It’s almost surreal that Amazon (NASDAQ: AMZN) shares lost 54% of their value between mid-2021 and late 2022. Or perhaps recency bias makes me think it surreal as they’ve since bounced back in style, surging 180% to take the company’s market cap to a record $2.48trn.

Indeed, the stock is up by a market-thrashing 25.4% in just the past three months! That means an investor who was brave enough to plonk down £20,000 in late October would now be sitting on around £25,080. That’s a fantastic return in just under 14 weeks.

But are Amazon shares still worth considering today after this strong showing? Let’s take a look.

Should you invest £1,000 in Safestore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Safestore Plc made the list?

Diversified business

One of the things I like about Amazon from an investing point of view is its optionality. In other words, it has different ways to win beyond online retail. It operates the world’s leading cloud computing platform, Amazon Web Services (AWS), and generates revenue by selling warehouse capacity and logistics services.

It also has a fast-growing digital advertising business on its e-commerce app. Sellers can pay to have their items appear at the top of search results or on product pages. Amazon charges them a fee whenever someone clicks on their sponsored listing. This is a very profitable revenue stream, while the Prime subscription service keeps customers coming back.

The company is also investing in delivery robots and drones, self-driving vehicles, various artificial intelligence (AI) initiatives, and more. While these can weigh on near-term profitability, they also have the power to boost efficiency and margins over the long run.

Despite being 30 years old and therefore no spring chicken, Amazon is still one of the most exciting companies around, in my opinion.

Surging profits

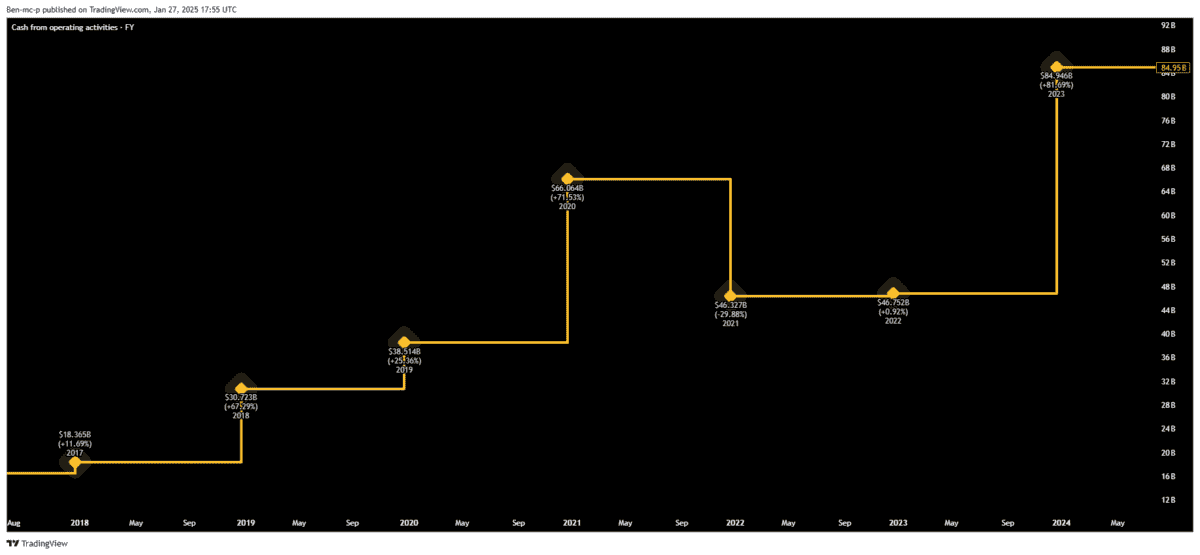

In recent years, the company has turned itself into a leaner beast. Consequently, its operating cash flow is absolutely surging, as we can see below.

Plus, Wall Street analysts forecast double-digit revenue growth over the next few years. In fact, the company remains on track to generate a mind-boggling $1trn in annual revenue by 2030! This assumes Amazon grows its top line by approximately 8% annually, which I think is more than realistic.

That said, nearing such a symbolic figure could bring negative headlines and more regulatory scrutiny in future. Last year, the US Federal Trade Commission advanced an antitrust lawsuit accusing Amazon of operating an unlawful monopoly. So potential regulation presents future risks here, I’d argue.

Is there any value left?

Unsurprisingly, the stock isn’t cheap after its monster run. It’s trading at four times sales, while the forward price-to-earnings (P/E) ratio is 37.

Yet I think this is reasonable value, considering the company’s profit margins are expected to continue expanding. The P/E ratio for 2026 drops to 31, based on consensus forecasts.

However, as we saw in 2022, Amazon stock can also go down as well as up. It has lost 50%+ of its value on multiple occasions over the past three decades. Therefore, it’s best-suited to long-term investors with a stomach for volatility.

Looking ahead over the next few years, I can only see Amazon getting larger as areas like e-commerce, digital advertising, and cloud computing expand worldwide.

Despite being at a record high, I think the stock is well worth considering.