Disruptive growth stocks trading for a few dollars have the potential to generate life-changing returns. One that’s been getting a lot of attention from investors is Recursion Pharmaceuticals (NASDAQ: RXRX). Recently, the stock soared almost 24% in a single day (14 February).

The company is backed by Nvidia, as well as Scottish Mortgage Investment Trust, and Softbank. So there’s a lot of smart institutional backing here.

Let’s take a closer look at this under-the-radar $10 stock.

The company at a glance

Recursion is a clinical-stage biotech firm that’s attempting to industrialise drug discovery by using artificial intelligence (AI) and machine learning to decode biology.

In July 2023, Nvidia announced a $50m investment in the firm, initiating a partnership aimed at enhancing Recursion’s AI-powered drug discovery capabilities. With Nvidia’s powerful chips, Recursion has built BioHive-2, the largest supercomputer in the biopharmaceutical industry (and 35th in the world).

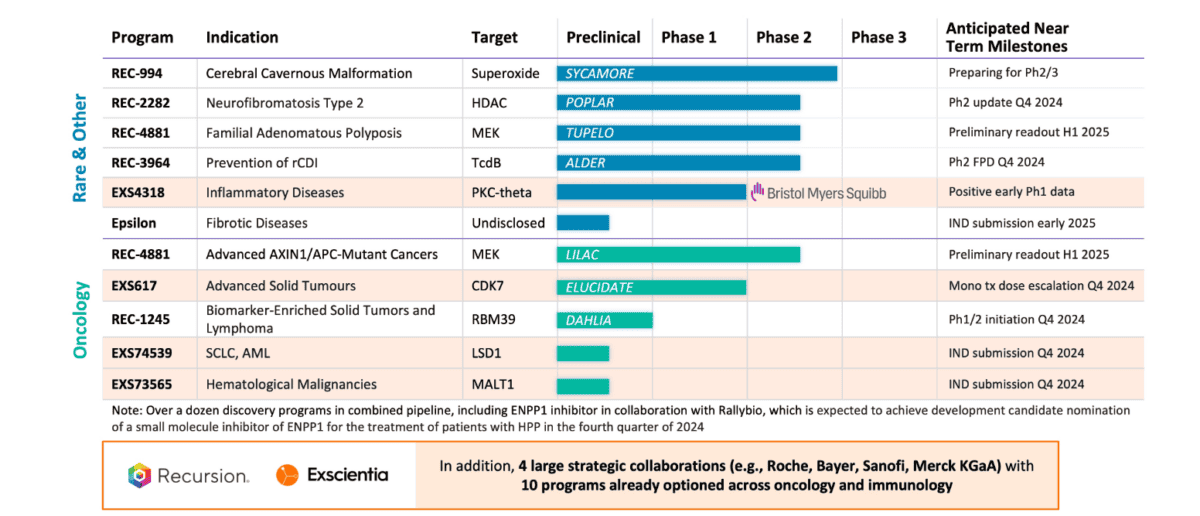

It’s developing a few therapies for cancer and rare diseases, but also aims to generate substantial service fees by allowing other biopharma firms to use its drug development platform. Notably, it has signed deals with industry heavyweights like Bayer, Roche, and Sanofi.

Another encouraging thing here is that Nvidia hasn’t sold any of the Recursion shares it bought even though the AI juggernaut did offload a few of its positions in Q4, including Soundhound AI. This apparent vote of confidence in the firm is what sent the stock up nearly 24% last week.

Recently, the company merged with Oxford-based Exscientia, another leader in the AI drug discovery space. The combined entity now has a portfolio of more than 10 clinical and preclinical programmes, and over 10 partnerships.

Recursion is automating the age-old practice of looking into a microscope and is replacing human interpretation with AI. This is exciting because it provides the opportunity to profitably pursue more minor diseases that may not have been commercially viable using traditional drug development processes.

Scottish Mortgage Investment Trust.

Still early days

As revolutionary as this sounds, the company’s pipeline is still at an early stage. That means it will be at least three-to-five years, at best, before any of these therapies start generating sales.

In the meantime, the company could sign more deals and receive milestone payments for drug development collaborations. However, this is a very speculative stock because consistent sales, let alone profits, aren’t expected for many years.

Following the merger, the firm has over $700m in cash and equivalents. That’s enough to pursue its pipeline for now, but a further fundraise can’t be ruled out at some point. Therefore, the possibility of shareholder dilution is a risk here.

Millionaire-maker?

Nvidia CEO Jensen Huang thinks the next big AI revolution will be in healthcare, which explains the partnership with Recursion. So the stock is definitely worth keeping on the radar.

However, it’s far too early for me to get bullish because the company’s platform isn’t yet churning out AI-discovered treatments.

To turn £10k into £1m, the stock would need to rise 100-fold, assuming constant exchange rates. Currently, Recursion has a $4.1bn market cap, which means it would be valued at around $410bn if it achieved that feat – larger than AstraZeneca today! So highly unlikely then.

As things stand, I’m not going to invest in this risky stock.