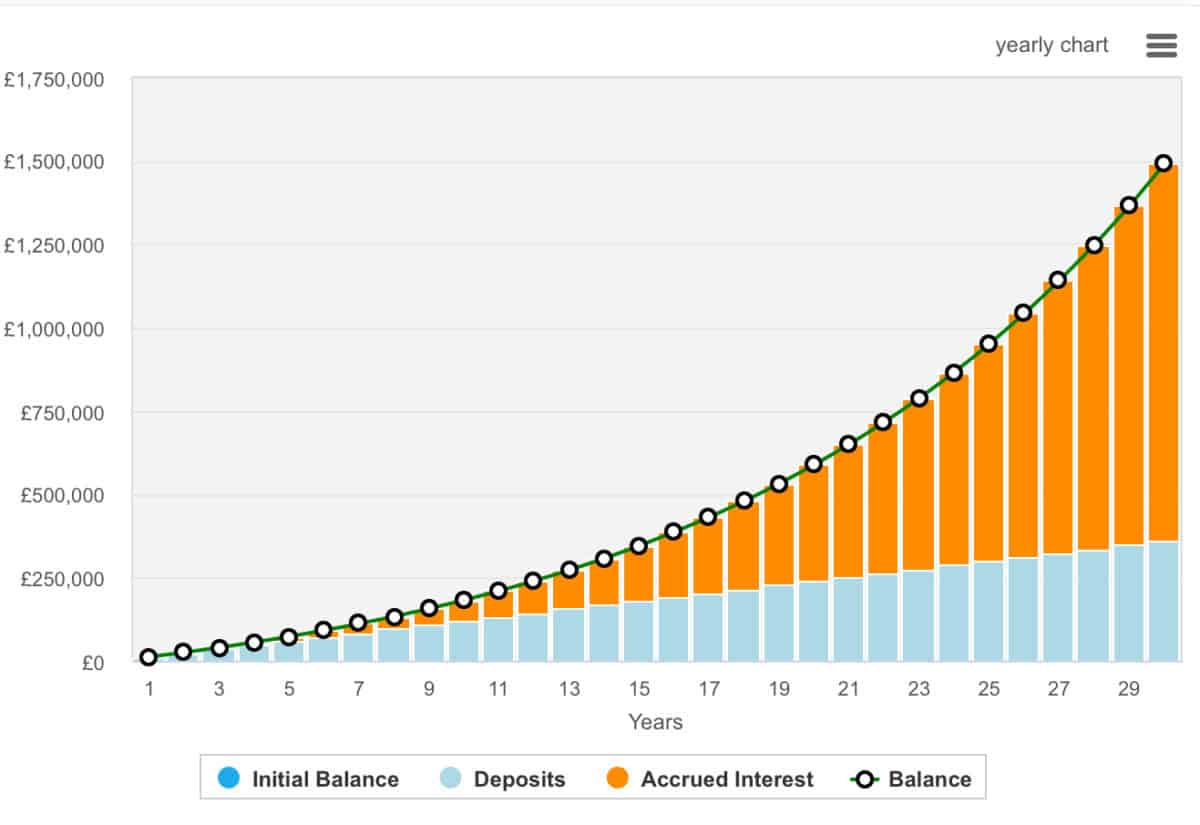

Building a seven-figure portfolio from scratch might seem daunting, but regular investing and compounding work in an investor’s favour. A consistent approach can turn even modest contributions into substantial sums over time. An investor starting with nothing but contributing £1,000 per month into a Stocks and Shares ISA could see their portfolio grow significantly.

Assuming an 8% annual return, including dividends and capital appreciation, the investment could reach £182,000 in 10 years. But that surges to £589,000 in 20 years, and to over £1.5m in 30 years. The key is reinvesting, allowing the power of compounding to take effect and accelerate wealth accumulation.

Diversification plays a crucial role in both building wealth and protecting income streams. A portfolio too heavily concentrated in one sector, such as financials or utilities, may expose an investor to sector-specific risks. Growth stocks are equally important in the portfolio’s early stages. Companies that reinvest profits rather than paying dividends can deliver superior capital appreciation, accelerating overall portfolio growth.

Finding diverisification

Novice investors may look at index tracking funds for diversification, but they can also look at Berkshire Hathaway (NYSE:BRK.B) as an alternative investment that offers both diversification and growth potential. Berkshire Hathaway, led by Warren Buffett, operates as a conglomerate with diverse business interests and investments, providing investors with exposure to multiple sectors and companies.

The company’s portfolio includes wholly-owned businesses across industries such as insurance, energy, and manufacturing, as well as significant stakes in publicly traded companies, like Apple. This diversity helps mitigate risk by spreading investments across various sectors, similar to a pooled equity fund. Berkshire Hathaway’s large cash reserves and ability to raise capital also position it for potential expansion and growth opportunities in new and promising markets.

However, investors should be aware of the risks associated with Berkshire Hathaway. One significant concern is the uncertainty surrounding future leadership and direction as Warren Buffett approaches retirement. The company’s success has been closely tied to Buffett’s investment acumen, and there are questions about whether future management can replicate his track record.

Despite this risk, Berkshire Hathaway’s long-term focus on value investing, strong financial position, and diverse portfolio make it an attractive option for investors seeking both diversification and growth potential in a single investment. It’s a stock that I’ve recently added to my daughter’s portfolio and mine.