Ferrari (NYSE: RACE) shares have performed wonderfully since listing in 2015. We’re looking at 720% rise overall, and 177% in just the past five years.

The stock raced 8% higher this week, which means it’s up around 126% since I first invested in 2022. However, I reckon it can keep climbing in the years ahead and is worth considering. Here are four reasons why.

Truly unique

As arguably the world’s premier ultra-luxury brand, Ferrari has a unique business model. It involves limiting supply to keep demand and prices incredibly high (exclusivity).

CEO Benedetto Vigna has said that seeing a Ferrari out on the road should be like encountering a rare and exotic animal. And unless you live in Monaco, Dubai or Beverly Hills, it probably still is for most people.

Warren Buffett once remarked: “If you gave me $100bn and said ‘take away the soft-drink leadership of Coca-Cola in the world’, I’d give it back to you and say it can’t be done.”

This also applies to Ferrari, if not more so. The Prancing Horse brand possesses a rich heritage and has a legendary history in motor racing, both of which make it truly unique.

Incredible pricing power and margins

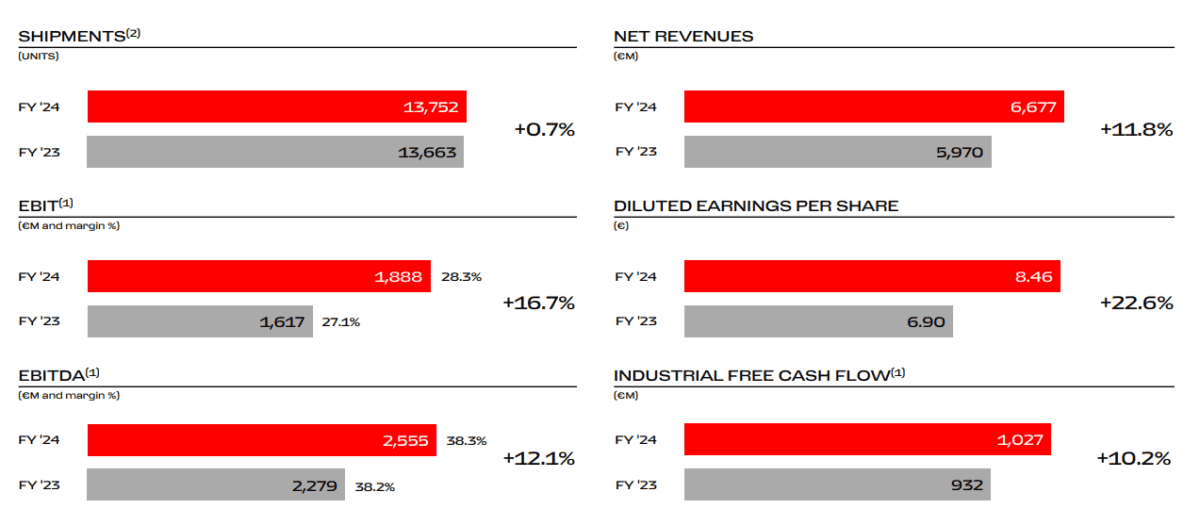

In 2024, the company shipped 13,752 vehicles, which was just 0.7% more than the year before. Yet revenue increased 11.8% year on year to €6.7bn while net profit jumped 21.3% to €1.5bn. Annual industrial free cash flow topped €1bn for the first time despite capital expenditure peaking at just under €1bn.

How’s this possible with such little volume growth? The answer is almost unlimited pricing power, along with insatiable demand for vehicle personalisation among its uber-wealthy customers.

Quality of revenues over volumes: I believe this best explains our outstanding financial results in 2024, thanks to a strong product mix and a growing demand for personalisations.

Ferrari CEO Benedetto Vigna.

The average selling price of a Ferrari is now above $500,000, up from $324,000 in 2019. And at 28.3%, the company’s operating margin remains industry-leading.

A history of outperformance

Another reason I’m bullish is that the Italian luxury carmaker has a habit of beating Wall Street’s estimates. Case in point was Q4, where revenue of €1.74bn topped expectations for €1.66bn. Earnings per share also rose 32% to €2.14, also higher than anticipated.

Indeed, management now anticipates reaching the high-end of its profitability targets for 2026 a year ahead of schedule!

Scarcity

Currently, the stock’s forward price-to-earnings ratio’s 49. That’s certainly a premium valuation.

Meanwhile, the company’s set to release its first fully electric car later this year. But this is new territory for Ferrari and could present real challenges if customers aren’t entirely satisfied. It might damage the brand. So this risk’s worth monitoring.

Looking ahead however, I see a final reason why the stock should head higher. That’s basic supply and demand. Last year, 81% of sales were to existing clients. So less than 3,000 people are getting their hands on a new Ferrari for the first time each year.

As the number of high-net-worth individuals grows worldwide, demand should continue to outstrip supply, bolstering pricing power. I intend to hold the stock long term, adding to my holding on share price dips and occasional market panics.