Shares of Scottish Mortgage Investment Trust (LSE: SMT) have slipped beneath £10 in recent days. Disappointingly, this has reversed most of the gains the growth-focused FTSE 100 trust had achieved in 2025.

As a shareholder though, it’s best to avoid worrying about these short-term movements and focus on the growth opportunities ahead. Admittedly, this can be difficult. But it’s portfolio decisions that will ultimately drive long-term returns (or not).

With this in mind, here are three insights that shareholders learned from a Scottish Mortgage investor webinar in February.

Buybacks

A year ago, the trust announced it would buy back at least £1bn worth of its own shares. The goal was to reduce the significant 14.5% discount between the trust’s share price and its net asset value (NAV) per share.

According to fund manager Tom Slater during the webinar, Scottish Mortgage had so far bought back £1.6bn worth of shares. This has reduced the discount to around 8.5%. He said: “I think we’ve made some progress. I don’t think we are yet where we want to be.”

The risk here is that the discount widens again, forcing investors to question whether capital might best be deployed into stocks instead.

Moreover, President Trump’s tariffs are driving massive uncertainty. This issue has the potential to trigger a further market sell-off, reducing the value of Scottish Mortgage’s holdings in the process.

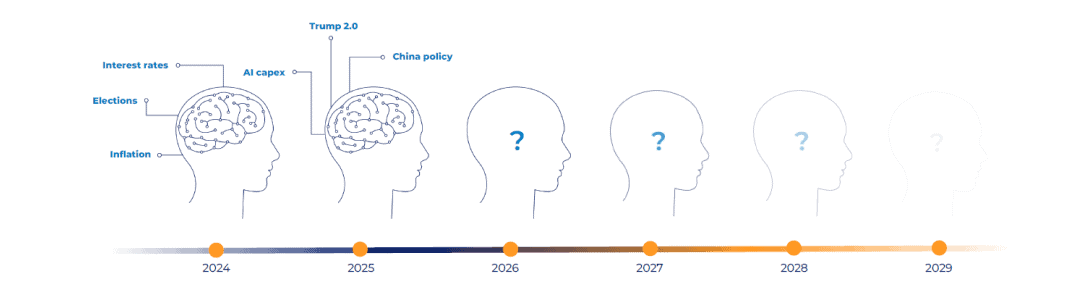

Naturally, there will always be such investor worries. In 2020, it was Covid. In 2025, it is Trump’s tariffs. In 2030, it will be something else.

Nvidia

Next, we had more commentary on the decision to reduce the holding in artificial intelligence (AI) chip leader Nvidia. Basically, the managers couldn’t envisage Nvidia increasing “several multiples” from a $3trn valuation.

Plus, they point out that AI costs are moving from training, where Nvidia’s chips dominate, to inference, where there could be much more competition.

Manager Lawrence Burns said: “We’re reducing Nvidia because we don’t think they can continue to take the same level of supernormal profits out of the ecosystem.”

Tesla and SpaceX

Finally, the managers were inevitably asked about Tesla. Slater confirmed that the trust had made “some very significant reductions to Tesla through the past few months“. It’s now less than 1% of the portfolio.

This is a big turnaround, as the electric vehicle (EV) pioneer had once been the largest holding. However, Tesla stock had been surging after the US election without any real improvements in company fundamentals. In hindsight, taking chips off the table was a smart move.

For SpaceX though (also run by Elon Musk and now the largest holding), the calculus is different. The rocket pioneer is making fundamental progress after successfully completing 134 trips to orbit last year (more than half of all global launches!).

Meanwhile, its Starlink internet service has around 7,000 satellites in orbit and 5m users, ranging from airlines to camper van owners. It’s also vital to Ukraine’s attempts to repel Russia’s invasion.

Scottish Mortgage first invested in SpaceX in 2018 when it was valued at $31bn. Today, it’s worth $350bn, meaning it’s already a 10-bagger. While rocket explosions are an ever-present risk, SpaceX has enormous growth opportunities in Starlink, lunar exploration, and space tourism.

At 978p today, I think Scottish Mortgage shares are worth considering.