The FTSE 100 leading index of shares shows no signs of slowing down after its blistering performance of 2024.

After hitting repeated record highs last year, the Footsie continues to break new ground at the start of 2025. In recent days it struck new all-time peaks around 8,767 points. It’s up 5.4% since New Year’s Day.

The FTSE 100’s gains are thanks to improved optimism over interest rate cuts, solid corporate earnings news, and fresh weakness in the UK pound. Lower sterling boosts overseas profits for the index’s multinational companies.

Yet some individual blue-chip stocks have performed even more strongly than the broader index. I’m confident some of them will continue outpacing the FTSE, too.

Legal & General (LSE:LGEN) is one such company I believe can keep climbing.

Buyback boost

Up 7.7% since 1 January, the share price has mainly been boosted by news of a major upcoming divestment.

It announced on Friday (7 February) the sale of its US protection business to Japan’s Meiji Yasuda for a total £1.8bn. In addition to this, Legal & General said it will cede a 20% stake in its pension risk transfer (PRT) business to the Japanese company.

As for the proceeds, £400m will be shuttled into the new PRT arrangement, while a further £1bn will be made available for share buybacks following completion.

As a result, the firm said it “now expects to return the equivalent of [roughly] 40% of its market cap to shareholders over 2025-2027 through a combination of dividends and buybacks.”

Room for growth?

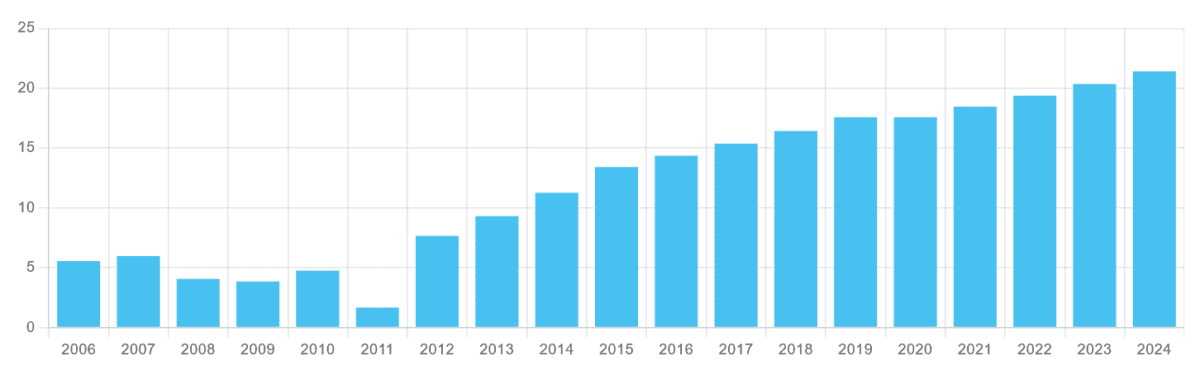

Thanks to its exceptional cash generation, Legal & General is famed for its huge dividends and ambitious share repurchase plans. For 2025, analysts expect a 14th year of dividend growth out of the last 15, which in turn drives its yield to 8.8%. Friday’s buyback news puts another layer of icing on the cake.

Legal & General’s share price has been under pressure over the past year. But boosted by lower interest rates and growing structural demand for financial planning services, I’m optimistic it may continue its recent rebound this year, providing a blend of healthy capital gains and dividend income.

The company’s cheap valuation certainly leaves plenty of scope for fresh gains, in my opinion.

For this year, it trades on an undemanding price-to-earnings (P/E) ratio of 10.3 times. What’s more, its price-to-earnings growth (PEG) for 2025 is a modest 0.3.

That’s some distance below the benchmark of 1 and below that indicates a share is undervalued.

Looking good

Being able to accurately predict near-term share price movements is exceptionally tough. This is no different with Legal & General, demand for whose shares could sink amid fresh signs of weak economic growth and sticky inflation that impacts revenues.

But on balance, I think things are looking pretty bright for the financial services giant. This view’s shared by City analysts, who expect sustained earnings growth of 33% and 10% in 2025 and 2026 respectively.

Regardless of its share price, outlook for this year, I think Legal & General shares are a top FTSE 100 share to consider. I own it in my own portfolio and plan to hold it for the long haul.