Yesterday (27 February), Rolls-Royce (LSE: RR.) unveiled its full-year earnings for 2024, and the results were nothing short of spectacular. The British aerospace titan not only soared past profit expectations but also announced a lucrative plan for rewarding shareholders.

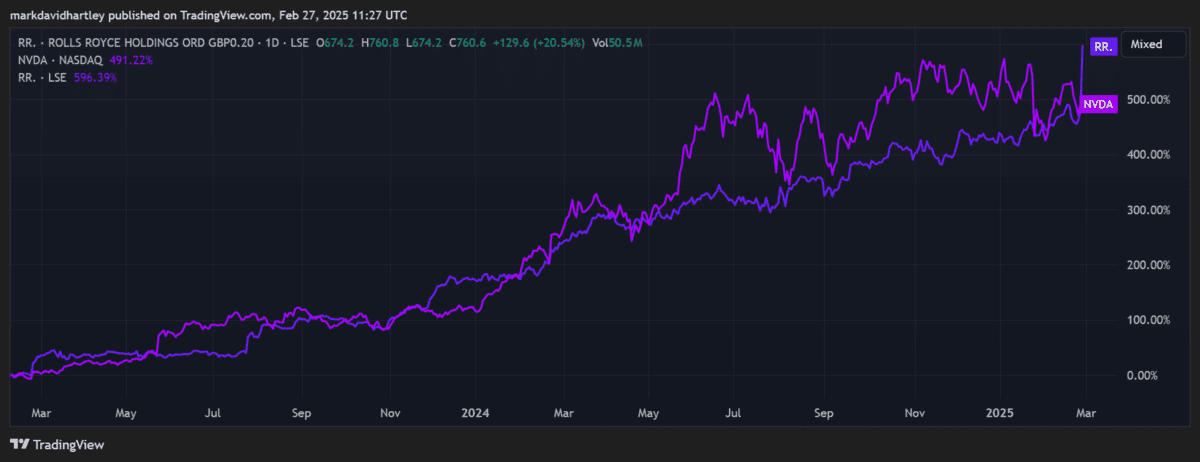

The stock surged 18% on the news, bringing its year-to-date (YTD) gains up to 28%. It’s now even outperformed Nvidia over the past two years.

The earnings report has sent ripples through the UK market, bolstering the aerospace sector and contributing to a 0.1% uptick in the FTSE 100 index.

Full-year 2024 results

In 2024, Rolls’ underlying operating profits rose a remarkable 55%, reaching £2.5bn, and sales soared by 15% to £17.8bn. The growth was fueled by a resurgence in air travel and heightened defense spending amid global geopolitical shifts.

But the news that seriously sent investors into a fervour was the reinstating of dividends. Initially, it plans £500m in payments supported by the launch of a £1bn share buyback programme. Dividends will be paid at 6p per share initially, equating to a 1% yield.

This marks the first dividend distribution since the pandemic, solidifying an undeniable financial recovery. CEO Tufan Erginbilgiç once again emphasised the importance of rewarding shareholders to attract future investments.

More growth coming?

Under the influence of Erginbilgiç, who took the helm in 2023, Rolls has sharpened its focus on financial performance, implementing cost-saving measures and renegotiating contracts to boost profitability.

The company now anticipates achieving its mid-term profit targets two years ahead of schedule, with projections of operating profits between £3.6bn and £3.9bn by 2028.

However, the rapid gains could severely limit further growth. The average 12-month price target is now 13.7% lower than the current price. These may be updated slightly in the coming days, but I wouldn’t expect much change. The price-to-earnings (P/E) ratio is now higher than average at 27, adding risk that a pullback could be imminent.

With the price overvalued and at high risk of a correction, I wouldn’t consider buying the stock now.

There’s also the ever-present risk of more travel disruptions, which could hurt the price again as Covid did. Additionally, any significant dip in defence spending could reverse the shares’ upward trajectory.

Yet, despite these risks, Rolls has another trick up its sleeve that could still help the company continue to grow in 2025.

Nuclear expansion

Rolls is particularly well-positioned to benefit from the UK’s plans for nuclear power. Thanks to its expertise in the development of small modular reactors (SMRs), it’s a key contender to support the nuclear strategy.

Unlike traditional large-scale nuclear plants, SMRs are smaller and faster to build, reducing construction risks. They’re also more cost-efficient at around £2bn per unit compared to the tens of billions needed for full-scale plants. Since much of the construction is done in factory conditions before assembly on-site, it’s much easier to deploy them.

The UK government has already backed Rolls-Royce’s SMR project with a £210m grant, and the company has raised additional private funding. If nuclear expansion accelerates, further government contracts or subsidies could flow to Rolls-Royce, helping to fund development and production.