Generating a £2,000 monthly second income through a Stocks and Shares ISA is an achievable goal with careful planning and disciplined investing. Assuming a 5% withdrawal rate — achieved through dividend stocks — for portfolio sustainability, an investor would need an ISA valued around £480,000.

Scared already?

£480,000 might sound like a lot of money. And it is. However, building a portfolio this large is much easier than many Britons think. It simply takes time.

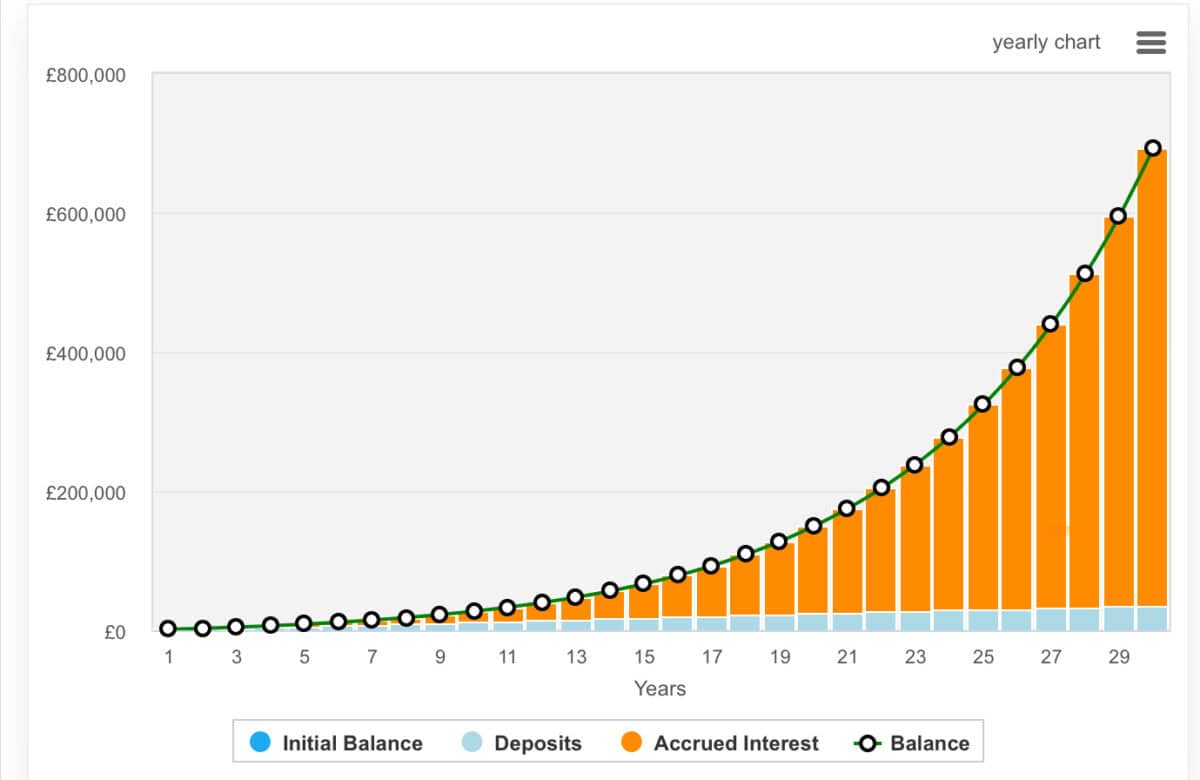

To illustrate, let’s consider a 30-year-old who starts investing £1,000 monthly in a Stocks and Shares ISA. Assuming an average annual return of 8% (which is in line with historical stock market performance), by age 55, their ISA could be worth over £480,000. This scenario doesn’t even utilise the full £20,000 annual ISA allowance.

It’s crucial to remember that consistency is key. Regular contributions, coupled with the power of compound interest, can turn seemingly small sums into significant wealth over time. Moreover, as one’s career progresses and earnings potentially increase, there may be opportunities to boost contributions, accelerating progress towards the goal.

However, it’s also important to highlight that some investors achieve much higher rates of return. My portfolio value has almost doubled over the last year and my long-term average is very strong.

For example, if a 15% rate of return was average over 28, an investor could reach this £480,000 mark with just £100 of monthly contributions. This is demonstrated in the graph below.

One stock to consider for the journey

Currently, I’m employing several different strategies for several different portfolios. The smallest of these is my daughter’s pension — as a one-year-old, her maximum contribution is around £240 per month, which is topped up by the government.

Despite a long time to maturation, I’m still following a growth-oriented approach. And because I’m investing relatively small figures, I’m preferring funds and ETFs to gain diversification, such The Monks Investment Trust, Scottish Mortgage Investment Trust, and Berkshire Hathaway (NYSE:BRK.B).

The latter presents an interesting opportunity at this moment. Berkshire has increasingly sold some of its prized holdings, including Apple, and now sits on $300bn in cash. This cash will likely be put to work on opportunistic acquisitions if the market goes into reverse.

However, this is a long-term investment into America. Warren Buffett’s conglomerate owns some of the most important parts of the American economy including banks, payment card services, railroads, and insurance.

Nonetheless, as with every investment, there are some risks. The conglomerate’s immense size may limit future growth opportunities, as finding acquisitions or investments capable of significantly moving the needle becomes increasingly difficult in today’s competitive market.