Millions of Britons invest for a second income. We invest, ideally through a Stocks and Shares ISA, over a long period of time with the aim of building a portfolio that’s large enough to sustainably generate an income. It doesn’t happen overnight, but in the end, it’s worth it.

So, why £27,500? Well, based on data from the Annual Survey for Hours and Earnings (ASHE) by the Office for National Statistics (ONS), the net average monthly earnings (this is after tax) are £2,297 (or £27,573) in the UK.

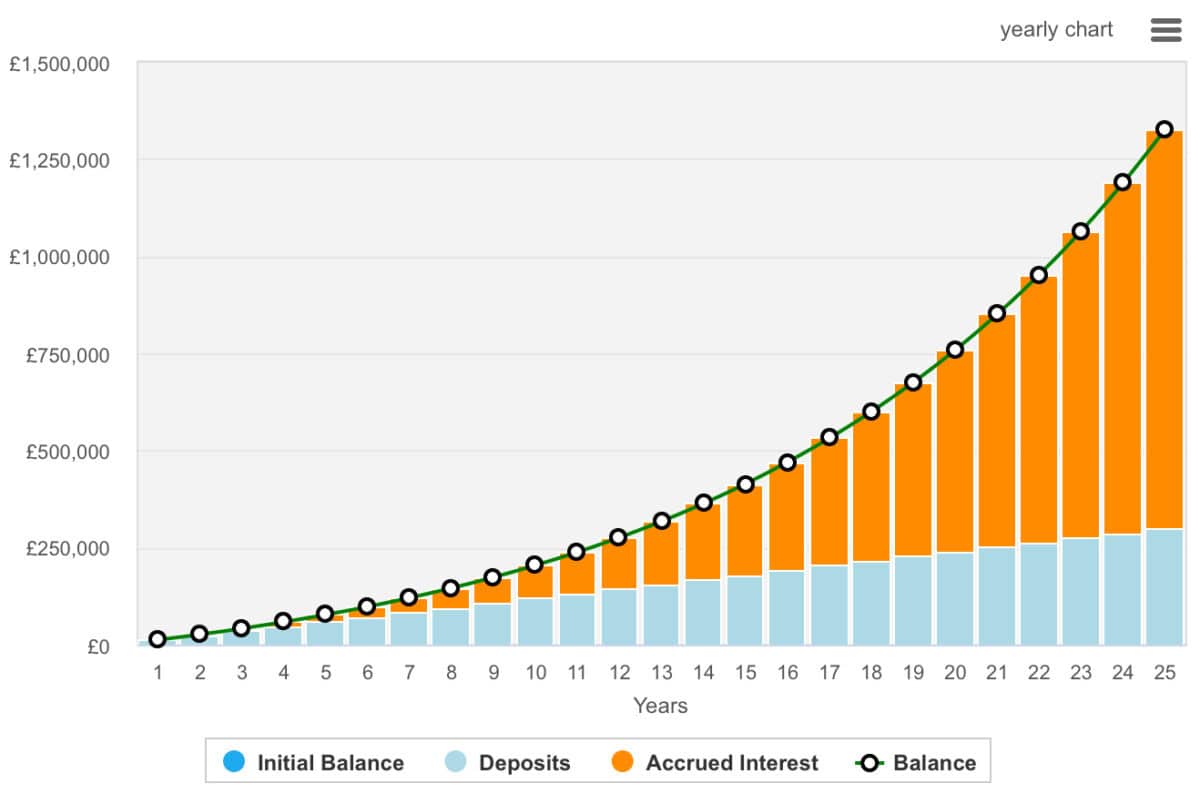

Here’s how it might be achieved by investing.

Playing the long game

In order to generate £27,500 a year from a Stocks and Shares ISA, someone needs £550,000 invested and to achieve a 5% annualised dividend yield. Now, this might sound a like a hard ask, especially if we’re starting from nothing. But I assure you, it’s entirely feasible.

There are lots of hypothetical or mathematical ways of getting to £550,000. However, all of these equations require investors to make consistent contributions and to reinvest the proceeds of capital gains and dividends.

In this example, a £550,000 portfolio could be achieved by investing £1,000 per month while achieving an annualised return of 10% over 17.5 years. At this point, an investor could move to a dividend-focused portfolio, or bonds, in order to take a tax-free second income.

However, we should remember the power of compounding. If an investor continues with the strategy for a longer period of time, the rate of growth would expand.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investments to consider

Of course, there’s a caveat. Invest poorly and people will lose money. With this in mind, novice investors are typically advised to take a diversified approach. This often means investing in an index tracker — a fund that aims to replicate the performance of an index.

However, some actively managed funds or trusts could give investors a better chance of beating the market. One option to consider could be Berkshire Hathaway (NYSE:BRK.B). It’s neither a fund nor trust, but a conglomerate with businesses in railroads and insurance, and stock holdings in companies like Apple, American Express, and Visa. In short, it invests in the backbone of the American economy.

While we’re currently seeing turmoil in US markets amid Trumpian uncertainty and recession fears, Berkshire Hathaway stock hasn’t been sold off. That might sound strange for a company that’s so tightly linked to the US economy. But there’s a good reason. The business has been slowly selling positions in its holdings over the past 18 months. Amazingly, it now has $334bn in cash.

Investors have been questioning why the Warren Buffett-controlled company has been turning to cash. However, with a recession becoming more likely and due to a huge selloff in US stocks, Buffett may be well positioned to make strategic acquisitions or initiate new positions in stocks.

Of course, there’s a risk with Berkshire, as there is with every investment. The risk is that Berkshire’s portfolio is incredibly concentrated on the US economy. During Buffett’s career, the US economy has outperformed, but there’s no guarantee that will continue forever. Nonetheless, I’ve recently become a Berkshire shareholder myself.