DP Poland (LSE: DPP) shares rose 9.9% Thursday (27 March), bringing their one-month gain to 13%. The five-year return is 82%, though it’s been a predictably bumpy ride for this penny stock.

DP Poland is the operator of Domino’s Pizza stores and restaurants across Poland and Croatia. What just sent the share price up? And does the news make me want to invest more money?

Strategic acquisition

Yesterday, the firm announced that it had acquired Pizzeria 105, the fourth largest pizza restaurant brand in Poland, for around £8.5m. Pizzeria 105 is a franchised business that operates 90 locations across the country.

CEO Nils Gornall commented: “This acquisition fast-tracks our transition to a predominantly franchised, capital-light model, with over half of our stores set to be franchise-operated from completion. By welcoming 76 experienced franchise partners, we expand our presence into 31 new Polish cities.”

Pizzeria 105’s main source of income was sales of goods to its franchisee partners and royalty fees. The founder will remain a shareholder to ensure a smooth transition and bring valuable local expertise, the buyer noted.

Long-term plans

DP Poland says Pizzeria 105 is profitable and the deal is expected to be immediately earnings enhancing from completion.

That said, the numbers are pretty small here. Revenue was £1.7m last year, with £1m in EBITDA, from £30.8m of system sales at the franchised stores. But DP Poland says they will benefit from Domino’s brand and marketing support, which will provide a path to drive a 56% higher order count.

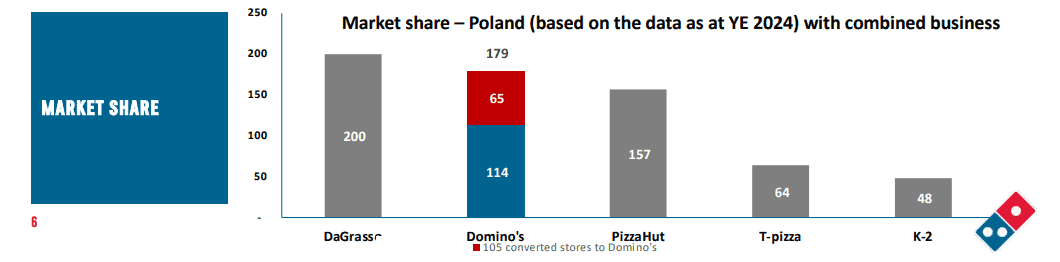

The deal also accelerates the company’s plan to have 200 Domino’s stores in Poland by 2027, with half of the outlets franchise-owned. Longer term, the company aims to have 500+ locations in Poland. Croatia is a much smaller part of the business for now.

Still loss-making

In 2024, like-for-like system sales grew 17.9%, marking the third consecutive year of double-digit growth. Before this acquisition, the firm was tipped to increase revenue to around £65.8m this year, good for 23% growth. A first profit might be also eked out.

However, while recent reductions in net losses and improvements in EBITDA indicate a positive trajectory, DP Poland hasn’t yet officially achieved net profitability. At the end of 2024, it had £13.4m in cash and was debt-free. But the fact that it’s still loss-making adds some risk here.

Also, new shares are being issued as part of the deal. Further shareholder dilution cannot be ruled out.

Should I order in more shares?

This acquisition fits in nicely with the company’s plan to turn Domino’s into the leading pizza brand in Poland. So I think it could turn out to be a smart move.

Unlike many parts of Europe, Poland’s economy is growing strongly. GDP growth was 2.9% last year, beating forecasts, and it’s expected to accelerate to at least 3% this year, then 3.6% in 2026. That’s a supportive backdrop for consumer spending, dining out, and pizza deliveries.

If the company continues taking market share and turns profitable, I think the stock could trade much higher than 10p in the years ahead. For context, the market-cap today is just £92m.

Given the risks though, I’m going to keep this as a small but potentially high-reward holding in my portfolio.