My Stocks and Shares ISA may be jam-packed with dividend-paying FTSE 100 stocks but that doesn’t mean that I shy away from investing in out-and-out growth businesses too. After enduring a couple of torrid years, I see one standout compelling growth story in the years ahead.

China uninvestable

Driving the narrative behind the poor share price performance of Prudential (LSE: PRU) is that China had become uninvestable. The delayed relaxation of Covid travel restrictions between the Chinese Mainland and Hong Kong undoubtedly hurt the Asian powerhouse economy.

On top of that the country’s bubble in real estate has been unwinding. This hurt domestic imports of commodities essential for a booming economy.

Given that nearly half of all its insurance profits are derived from China and Hong Kong, its little surprise that the share price has been falling. It’s down over 40% in two years.

Covid blues

The strong FY24 results released on Thursday (20 March) highlight that the sell off had been completely overdone. New business profit was up 11% to $3.1bn. But I believe this is just the beginning.

The markets in which the company operates are some of the fastest growing in the world. In both China and India, GDP is expected to grow by 5% in 2025.

A growing middle class is increasingly expecting access to what Western consumers take for granted. In particular, insurance and savings products.

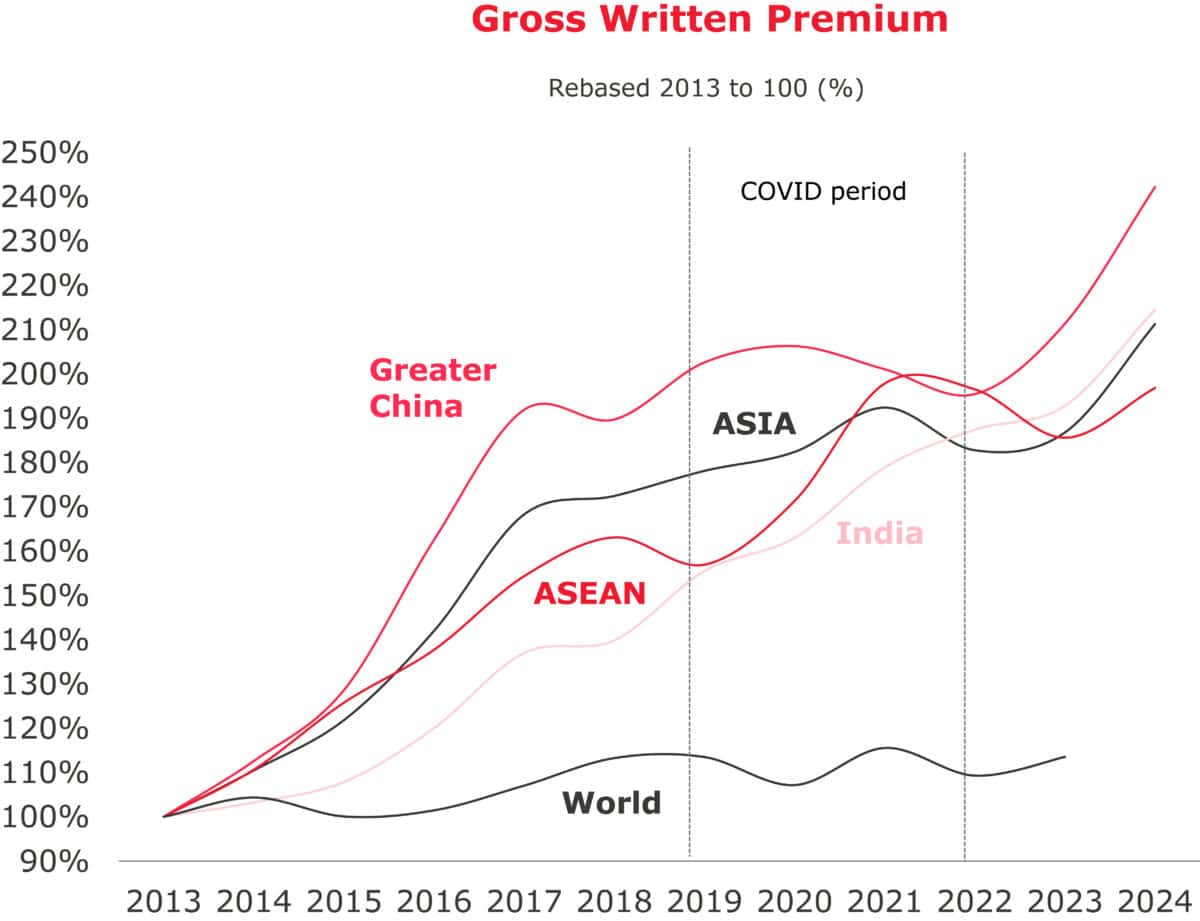

Times may have been tough for such consumers during Covid. However, the following chart highlights that gross written premiums in its core markets has now fully recovered.

Source: Prudential presentation

Structural growth drivers

The opportunity presented to it in the coming years is truly gargantuan. Out to 2033, the total addressable market in Asian life insurance gross written premiums is predicted to double to $1.6trn.

The drivers for this growth are varied. By 2040, 28% of China’s population will be over 60. Wealth creation across Asia is increasing too. Today, the region accounts for 30% of total global wealth creation. Third, are low insurance penetration rates. The gap in insurance coverage is estimated at a whopping $119trn in Asia.

I believe that it is well placed to capture a significant slice of this burgeoning market. Key for the business is it growing cohort of agents.

Selling insurance-related products is first and foremost a people business. Prudential has been working hard to recruit quality agents and train them in selling their products. Many of its agents are now members of the prestigious Million Dollar Round Table network.

Risks

Of course, there are plenty of risks here. All insurance businesses face ongoing credit and liquidity risks. Uncertain interest rate trajectories and increasing protectionism policies could affect underlying growth drivers. This is particularly acute in China where concerns about the long-term health of its property sector won’t go away.

But when I look at the bigger picture here, I think it makes for one of the most compelling growth stories in the FTSE 100. The hike in its dividend per share by 13% in FY24 highlights to me that management is very bullish too.

Beyond its growing dividend, it’s also in the middle of executing a $2bn share buyback programme. With all this, it’s little wonder I have been hoovering up Prudential shares lately while they remain cheap.