Investors don’t need to buy shares in their ISA to utilise any annual allowance they may have remaining. Just depositing cash in a Stocks and Shares ISA or Lifetime ISA is enough to secure the tax benefits for the funds.

But with so many brilliant bargains out there, individuals may wish to strike straight away instead of waiting to invest. The FTSE 100 share index alone is choc full of dirt cheap quality shares following the recent stock market mini crash.

Here are two I’m considering buying before the 5 April ISA deadline.

Standard Chartered

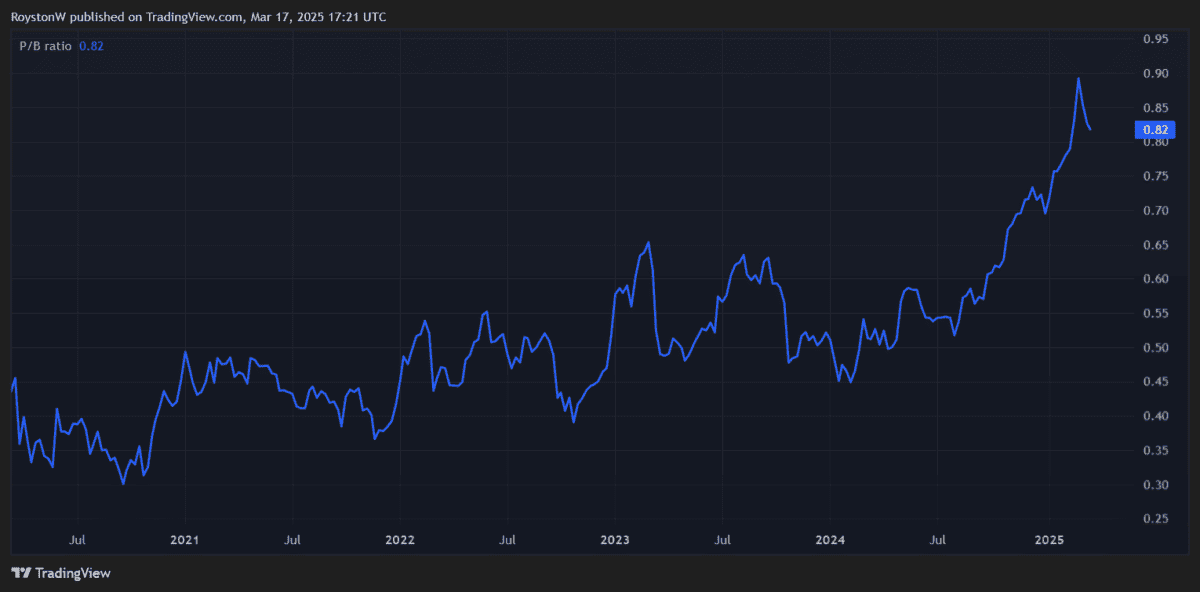

With a price-to-book (P/B) ratio below 1, Standard Chartered (LSE:STAN) still trades at a discount to its book value (total assets minus total liabilities). This suggests the emerging market bank’s shares have further scope for price appreciation — they’re up 79.4% over the past year.

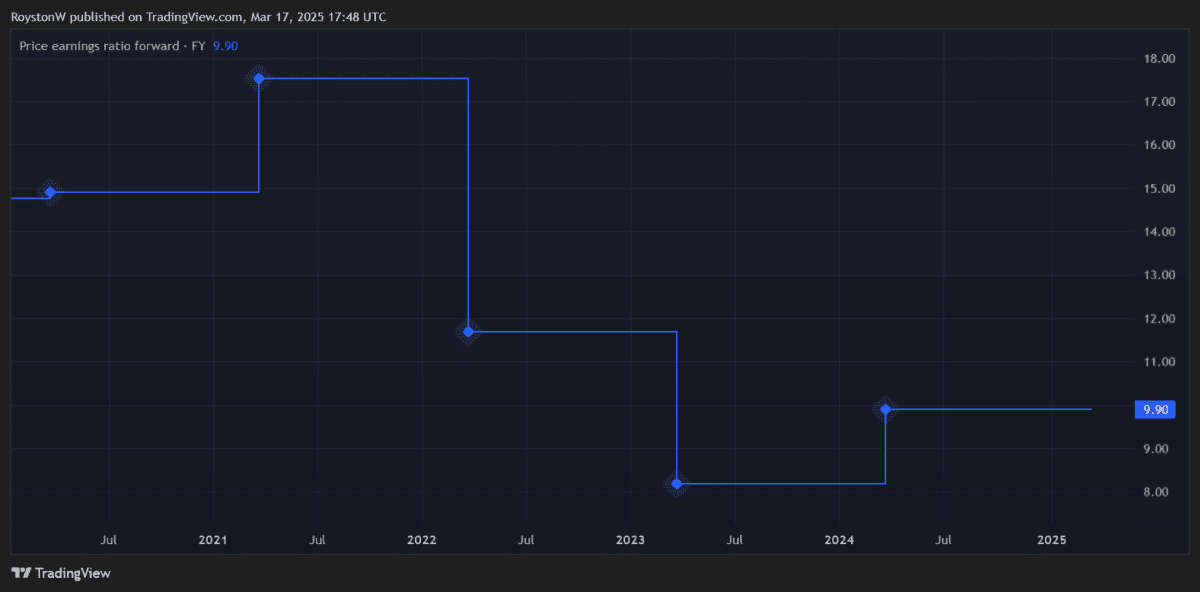

This isn’t all, with StanChart shares also looking mega cheap relative to expected earnings. A predicted 14% bottom-line rise leaves the firm trading on a forward price-to-earnings (P/E) ratio of 7.3 times.

Meanwhile, its price-to-earnings growth (PEG) multiple registers at 0.6. Like the P/B ratio, a sub-1 ratio illustrates supreme value.

Intensifying trade wars could have significant ramifications for the bank’s Asian and African operations. However, Standard Chartered’s resilient performances during recent tough times provide reasons for encouragement.

Operating income soared 16% in the fourth quarter, to $4.5bn. This was also a good $300m better than analyst forecasts.

I also like Standard Chartered’s shares because of the strength of the balance sheet. Its CET1 capital ratio was 14.2% as of December, moving further ahead of its target range of 13-14%.

This puts the bank in good shape to keep investing in growth while also returning decent amounts of cash to shareholders. In 2024, it hiked the total dividend 37% year on year, and also recently announced plans for a $1.5bn share buyback programme.

Vodafone

Telecoms giant Vodafone (LSE:VOD) also offers great value across a variety of metrics. Like StanChart, it trades on a sub-1 P/B ratio, at 0.4. It also looks cheap in relation to expected profits for the upcoming financial year (commencing March).

Vodafone shares carry a P/E ratio of 9.9 times and a PEG multiple of 0.6. That’s based on predictions of a 16% earnings jump for the period.

Finally, the dividend yield on Vodafone shares for fiscal 2026 is a robust 5.7%. That comfortably beats the FTSE 100 forward average of 3.6%.

The immense sums Vodafone’s spent to chase growth in the 5G and broadband markets have weighed heavily on shareholder returns. This reflects a blend of share price weakness and dividend cuts.

While high capital expenditure will remain a problem, on balance, I believe the long-term outlook here remains compelling.

I like Vodafone’s significant exposure to fast-growing developing markets like Africa (turnover here grew a robust 4.1% in the December quarter). And more broadly, its broad regional footprint means it’s placed to capitalise on the booming digital economy.

With restructuring cutting costs and refocusing on lucrative areas (like Vodafone Business), I think the share price could recover strongly after years of disappointment.