The Stocks and Shares ISA can make investors rich over the long run, assuming a sensible and informed investing strategy. That’s because it allows UK residents to invest and take their gains without paying tax.

While many Britons have elected to invest in buy-to-let property as a means to earn a second or passive income — and it certainly can be remunerative — I personally believe investing offers a much better way to make money.

It’s a very simple process: open a Stocks and Shares ISA, and then make monthly contributions while investing that money wisely. Keep it up for a long time and returns will compound heavily.

Sadly, investing isn’t something us Britons do well. In the UK, adults hold the smallest amount in equities and mutual funds of any G7 country at just 8%. In fact, UK has been bottom of the G7 league for investment in 24 out of last 30 years.

I genuinely believe that if this trend continues, we’ll become infinitely poorer compared with our international peers.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A six-figure passive income

Across an entire portfolio invested in dividend paying stocks, it’s possible to sustainably, in my opinion, achieve an average yield of 5%. This is the money paid in the form of dividends and received by the shareholders, free from tax. As such, in order to earn £100,000 in passive income, an investor would need a portfolio worth £2m. That might sound like a tall order, but with time, it’s very achievable.

The answer lies in compounding. This is when the returns get larger and larger each year as the pot gets bigger. As such, the longer investors leave money in the market, assuming they can still match previous performance, the faster the money grows.

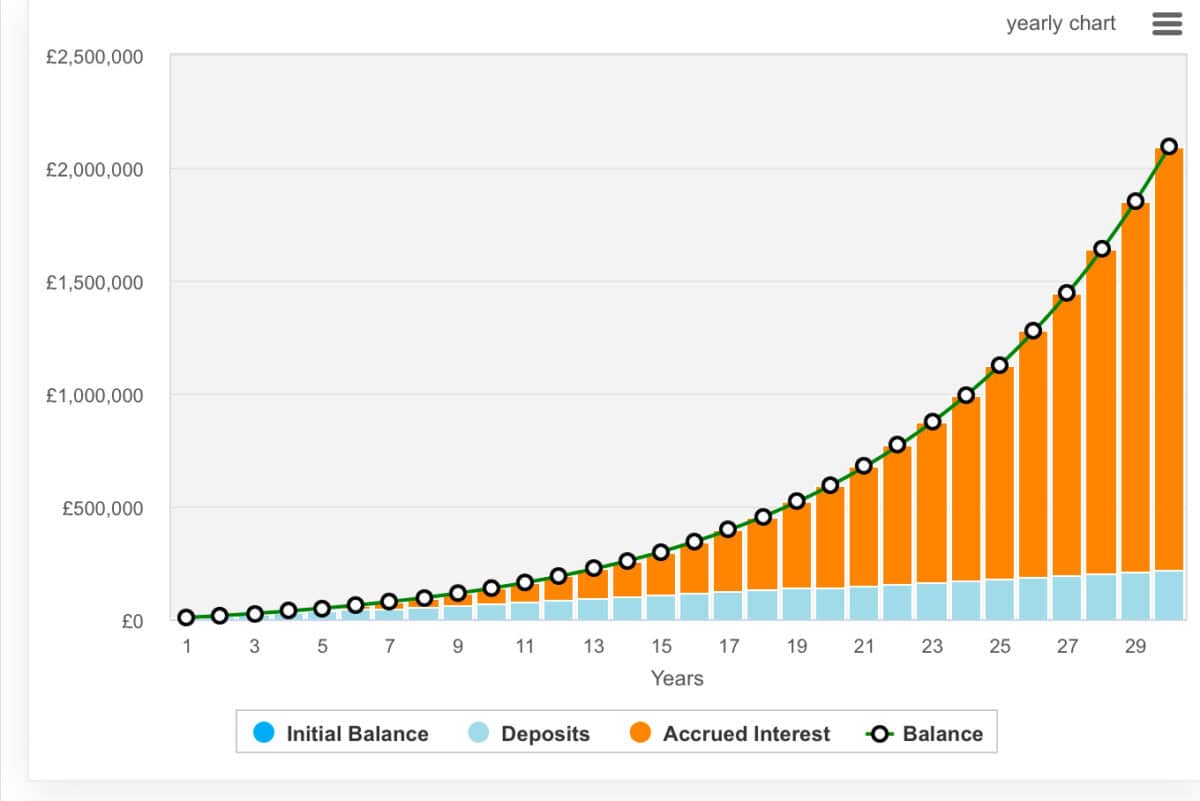

Just take a look at this example. Here, an investor puts aside £600 a month for 30 years while averaging a strong, but achievable, 12% annualised return. The growth towards the end of the period’s truly outstanding.

For further context, this portfolio would grow by £238k in the final year. Even in 29 years, that would still represent an impressive single-year wealth gain. Ok, it’s not guaranteed, but I’d need to earn over £500k in a salaried job to pocket that kind of money.

A stock for consideration

Hands-off investors may wish to start by considering funds or trusts like Scottish Mortgage Investment Trust. Or those seeking a more active approach may like to consider an undervalued stock like Jet2 (LSE:JET2). This AIM-listed airline trades at a massive discount to many of its peers.

Jet2’s net cash position is a key strength, projected to surge from £1.7bn in 2024 to £2.8bn by 2027. This liquidity supports expansions, including a 9% seat capacity increase for summer 2025.

Valuation metrics highlight upside potential. Jet2’s EV-to-EBITDA ratio is set to fall from 2.01 in 2024 to 0.52 by 2027, far below IAG’s 4.7. The price-to-earnings ratio of 8.1 times and a price-to-earnings-to-growth (PEG) ratio of 0.76 reinforce its undervaluation.

Risks include exposure to fuel prices and demand shocks. What’s more, its 17.7% gross margin lags IAG’s 27%, and an aging fleet may require higher capital expenditure. However, it’s a stock I’ve recently bought.