Over the past year, Tesla (NASDAQ: TSLA) has doubled in value. But while that 100% growth is incredible, has the tide turned? Tesla stock has crashed 22% from where it stood barely a week before Christmas.

For a company with a market capitalisation north of a trillion dollars (still), that is a big fall. Is this a buying opportunity for me, or just the start of a rapid downhill road for Tesla stock?

What to look at here

I do not know where the share will go from here. Nobody does. But quite a few things are making me nervous right now about whether the business merits that valuation (or anything like it).

First is the company’s car business. After years of strong growth, sales volumes last year declined (albeit only slightly).

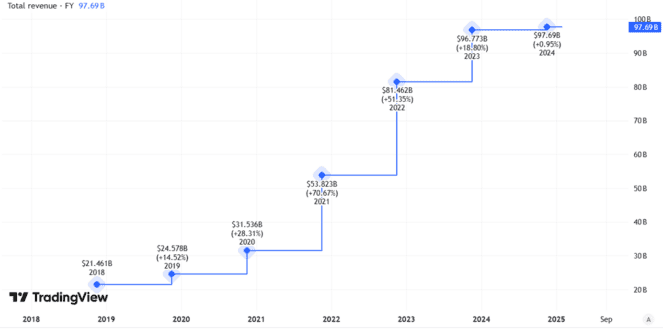

But the market overall is still growing. Tesla is increasingly being outpaced by rivals such as BYD. So while the company’s total revenues grew last year (and are substantial) that growth was small.

Created using TradingView

Even if the car business should plateau – or sees sales falling this year, which is a risk given growing competition – Tesla has more than one string to its bow.

It has used its energy storage expertise to build a business in that field. It is expanding rapidly and I see strong further growth opportunities.

But surely the recent Tesla stock price cannot be justified just by the car business and energy storage opportunity? I think Wall Street has been factoring in a big premium for the potential dangled by two things: self-driving taxis and robotics.

A tough environment and getting tougher

Tesla has good opportunities in both areas. But so do multiple competitors. Alphabet subsidiary Waymo is already pulling ahead of Tesla in rolling out self-driving taxis.

In any case, the business model for that market remains to be seen. If it is too crowded, players may compete on price and turn self-driving taxis into a money pit not a money maker. Uber is profitable now, but for a long time it burnt cash like nobody’s business.

In robotics too, Tesla is eyeing a crowded field. Not only does the business model remain to be proven but I am unclear that Tesla has a unique competitive advantage to set it apart from other robotics manufacturers.

Things could get worse

If we ignore valuation for a moment, I see a lot to like about Tesla. While the car business looks like it may be running out of steam for now, it is still huge and simply maintaining current sales should be enough to make serious money.

The energy storage business is growing well and Tesla has strong expertise. Other ventures such as self-driving taxis can be seen as potential growth drivers.

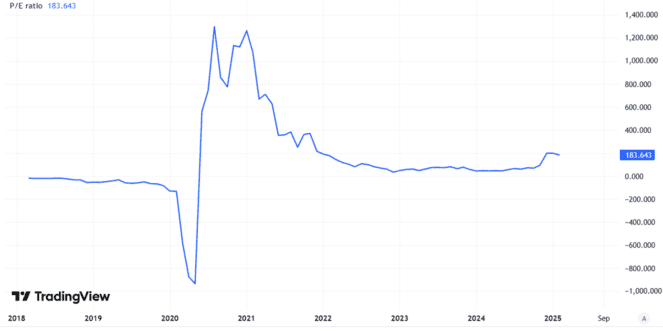

As an investor though, I cannot simply ignore valuation. Tesla stock is selling on a price-to-earnings ratio of 184, which strikes me as very expensive. Sure, it has long looked expensive.

Created using TradingView

But having been expensive in the past does not mean that being expensive now equals a reasonable price.

Growth prospects in Tesla’s car business look worse than previously. Other ventures like self-driving taxis are interesting opportunities at this point, but not proven businesses.

I think Tesla stock looks badly overvalued and have no plans to buy.