Turning £20,000 into a second income through investing is easier than many think. With the right approach, these savings can grow over time and eventually deliver a potentially life-changing passive income. Dividend stocks, index funds, and growth-oriented investments offer simple ways to build wealth, while reinvesting earnings helps accelerate progress.

New investors must remember that market ups and downs are normal, but a long-term mindset makes all the difference. Even small gains can add up, providing extra financial security. Investing isn’t just for the wealthy — it’s a powerful tool for anyone looking to boost their income.

There’s never a better time to get started

Time’s one of the critical components of investing. The longer money stays invested, the greater the potential for compounding returns. Compounding’s why reinvesting dividends and allowing profits to grow can turn modest amounts into substantial wealth over time. Starting early and staying invested is key. In fact, time in the market matters more than trying to time the market.

Seeing’s believing

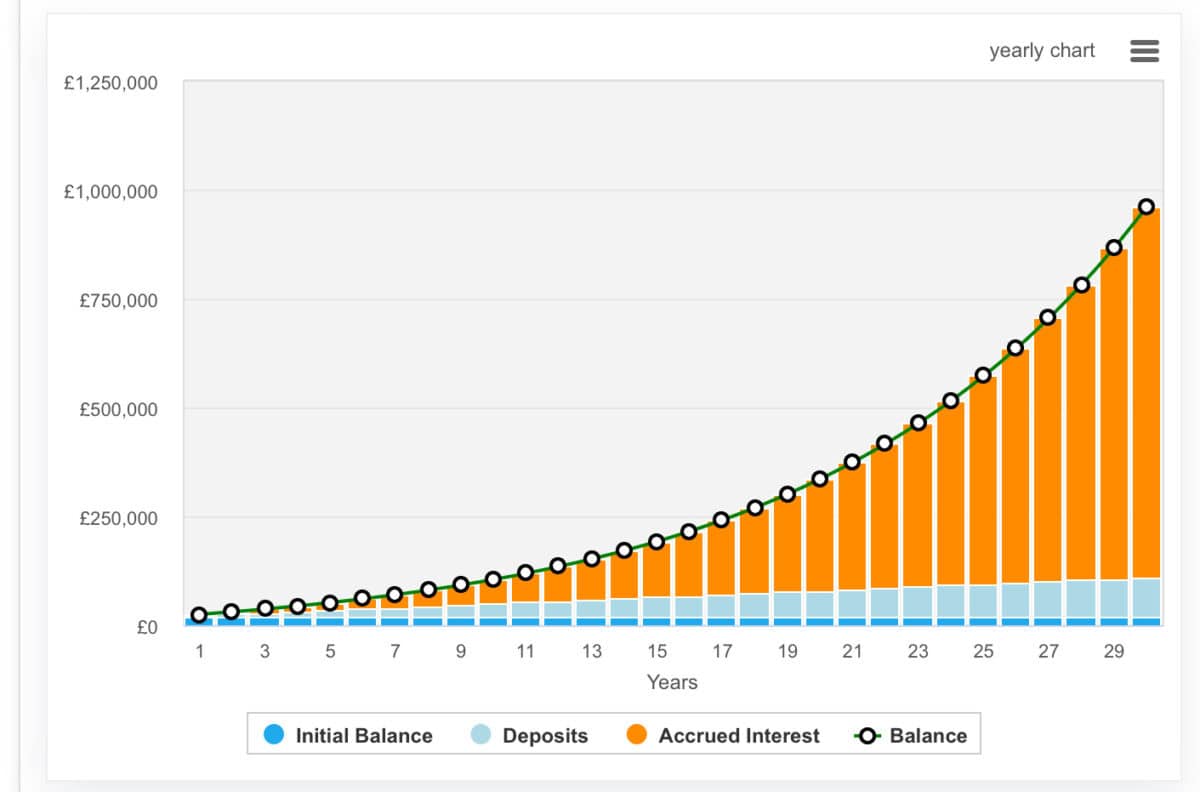

£20,000 would be an amazing starting point for any new investor. However, if an investor wants this to grow into something substantial, they should consider making a monthly contribution from their salary. These things really do add up over time.

So let’s crunch the numbers. Starting with £20,000 and adding £250 a month, an average annual return of 10% over 30 years could grow the investment to an impressive £961,000. And with £961,000, I’d be able to generate around £48k annually — or £4,000 monthly — if I invested my pot in dividend-paying shares with an average yield of 5%.

Where to consider investing

Many social media influencers will recommend investing in global index trackers to obtain maximum diversification while growing wealth. I can’t disagree that these vehicles are excellent for diversification and the long-run performance is strong, beating savings accounts by some distance.

However, investors may also want to consider a more growth-oriented approach through Scottish Mortgage Investment Trust (LSE:SMT). This FTSE 100 stock’s delivered impressive long-term performance, with a 10-year total return of 365.1% compared to the Global AIC sector’s 236.6%.

The trust focuses on high-growth technology and tech-affiliated stocks, with top holdings including SpaceX (7.5%), Amazon (6.3%), and Meta Platforms (4.6%). Despite its strong track record, investors should be aware of potential risks such as economic slowdowns and trade tariffs, which could disproportionately affect the tech sector.

Nonetheless, the trust’s diversified approach, with 95 different holdings, helps mitigate some of these risks. Currently trading at a discount to its net asset value, Scottish Mortgage offers investors exposure to both public and private companies in the fast-growing technology sector.

This stock could help multiply wealth and help investors actualise their second income goals faster.