With markets at record highs — even in the usually sluggish FTSE 100 — it can be challenging to find quality growth stocks trading at reasonable valuations. However, I think these two fit the bill, and could therefore be worth thinking about for a Stocks and Shares ISA.

Uber

First up is Uber Technologies (NYSE: UBER). Hardly a week goes by without me using its app for taxis or food delivered. I recently booked train tickets on there for a trip to London and got 10% off a ride at the other end.

At the end of December, there were 171m active monthly users (14% more than the year before). Gross bookings grew 18% in Q4 (or 21% at constant currency rates), helping revenue jump 20% to $12bn.

While growth is nothing out of the ordinary for Uber, what is new is the company’s profitability. It has gone from incinerating billions a year to generating nearly $7bn in free cash flow last year. Profits are expected to head much higher in future.

Star hedge fund manager Bill Ackman recently took a massive $2bn stake in the stock. He has an excellent track record of spotting high-quality businesses that prove to be undervalued.

Ackman said: “We believe that Uber is one of the best managed and highest quality businesses in the world. Remarkably, it can still be purchased at a massive discount to its intrinsic value.”

The stock’s trading at a forward price-to-earnings (P/E) multiple of 30, which is reasonable for a market leader growing the bottom line very strongly.

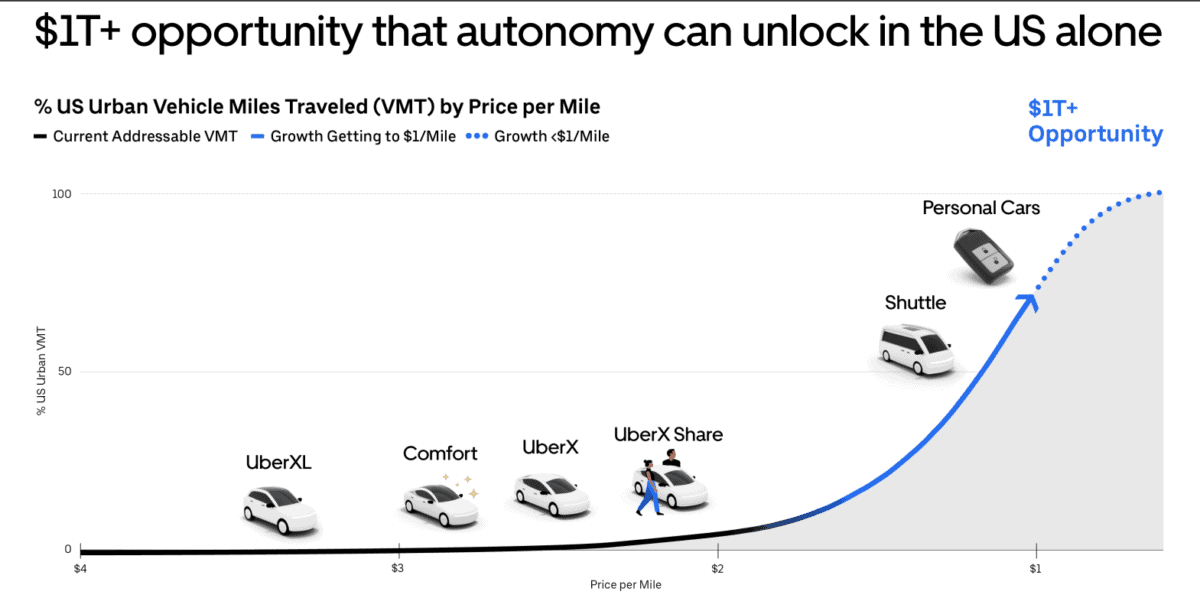

What could go wrong? Well, if self-driving taxis from Waymo and Tesla ever become mainstream, Uber’s driver-based model could be disrupted. This is a genuine long-term risk, assuming these deep-pocketed firms build their own networks.

That said, Uber has partnered with several leading autonomous vehicle (AV) companies, spying a $1trn+ market opportunity in the US alone. The thinking is that if AVs eventually drive down the per-mile cost because there are no drivers to pay, both bookings and Uber’s profits could explode higher.

Ashtead Technology

The second stock is AIM-listed Ashtead Technology (LSE: AT.). This is a company that rents out specialist subsea rental equipment to the global offshore energy industry. That includes both renewables (wind turbines) and oil and gas.

Fuelled by an acquisition-driven growth strategy, revenue soared 52% to £168m last year, with underlying operating profit coming in higher than expected at £46.6m. The compound annual growth rate in earnings over the past five years stands at 41%.

In the trading update for 2024, CEO Allan Pirie said: “With one of the largest and most technologically advanced rental fleets in the industry and a continued focus on operational excellence, we remain confident in the Group’s ability to generate substantial long-term value for shareholders.”

Risks here include economic downturns or global energy price shocks, which could slow exploration and lower demand for rented equipment. The firm’s also a small-cap valued at £426m, so doesn’t have the financial firepower of a firm like Uber.

Nevertheless, I like the risk/reward set-up here. The share price is down 33% in six months, leaving the stock on a low forward P/E ratio of 11.6. At 531p, I think the stock could be a hidden gem and is worthy of further research.