The Scottish Mortgage Investment Trust (LSE: SMT) share price seems to have rediscovered its mojo. It’s up 30% in a year and 64% since bottoming out in May 2023.

This ongoing recovery’s seen it break through the 1,000p barrier for the first time in nearly three years.

Why?

There seem to be a few reasons why this has happened. First, the growth-focused trust reported its interim results back in November, which covered the six-month period to the end of September. Here, we learned that its net asset value (NAV) per share had increased by 1.9%, compared to a rise of 3.6% for the FTSE All-World index.

Should you invest £1,000 in Burberry Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Burberry Group Plc made the list?

However, the longer-term performance was much stronger. Over five years, the NAV had gained 88.9%, outpacing the index’s 66.9%. And over a decade, it had grown 347.8%, compared with 211.3% for the benchmark. As a shareholder, I’m pleased by this outperformance.

Before yesterday (27 January), when semiconductor stocks took a shellacking, many top holdings had also reached new highs. These included Tesla, Amazon, Nvidia, Taiwan Semiconductor Manufacturing, Spotify, and Meta Platforms. Most have been boosted by ongoing bullishness around all things artificial intelligence (AI).

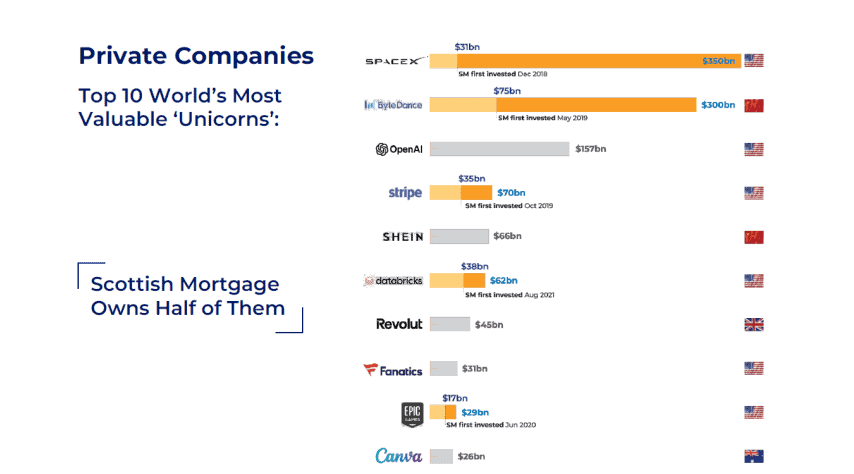

On the private side of the portfolio, SpaceX’s valuation has nearly doubled in a year. Scandinavian Airlines is the latest company to announce a partnership with its satellite internet service Starlink, intended to introduce free high-speed Wi-Fi across its aircraft. Meanwhile, Starlink’s begun beta-testing a direct-to-mobile service, which could transform the global telecoms landscape.

Also, there are reports that another unlisted holding, data analytics platform Databricks, might be eyeing an IPO. It has just carried out a successful financing round at a much higher $62bn valuation.

These are two very exciting growth companies building value for Scottish Mortgage shareholders outside of public markets.

Elsewhere, TikTok’s back on phones in the US, with reports saying that owner ByteDance will retain a stake in the business once it’s sold. That’s probably the best outcome for Scottish Mortgage’s large holding in the social media giant.

Finally, the FTSE 100 trust continues to buy back its own shares, which can help boost the share price.

Achieving its objectives

However, there are also reasons to be a bit cautious. The main one is that most of the portfolio’s companies are listed across the pond, where valuations look stretched. If Big Tech earnings come in light this year, that could cause volatility and knock the trust’s valuation.

Nevertheless, I’m excited about the potential here. Scottish Mortgage’s aim is to invest in the world’s greatest growth companies. It won’t get every pick right, but it doesn’t need to when it can make 100 times its money on a stock, as it did with Nvidia.

To give another example, it first invested in SpaceX in 2018 when it was worth $31bn. Now the rocket pioneer’s valued at $350bn, meaning the investment is more than a 10-bagger in just over seven years!

Indeed, it holds half of the world’s most valuable private companies, and they’re becoming more valuable.

All this tells me the trust’s doing what it says on the tin. And I believe it’s set up for strong returns over the long run — the only timeframe that matters.